Welcome to a/symmetric, our new newsletter. Once a week, we bring you news and analysis on the global industrial contest, where production is power and competition is (often) asymmetric. You can also find us on Substack.

This week:

- China’s longstanding strategy of de-risking, and different asymmetric strategies for breaking foreign technological “chokeholds”

- Weekly Links Round-Up: Missiles backlog, US LNG exports, blacklisting Quectel, Chinese battery materials investments in Morocco

De-risking with Chinese characteristics

One reason for the ongoing (and frustrating) debate over whether deglobalization and decoupling are actually happening is the lack of broadly accepted definitions of the two terms.

Does deglobalization mean a regression to pre-globalization times, or a rejigging of what we have come call globalization? Does decoupling mean severing economic links between the US and China, or attenuating some ties while maintaining others? And what about de-risking—is it a cause, consequence, or both of decoupling and deglobalization?

Source: WTO World Trade Report 2023. Trade within blocs has grown more quickly than between blocs since February 2022.

One thing is clear, though: even as Beijing denounces de-risking (link in Chinese), China has for decades pursued just such a strategy—even if it doesn’t call it as such.

As I wrote a few months ago for Quartz:

“…if the fundamental goal of de-risking (or decoupling or friendshoring) is to address supply chain vulnerabilities across key industries, and particularly in critical high-tech fields, then China has long been engaged in the very same policy that it now denounces…A close look at the history of Chinese industrial strategy would trace Beijing’s pursuit of de-risking…back decades.”

“Two markets, two resources”

At the heart of China’s de-risking pursuit is its embrace of asymmetries. This is perhaps best encapsulated in its longstanding doctrine of “two markets, two resources”—most recently spruced up as “dual circulation.”

As the Quartz piece linked above explains:

“One guiding tenet of Beijing’s economic planners has been ‘two markets, two resources’…The idea is simple: There are markets at home and abroad, and resources domestically and globally. China must strategically make use of both to accelerate its development and catch up with advanced nations.”

China’s rare earths strategy—which we wrote about at length last month—illustrates this concept in practice. China snaps up critical mineral assets abroad, then uses it to feed its processing and magnet-making operations further downstream—in turn cement its dominance across the full rare earth supply chain. Using foreign technology to jumpstart domestic capabilities before undercutting, out-innovating, and leapfrogging legacy players is another application of “two markets, two resources.”

Rounding out China’s industrial strategy is its focus on building a robust domestic manufacturing base. In fact, Chinese scholars see China’s industrial strategy as subverting and transcending that of the West. One academic wrote last year in Dangjian (link in Chinese), a magazine directly supervised by the Ministry of Propaganda:

“Building a modern industrial system is the transcendence of Western industrial theory…[The West’s] theory has led to the decline of the manufacturing industry and the hollowing of industries in Western developed countries, and a large number of industries outsourcing offshore production, thus gradually weakening the economy.”

Dig, jam, attack, subvert

We have been discussing in broad terms how China pursues asymmetric strategic choices to catch up to the West in science and technology—and then surpass it. But how might that strategy play out on the level of specific technologies?

A fascinating piece of research published last year in the Bulletin of Chinese Academy of Science gives shape to that question.

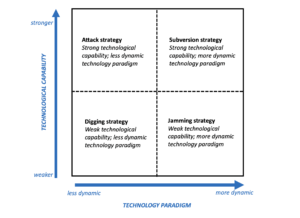

The paper argues that for China to break the “chokehold” of foreign technology dependence, it must pursue different asymmetric strategies for different technologies. Specifically, it should tailor its asymmetric strategies to the strength of China’s technological capability in a given technology, and how dynamically a given technological paradigm changes.

The chart below is adapted and translated from the paper:

Let’s look at each of the four strategies in turn.

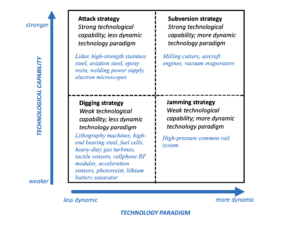

Digging strategy

For technologies where China has weak capabilities, and where the underpinnings of the technology itself are not likely to change drastically, China should adopt a “digging strategy” to work on multiple breakthroughs, and seek to establish a “local technological advantage,” according to the authors. Lithography machines are in this category, as are photoresists, fuel cells, and heavy-duty gas turbines.

Jamming strategy

Where domestic tech capabilities are weak, but the technology itself is likely to see a more dynamic development trajectory, China should pursue a “jamming strategy” so that when the technology begins to develop along a different track, China can seize the opportunity to overtake incumbent players. The authors put high-pressure common rail systems in this category.

Attack strategy

Where homegrown capabilities are stronger, and the technology paradigm is not likely to undergo massive shifts, the authors suggest an “attack strategy.” Because the technology paradigm is not likely to undergo massive shifts, China can concurrently invest in catching up on multiple technologies in this category. Lidar sensor technology, high-strength stainless steel and aviation steel fall in this category.

Subversion strategy

For products where China has a strong technical base, and that have a dynamic technological paradigm. Here, China needs to “break the technological blockade, form a substitute for existing technologies, and become a leader in the new technological paradigm.” Products include milling cutters, aircraft engines, and vacuum evaporators.

Here’s the chart again, this time with the various technologies labeled:

De-risking: China vs. the West

The bottom line: China has been de-risking for decades.

It has just done so under different banners: “two markets, two resources;” “dual circulation;” breaking technological “chokeholds;” and “bringing in, going out.”1

And the “bringing in, going out” strategy now has a third dimension in full swing: “going in.”

That means directly establishing physical footholds in foreign markets by establishing factories overseas. We see this playing out as Chinese companies set up EV factories and battery plants across Europe. The result: further entangling global supply chains and undermining the West’s own de-risking efforts.

Weekly Links Round-Up

️ The West’s yearslong missiles backlog. A quote from an executive at Norway’s Kongsberg Defence & Aerospace emphasizes the importance of covering all critical nodes of the defense industrial supply chain—all the way to the upstream: “We are supplied by companies with their own supply chains, which in turn have their own supply chains, which have their supply chains, till it gets right down to the mine that digs up the basic resources.” (WSJ)

️ The US takes the LNG crown. For the first time, the US became the world’s biggest exporter of liquefied natural gas, overtaking Australia and Qatar. Europe continues to be the main buyer of US LNG. Russia therefore has had to find another customer: China. This week, Gazprom said it set a new daily record for supplies to China via the Power of Siberia pipeline. (Bloomberg, Reuters)

️ US lawmakers want to blacklist Quectel. The House Select Committee on the Chinese Communist Party are requesting that the White House designate the Shanghai-based maker of wireless communication modules as a company within the Chinese military-industrial complex. We looked at Quectel in detail last year (pdf, p17): Beijing designates the company a “single champion,” and provides it with support to ensure it can maintain its leading global position in critical industrial nodes. (House Select Committee on the CCP, Force Distance Times)

️ China’s battery materials players head to Morocco. The north African country—which has free trade ties with the US and EU—is on track to become a key producer of cathodes, the positively charged end of a battery. China’s BTR’s recently announced 497 million USD investment in a cathode plant there adds to recent investments by other Chinese players, including Huayou Cobalt, CNGR, and Tinci. Another attraction is Morocco’s upstream resources: “Morocco has considerable critical mineral supply which BTR may be planning to employ as feedstock,” says Benchmark pricing analyst Anya Sidhu. (Benchmark Source)