Japan has recognized the strategic value of friendshoring since well before it became a buzz phrase—and a burgeoning Japan-Australia green hydrogen partnership could offer lessons to other countries. Meanwhile, the US shale boom looks to be flagging, a new report raises aluminum alarms, and Europe’s China stance is hardening. Plus: Are we back to supply chain normalcy yet?

JAPAN’S BIG HYDROGEN BET

A Japan-Australia hydrogen supply chain takes shape

Japan is marshalling the forces of private companies, government coordination, and the state’s financial firepower to build an ocean-spanning hydrogen supply chain.

The Japanese government this week committed 220 billion yen (1.6 billion USD) of funding to a Japan-Australia joint venture producing carbon-free green hydrogen from brown coal. The Hydrogen Energy Supply Chain project will gasify coal from Australia’s Latrobe Valley, refine that gas into hydrogen, liquefy it at a nearby port, then ship it to Japan.

The complex effort draws on resources and technical know-how from major Japanese companies. The electric utility J-Power and industrial conglomerate Sumitomo Corp. will take charge of producing green hydrogen with carbon capture, utilization and storage. Then, Japan Suiso Energy, a joint venture between Kawasaki Heavy Industries and Iwatani Corp., will oversee purchasing, liquefying, and shipping the hydrogen. The ship, custom-built by Kawasaki and completed in 2020 with joint funding from Japan and Australia, is the world’s first liquefied hydrogen carrier.

And now, with the latest injection of Japanese government financing—drawn from the state’s 2 trillion yen Green Innovation Fund— the Australia-Japan hydrogen supply chain project has entered the commercial demonstration phase. Full production for export is set for the late 2020s, with the potential to supply up to 225,000 tons of green hydrogen a year.

This isn’t the first time Japan has sought to shore up its resource security through a major public-private undertaking in partnership with Australia. Recall the Japanese state-backed company Jogmec’s rescue of Australian rare earths miner Lynas from bankruptcy in 2016, keeping alive the only significant non-Chinese source of rare earths. And that effort is continuing: This week, Jogmec and Sojitz invested another 134 million USD in Lynas to secure the supply of heavy rare earths.

A similar playbook is again being put to the test as Tokyo seeks to leverage its alliance with resource-rich Australia to mitigate its energy scarcity. Much hinges on the hydrogen project, not least Japan’s energy security. And if successful, it could be an exemplar of strategic and coordinated friendshoring.

FACTORS

FACTORS

FACTORS

FACTORSIs the US shale boom fizzling?

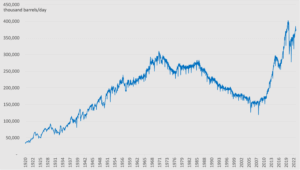

Record oil production, driven by the shale boom, making the US the world’s largest supplier. Now, rising costs, investor pressure, a lack of reinvestment, and the reality that the best wells have already been tapped are weighing on supply growth.

US oil production in 2022 grew at one-third of the annual average pace seen from 2017 to 2019, and is still below pre-pandemic levels. Research by investment firm Goehring & Rozencwajg indicates that Bakken and Eagle Ford—two of the Big Three oil fields—are suffering from depletion. Energy executives warn that the looming end to America’s shale boom portends a return to foreign energy dependence and the ceding of global oil market influence to OPEC.

And of course, electrification is no panacea either: As we’ve noted repeatedly, America’s growing dependencies in the materials and technologies underpinning electrification present their own set of risks.

US crude production, 1920-2022

Source: Energy Information Administration

Beware US aluminum supply risks

The US must ramp up domestic aluminum production as a matter of national and economic security, says a new report from the SAFE Center for Strategic Industrial Materials. US aluminum demand is rising. But domestic production has declined for decades, and since last June the single US smelter capable of producing high-purity military grade aluminum has been completely idled due to high energy prices. That poses risks of increased reliance on the UAE, Russia, and China. The good news, per the report: The clean energy transition, boosted by the Inflation Reduction Act and infrastructure deal, can “[advance] the US primary aluminum sector’s potential economic viability.”

Are we back to supply chain normalcy yet?

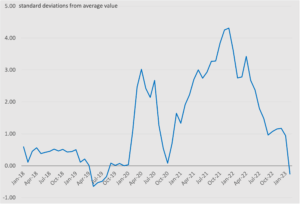

The New York Fed’s Global Supply Chain Pressure Index would suggest that global supply chains have untangled their snarls and resumed “normal” functioning. But have they really?

The index is built on a range of metrics, including data from the Institute for Supply Management’s PMI, to track things like delivery time, backlogs, and transportation cost. Importantly, as the research organization Employ America points out, the PMI data measures the rate and direction of change, not the outright level. That means the index’s latest negative reading shows that “things are likely, in aggregate, no longer getting worse”—but the disruptions built up over the past three years of snarl have yet to pass through the system completely.

Nor is it clear that the pre-pandemic “normal” of supply chain pressures is the status quo the world should aspire to. Disruptions unleashed by Covid and Russia’s invasion of Ukraine underline the vulnerabilities of today’s supply chain configurations, whether or not they benefit from periods of relative calm.

New York Fed’s Global Supply Chain Pressure Index

Source: Federal Reserve Bank of New York

MARKETS

MARKETS

MARKETS

MARKETSThe hawks keep circling

US Federal Reserve chair Jerome Powell laid out a hawkish outlook in his Capitol Hill appearances this week. On Tuesday, he said that interest rates are likely to go higher faster than policymakers expected. That sent markets into a tizzy. The S&P 500 shaved off 1.5%, and two-year Treasury yields climbed above 5% for the first time since 2017. On Wednesday, Powell reaffirmed that message, but added a caveat: The decision is still up for debate.

Either way, it’s a far cry from Powell’s decidedly more dovish comments last month. (Prompting some investors to grow tired of Powell’s inconsistent messaging.) But like it or not, they have to contend with the fact that the US labor market remains exceptionally strong: 311,000 jobs were added in February, more than economists had forecast.

Europe hardens its stance on China

Several recent developments indicate a hardening of Europe’s policy towards an aggressive China, and a growing transatlantic convergence on relevant policy tools.

Last week, a senior EU official warned of sanctions if China provided weapons to Russia; German chancellor Olaf Scholz echoed that with a warning of “consequences.” Meanwhile, Germany is reportedly considering banning certain components from Chinese firms Huawei and ZTE in its telecoms networks. And the Netherlands officially joined the US this week in restricting exports of advanced semiconductor manufacturing technology.

A coordinated US-EU approach to China is certainly better than a scattershot one, or of course unilateral US action. But remember: Sanctions and export restrictions will only be effective if they target key nodes and building blocks of the Chinese industrial ecosystem, and not merely surface level threats. Case in point: The Financial Times reports that Chinese AI firms are circumventing US chip export controls by simply renting long-term access to to Nvidia’s A100 chips.

The Silicon Valley Bank saga

We can’t not mention Silicon Valley Bank. In case a recap is necessary: On Wednesday, SVB, known as the start-up bank, surprised investors with the news that it would need to raise $2.25 billion to shore up its balance sheet. Two days of mass hysteria and 42 billion USD in withdrawals later, the bank had officially failed and the Federal Deposit Insurance Corporation had been appointed receiver. Now, a search is on for a buyer — and the bank’s depositors, including a who’s who of start-ups, tech companies, and their investors, are sitting in cash limbo.

These depositors may ultimately get their money back. But in the meantime, they’re frozen. Already, start-ups are struggling to make payroll. This creates chaos and, of course, the potential for ripple effects. It also creates the potential for enormous opportunity in the form of access to cash-strapped assets. One thing we’re watching: Will China and Chinese investors sweep in to take advantage of the moment; of this access to US innovation?

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSLithium short sell

Short seller Blue Orca Capital alleges in a report that the North Carolina-headquartered Piedmont Lithium’s supply deal from a Ghana mine is essentially worthless because key mining licenses obtained through a UK-listed company were through “textbook corruption.” Piedmont’s shares slumped sharply Wednesday on the report, but rebounded from early losses to finish up over 4% for the day.

According to the report, Atlantic Lithium obtained the licenses by bribing the son of a leading politician whose party is no longer in power. Blue Orca wagers that Ghanaian authorities will refuse to ratify the licenses because they are “tainted by corruption.” That would leave Piedmont’s planned lithium hydroxide processing plant in Tennessee—supported by a 142 million USD grant from the US Department of Energy—without raw material supplies, and therefore unviable.

In response, Piedmont notes that Atlantic has denied Blue Orca’s allegations. It adds it would be able to secure alternative feed for its Tennessee facility should the offtake supply deal with the Ghana mine fall through.

Japan and South Korea make nice

A shared objective to contend with an aggressive China may finally help Japan and South Korea resolve their historical dispute over wartime forced labor. Seoul announced this week that it would set up a government fund to compensate victims of forced labor during World War II, dropping its longstanding demand that Japanese companies make the payments. The rapprochement will continue with the two countries’ leaders meeting in Tokyo next week—the first such two-way summit in 12 years.

Chinese observers are taking note: A researcher at Beijing’s Central party school scoffed at South Korea’s “diplomacy of humiliation,” adding that Seoul is merely “dancing with the wolves” by throwing in its lot with Washington and Tokyo. “Even if it can benefit in the short term, will it end well?”

(Photo by Madison Inouye/Pexels)