Welcome to a/symmetric, our weekly newsletter. Each week, we bring you news and analysis on the global industrial contest, where production is power and competition is (often) asymmetric.

This week:

- The world’s largest air-con maker turns to next-gen chips: Gree’s new SiC wafer plant underlines the importance of compound semiconductors in China’s chip strategy.

- Weekly Links Round-Up: EU’s guncotton shortage, defense tech investment in Europe, slashed internet cables under the Red Sea, keypad lock vulnerabilities, and asymmetries in shipbuilding.

An air-con maker turns to next-gen chips

Gree, the world’s largest manufacturer of air conditioners, is jumping into the business of making next-generation semiconductors.

The Chinese state-owned electrical appliances giant announced last week that its new silicon carbide (SiC) wafer plant in Guangdong province will begin production in June. Eventually it’s set to churn out 240,000 six-inch SiC wafers a year, and, alongside another production line for sealing and testing, “help China’s semiconductor industry to achieve full, independent and control,” according to Chinese media reports. That’s the goal, anyway.

Gree’s semiconductor endeavors aren’t entirely new. It already has a chip-designing subsidiary, a minority stake in compound semiconductor firm Sanan Optoelectronics, and a small stake in Chinese smartphone contract manufacturer Wingtech (which owns the Netherlands-headquartered chip maker Nexperia).

Compound interest

Gree’s push into compound semiconductors—which, unlike single-element silicon-based chips, use two or more elements, and promise greater efficiency and performance—is particularly interesting given their prioritization in China’s industrial strategy.

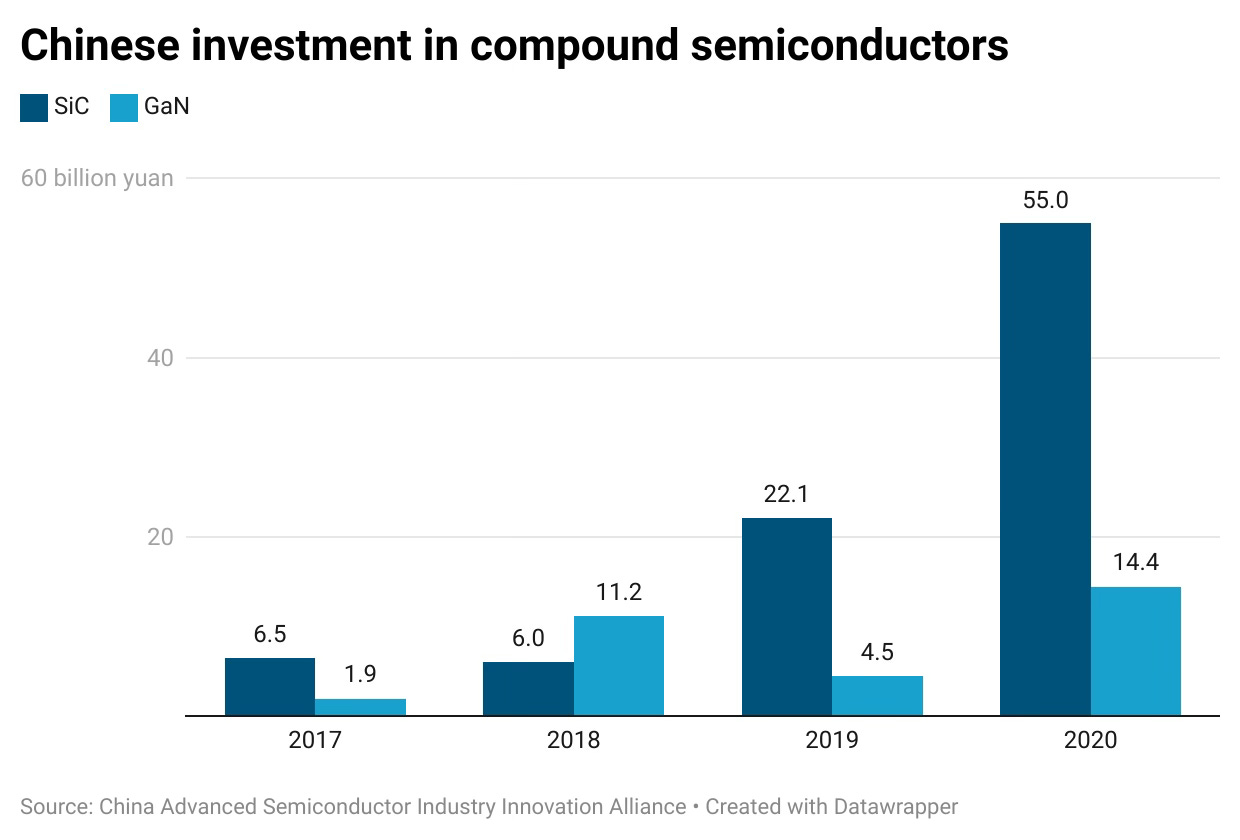

Beijing’s 14th Five Year Plan identifies SiC, gallium nitride (GaN), and other wide-bandgap semiconductors as key emerging fields to invest in. This focus stems in part from next-generation chips being seen as having the potential to reshape current competitive dynamics and allow the country to leapfrog over incumbent leaders, “shake off China’s passive situation in integrated circuits, and achieve chip technology catch-up and development.”

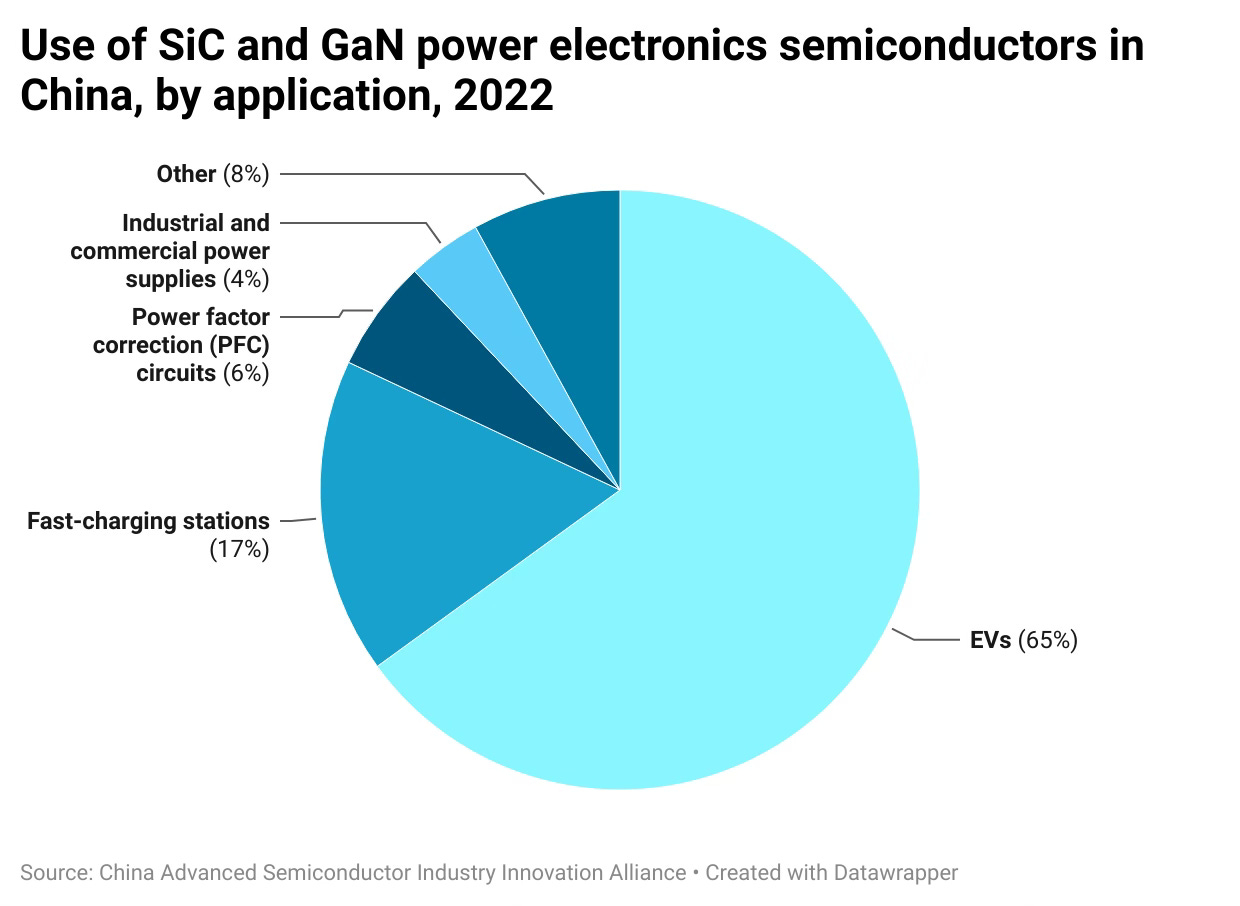

Meanwhile, Bloomberg reports this week that the Chinese government is urging domestic carmakers to sharply increase their sourcing from local automotive chipmakers. Car firms are taking heed: a foreign bidder recently failed to win a contract from a major domestic car brand despite offering a price estimated to be 30% lower than the eventual winner, according to Bloomberg.

Beijing’s latest directive will likely give China’s compound semiconductor players a big boost: in 2022, electric vehicles accounted for 65% of SiC and GaN power electronics semiconductors usage in China, according to industry data.

Export restrictions workaround

All this matters because while the US focuses much of its efforts on restricting Chinese access to advanced chips and chipmaking equipment, China is simultaneously investing heavily in domestic capacity in both legacy domains and emerging fields like compound and optical semiconductors.

Whether Gree’s compound semiconductor bet will pay off is an open question. But it does point to the emergent role of SiC in China’s semiconductor strategy—particularly as it works to ramp up investment at home and push back against foreign restrictions.

As Doug O’Laughlin of Fabricated Knowledge writes: “SiC is different because every single tool is not banned from use. China will climb this expertise curve a lot quicker than Western companies appreciate.”

Weekly Links Round-Up

️ Europe’s gunpowder shortage… Earlier this month, EU industry chief Thierry Breton said the bloc was struggling to find enough raw materials to make gunpowder, in turn hindering artillery shell production. One such material is guncotton, for which Europe is heavily dependent on China. Chinese media picked up on the comment, noting that China accounts for 70% of global guncotton, also known as nitrocellulose—and that Xinjiang is a key node of production. (AFP, 36Kr)

️ …and defense tech hesitation. While public money from the EU and NATO are flowing to companies working on dual-use technology, the continent’s investors have been more reticent due to ethical concerns around directing capital towards weapons. (Sifted)

️ Untangling submarine communications cables. Kevin Xu at Interconnected takes a detailed look at the companies and countries involved in the four undersea data center cables recently slashed by Yemen’s Houthi rebels. He dug up two statements from a Hong Kong broadband provider, in which the company explains steps it took to reroute affected traffic—including through mainland China. (Interconnected)

️ China dominates global shipbuilding, while the US now produces less than 1% of commercial vessels worldwide. “The resulting asymmetry comes with both commercial and military concerns for the US,” writes Rana Foroohar. Following the US Steelworkers’ filing of a petition this week requesting a probe into China’s unfair trade practices in shipbuilding and maritime logistics, the US government now has till late April to respond. (FT)

️ Lock vulnerabilities. Two major manufacturers of keypad locks have been accused of putting backdoors in their products by allowing the use of reset codes by third parties to bypass locks without the owner’s consent—a major but little-kown security risk. The two companies are China-based Securam and US-based Sargent and Greenleaf. (404 Media)

(Photo by Khara Woods on Unsplash)