This article accompanies our new report, “Competing for Fuel: Benchmarking the US-China Energy Competition.” Read the report here.

–

Energy undergirds modern societies. It is also a strategic domain. Energy shapes global economic development and security. It is both a source of, and a channel through which to project, national power. Nations have therefore long fought over access to and influence over energy.

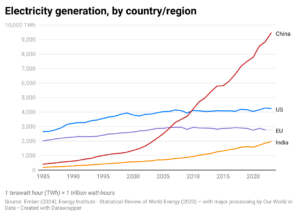

China and the US are, in that order, the world’s two largest producers and consumers of energy. In turn, energy plays a central role in shaping the current US-China strategic competition. Understanding their relative standings and competitive approaches to energy is hence crucial to assessing the state and trajectory of the US-China contest.

To a greater degree than the US, China treats energy not only as a matter of security but also a competitive domain. For Beijing, energy is not merely a question of security: having sufficient energy supplies to meet demand. It is also a contested realm: one in and through which to project power, acquire leverage, and exact concessions.

And if the electrification of power consumption is a defining energy trend of the 21st century, China is currently leading the field by a wide margin:

Energy as a competitive domain

To understand China’s competitive approach to energy, consider its dominant position in clean energy technologies.

Last year, Chinese exports of renewable energy products soared. Electric vehicle exports rose 64%. Solar module exports grew 34%. Wind turbine exports went up 60%. Battery exports jumped 28%. Meanwhile, Beijing’s metals mining investments overseas also hit a record high – in turn reinforcing its midstream processing and downstream manufacturing strengths.

China’s push to seize market share in clean energy technologies is deliberate and state-led. PRC sources frame the shift towards renewable energy as a strategic opportunity to amass greater global influence. As legacy fossil fuels slowly give way to renewable sources, existing competitive balances are upended. A space opens up for an emergent player to stake out newfound energy dominance. China hopes — and is well on its way — to being precisely that disruptive upstart.

China is simultaneously hedging its bets with investments in fossil fuels. Last year, the country reclaimed the crown as the world’s largest LNG importer. It is also expanding its global LNG trading capabilities — a development that could eventually grant the PRC greater pricing power over a key commodity.

–

Contesting the entire industrial chain

Another defining characteristic of China’s competitive approach to energy is its positioning across key nodes of entire industrial chains.

More so than the US, China tends to prioritize the full scope of supply chains. Its energy-related policy discourse, legislation, and firm-level investments have long prioritized vertical integration of energy supply chains, connecting upstream to downstream.

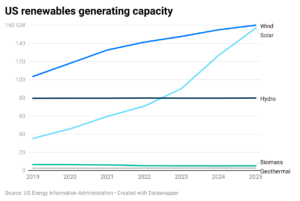

By contrast, the US takes a less integrated approach: it’s a top upstream exporter of LNG and oil, but lags in LNG shipbuilding capacity; it’s installing plenty of solar capacity, but lacks production of upstream components like ingots, wafers, and cells.

Asymmetries in the contest

In the upstream, for example, China’s approach most clearly plays out in critical minerals: the country has spent years making targeted investments in mine assets overseas. This feeds into its midstream domestic processing capacity, which then cements its strength in downstream products, like permanent magnets, batteries, and solar panels. Together, this grants China both monopoly and monopsony power as the dominant buyer and seller — thereby making it exceedingly difficult and costly for other countries to reduce their China dependence.

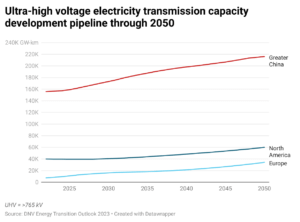

Meanwhile, the PRC is rapidly deploying ultra-high voltage transmission lines to transport electricity across long distances, promising a robust grid to support its energy transition. The Greater China region currently has four times as much ultra-high voltage transmission capacity than North America, and it will maintain that lead at least through 2050, according to data from Norwegian risk assessment firm DNV.

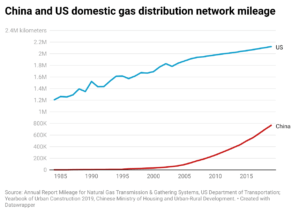

China’s lead in building out its national UHV power lines network will help supercharge its energy transition. It may perhaps also make up for its lack, relative to the US, of a dense domestic natural gas pipeline network. Might China’s lead in emerging infrastructure (UHV power lines) flip the relative competitive balance in a legacy one (gas pipelines).

Meanwhile, Beijing has ambitions of building a global power grid. While that project remains in very preliminary stages, the vision speaks to the PRC’s goal of embedding itself deeply into global energy flows — a position of power (no pun intend) that it can leverage for control. In the end, China may not even need a transnational grid to exert global energy influence. It could well find a cheaper and quicker route by simply dominating the chips, modules, and devices that make up the Internet of Things for the energy sector.

–

Opportunities and vulnerabilities

Energy markets have long been defined by volatility. The global energy transition adds another layer of uncertainty and asymmetry. Old competitive frameworks are butting up against new ones.

For incumbent and emerging players alike, this presents both opportunities and vulnerabilities. Chinese discourse suggests that Beijing aims to maximize the former for itself and the latter for others. Whether it achieves that vision holds important implications for the trajectory of global energy geopolitics.

–

For more, read our new report, “Competing for Fuel: Benchmarking the US-China Energy Competition.”