It’s not every week that the largest ever lithium deal gets inked–and more consolidation could be on the horizon. Meanwhile, Argentina wants to be a copper major, Australia wants to ride the hydrogen commodity boom, and Canada is struggling to monitor mining investments. Plus: A look at Rockwell Automation’s China footprint.

LITHIUM MINERS UNITE

A lithium juggernaut is born

A blockbuster lithium deal could shake up the global market for the battery mineral.

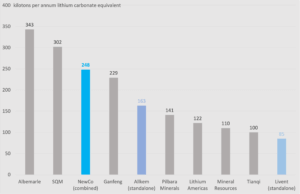

This week, US-based Livent and Australia-based Allkem said they are combining in a 10.6 billion USD deal. It’s the largest ever transaction in the lithium industry, creating a globe-spanning enterprise that will be the world’s third largest producer of the battery metal.

The mega merger into an as-yet-unnamed company—the placeholder website is merely globallithiumleader.com (and we love it) —will boost the new entity’s financial firepower, access to resources, technical skills, and pricing power. All are key factors in successfully developing lithium projects to meet surging global demand, ensuring security of supply, and competing more forcefully against Chinese heavyweights.

A major focus for the newly merged company, which will be listed on the NYSE and headquartered in the US, is Argentina. Livent and Allkem already have lithium brine facilities there; consolidating their operations should speed up projects.

Another major factor that could determine the new company’s success: whether Argentina can clinch a deal with the US so the country’s lithium can qualify for Inflation Reduction Act tax credits.

Meanwhile, Livent and Allkem aren’t the only lithium players looking for more heft. In March, the world’s largest lithium producer Albemarle made a takeover approach to Australia’s Liontown Resources. Liontown said no. Albemarle is unfazed, and is still on prowl for more acquisitions. So is China’s Tianqi Lithium, which had its bid for Australia’s Essential Metals rejected by shareholders last month. More M&A deals could be in the works, and lithium miners’ stocks surged this week on hopes of additional consolidation among producers.

Forecast attributable lithium production capacity (ktpa LCE)

Source: Allkem and Livent

FACTORS

FACTORS

FACTORS

FACTORSArgentina wants to be a major copper player

While Argentina is known as a major lithium producer, the country also wants to muscle into the copper arena. If its current pipeline of projects progress as planned, Argentina’s government forecasts it could become a global top 10 producer of the red metal by 2030.

The country is already attracting major miners including Glencore and Lundin Mining. Another is McEwan Copper, which automaker Stellantis recently bought into to gain access to a giant copper deposit in Argentina’s San Juan province.

Still, Argentina’s lofty metal ambitions must contend with the country’s deepening macroeconomic troubles. Its foreign reserves are falling while inflation climbs and the exchange rate—both official and black market—weakens. A historic drought is making matters worse by hitting exports of corn, wheat, and soy. Will mining projects manage to skirt the turmoil of Argentina’s economic crisis?

Canada’s risky prospects

In other minerals news: Canada’s critical minerals-related national security provisions appear to have a giant prospecting loophole. While Ottawa is cracking down on Chinese acquisitions of Canadian critical minerals assets and companies, the Globe and Mail reports that there are “almost no restrictions at all” at the prospecting stage.

That means a foreign firm with ties to China could very easily buy claims across Canada while hiding its identity thanks to an opaque registration system complicated by confusion over federal and provincial jurisdictions. That could give state-linked Chinese firms cheap access to lucrative mining claims, all while skirting scrutiny until they have amassed control over a potentially strategic and valuable deposit.

An Africa-Europe hydrogen corridor

Austria, Germany, and Italy have signed a joint letter to support a 3,300-kilometer hydrogen pipeline to transport the fuel from the North African coast in Tunisia, through Italy and Austria, and into Germany’s industry-heavy Bavaria region. Each segment of the green hydrogen corridor—set to be fully operational by 2030—will be eligible for EU funds and expedited permitting. Better still, North Africa’s significant export capacity means the corridor could deliver 40% of the EU’s hydrogen import target—an important step in Europe’s efforts to diversify energy supplies.

Green hydrogen is now an “economic product”

Over in the US, Florida-based NextEra is also betting big on green hydrogen. While the company had pledged to invest in clean hydrogen before the Inflation Reduction Act passed, the climate legislation has fundamentally changed the business calculus, according to the firm.

And Australia is eyeing hydrogen as the next big commodity boom to ride. As part of its new annual budget, Canberra this week announced a two billion AUD (1.4 billion USD) investment to scale up the country’s production and export of green hydrogen.

One potential bottleneck for the world’s green hydrogen ambitions: the scarcity of iridium, a rare metal needed for electrolyzers and whose supply is currently dominated by South Africa. The good news is that there are promising workarounds. Japan’s Toshiba, for example, announced in October that it developed large-scale production technology for electrolysis electrodes that slash iridium use by 90%.

MARKETS

MARKETS

MARKETS

MARKETSThe IRA is crowding in private investment

Speaking of the Inflation Reduction Act changing business calculations for clean tech firms: Comments from CEOs in recent earnings calls suggest that the IRA is already crowding in private investment in the renewable energy and industrials space.

Take Ohio-based flat-rolled steel maker Cleveland-Cliffs. Its CEO said last month that money from coming from the IRA “will support more and more investment” in steel production for customers in the wind, solar, and EV charging infrastructure businesses. Similarly, North Carolina steelmaker Nucor sees the IRA driving up to three million tons of additional annual steel demand for clean energy projects. And long-duration storage system maker ESS Tech says the IRA has “definitely juiced up the number of customer conversations”

Industrial manufacturers and engineering firms are getting busy, too. Texas-based Flowserve sees growing demand for its industrial machinery like pumps and valves to support clean energy pipelines worldwide. ESCO Technologies, which makes highly engineered industrial products to support electric grids, sees “very, very robust investments” from utilities and renewables customers. Willdan, which provides energy and engineering services across the US, says IRA funding is helping cities pay for major projects.

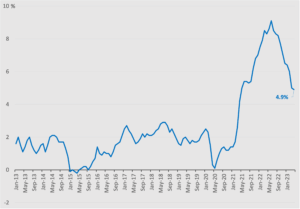

US prices are lower, but still high

The latest US consumer price index data give some reasons for optimism. Inflation has slowed for ten straight months. The CPI rose 4.9% in April on the year, down from 5% in March. Excluding energy and food, the core CPI rose 5.5% on the year, down from 5.6% the prior month. That’s all good news, and could strengthen the case for the Fed pausing its rate hikes. Wall Street definitely seemed to think so. But prices are still high. And structural factors, most notably disruptions from climate change and an ageing population, could keep prices high for years to come.

US CPI, 12-month percentage change

Source: US Bureau of Labor Statistics

Sputtering industrial momentum?

Germany and China—both industrial powerhouses occupying critical nodes across key supply chains—are showing signs of economic weakness and slowing manufacturing activity.

Germany’s factory output fell 3.4% in March over the prior month. It was a far steeper decline than the 1.3% drop economists had forecast, and marked the largest drop in a year. Recession risk warning signs are flashing red.

And in China, disappointing trade data points to an elusive and sluggish Covid-reopening recovery. Imports fell sharply in April, contracting 7.9% on the year. The fall in inbound shipments suggests weak domestic demand, but also likely faltering momentum among its trading partners given that China re-exports some of its imports.

Meanwhile, though Chinese exports grew 8.5% last month on the year, the increase is skewed by the fact that much of China was locked down in April 2022. Plus, a 41% year-on-year slump of domestic excavator sales, and a deceleration in excavator exports, point to slowing economic activity both in China and globally.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSRockwell Automation’s China footprint

The Wall Street Journal reports this week that the American industrial automation technology company Rockwell Automation is facing a US government probe over its software operations in China. Specifically, the White House worries that Rockwell’s China-based facilities could be exploited to target critical US industrial and military infrastructure in cyberattacks.

An immediate question is why Rockwell needs to outsource its software work to China in the first place. Given that China views advanced manufacturing and industrial automation as a key priority, Rockwell’s footprint in the country would appear to be a key point of leverage that Beijing could use against the company.

In an earnings call shortly after the WSJ’s story broke, Rockwell CFO Nicholas Gangestad acknowledged that relocating software operations out of China would be easier than moving capital-intensive manufacturing facilities: “It’s something that…could and would be addressed… if we need to take action, we, of course, will take that action.”

(Photo by Mike Bird/Pexels)