Welcome to a/symmetric, our new newsletter. Once a week, we bring you news and analysis on the global industrial contest, where production is power and competition is (often) asymmetric. You can also find us on Substack.

This week:

- A framework for thinking about the competitive dynamics of the global AI race, and poking at assumptions to examine potential asymmetries

- Weekly Links Round-Up: The “common prosperity” investment theme flops, the value of open-source research, and competition in lidar

China’s game plan for the AI race

This was the year the world “woke up to AI,” as multiple news articles declared recently.

But do we have a clear-eyed view of the competitive dynamics of the global AI race?

ChatGPT has indeed take the world by storm in the 13 months since it launched. In China, it sparked a frenzy over generative artificial intelligence as domestic tech giants scrambled to unveil their own ChatGPT alternatives. So far, the Chinese government has approved 11 large language models from as many labs.

But LLMs like OpenAI’s chatbot represent only one segment of the AI industrial chain, albeit an important and high-value one. That means focusing only on GPTs1yields a partial view of the AI landscape and the relative competitive balances between players in that space.

How China views the AI industrial chain—and how that shapes its AI strategy

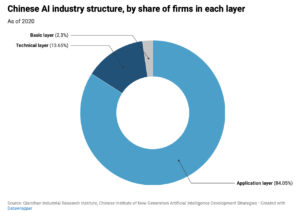

To understand China’s approach to developing a technology, it is often helpful to look at how Chinese sources portray the layout of a given industry. Take, for example, the schematic representation of the AI industrial chain below, regularly referenced in Chinese discourse on AI:

Mainstream media coverage has portrayed China as having been caught flatfooted by ChatGPT’s launch and now scrambling to catch up, with its homegrown alternatives stymied by state censorship.

The implication seems to be that China faces structural and systemic constraints on its ability to compete in AI. But that view risks being a miscalibrated one, not least because—as the diagram above shows—the AI industrial chain is long and complex.

Even if ChatGPT is viewed by some as a step towards artificial general intelligence (AGI)—AI systems that are “generally smarter than humans,” and often considered the holy grail of AI development—winning and retaining that grand prize depends on numerous other factors. Think: chips and computing power, technology to put AI to use, and the ability to incorporate AI for commercial and industrial applications at scale.

How China could leverage asymmetries in AI

This leads to some questions, however speculative, about potential asymmetries:

- Even supposing that China’s pervasive censorship and information controls hold it back from AI’s cutting edge, could it build sufficient capacity elsewhere in the AI industrial chain to create critical dependencies on the part of its competitors?

- Consider industrial and commercial applications, which the chart above shows China’s AI industry is heavily invested in. Even supposing China lags its most advanced competitors in AI research, could it gain an edge in developing and deploying industrial applications of AI (say, autonomous driving), in turn winning new leverage in global markets?

- One mainstream assumption holds that the West has a natural advantage in developing LLMs given its free and open information environment. Might China have a mirrored advantage in machine vision and visual learning, given its abundance of and dominance in surveillance cameras and drones? And how might that mirrored advantage be incorporated in industrial applications?

- China may be playing a shrewd game of wait-and-see, weighing the relative costs and benefits of securing first-mover advantages versus letting the likes of OpenAI and Microsoft take huge and risky bets.This is a familiar Beijing playbook, deployed across different technologies.

- China bid its time in developing a narrow-body jet liner, and is now scaling by accessing foreign technology.

- Ditto for high speed rail: China rode the coattails of Europe’s and Japan’s decades-long work, obtained advanced foreign technology, then grabbed global market share by leveraging distortive industrial policies.

- Same goes for batteries: China scooped up US lithium-ion battery startup A123 from bankruptcy in 2012.

- Recent news that ByteDance was secretly using OpenAI to train its own, competing model suggests China is using this playbook again in AI.

Weekly Links Round-Up

️ Common prosperity for me and not for thee. This shouldn’t be surprising in the least, but attempts to pick stocks based on Beijing’s professed drive to reduce economic inequality led to steep losses for investors. (Bloomberg)

️ Sussing out China’s capabilities and ambitions. The US suffered a catastrophic intelligence setback in China a decade ago when its network of Chinese agents was dismantled. But “much of what U.S. spy agencies need to know is hidden in plain sight, if it can be found in an ever-proliferating cache of open-source intelligence…[including] billions of social media postings, huge commercially available databases and academic papers,” writes Warren P. Strobel. (WSJ)

️ The US lidar industry lobbies Washington for restrictions on a Chinese rival. The remote sensing technology key to autonomous cars poses another dependency and security vulnerability as Chinese manufacturer Hesai grabs market share. Says former National Security Council China Director Liza Tobin: “Sometimes once we start noticing the problem in a particular subsector, like lidar, it’s almost too late.” The question, then: how to get ahead of these problems? Keeping close tabs on Chinese industry, and its broader science and technology apparatus, is one key step. (Politico)

️ Russia exported almost all its oil to India and China this year, according to Moscow. (AFP)