The Pentagon is funding a major domestic rare earth magnet factory–but beware hidden risks of its China exposure. Meanwhile, diesel prices surge, uranium may be entering a bull market, Australia’s national manufacturing fund places its first bets, and SoftBank ups its bet on MapBox. Plus: a Saudi-Israeli-American uranium deal.

REDUCING DEPENDENCE OR INCREASING EXPOSURE?

A large-scale rare earth magnet factory is coming to the US

The US Department of Defense this week announced an award of nearly 100 million USD to E-VAC Magnetics to establish domestic rare earth permanent magnet manufacturing capability.

E-VAC, which is part of Germany’s Vacuumschmelze, is tasked with installing manufacturing equipment and running production lines to reach “high volume” magnet output by 2025.

Some background: Vacuumschmelze is the West’s largest producer of rare earth permanent magnets. The company is taking big bets on the US: in January, it finalized a deal with General Motors to build a North American plant to make permanent magnets for electric vehicles.

But Vacuumschmelze is also deeply exposed to China: a quarter of its employees work there and it has a major production plant in the Chinese province of Shenyang. Plus, Vacuumschmelze owns 49% of a Chinese joint venture with Zhongke Sanhuan, China’s largest manufacturer of rare earth magnets. And Zhongke Sanhuan’s controlling shareholder is the Chinese Academy of Sciences, which itself sits directly under the State Council.

A question: what does it mean for the US to rely on Vacuumschmelze to reduce China dependence, even as Vacuumschmelze itself has a massive China footprint? Another question: where will E-VAC source its raw materials from?

FACTORS

FACTORS

FACTORS

FACTORSDiesel shortage? Chinese refiners’ exports are surging

Oil is headed towards the 100 USD per barrel mark. But that’s not even biggest inflationary risk on the horizon. Diesel prices have surged even more as the world’s refining system struggles to keep up with rebounding consumption and plants that were shuttered during Covid.

China appears to be in a position to take advantage of the global market tightness. It imported record volumes of crude in the first half of 2023, and vast quantities are flowing to its inventories. A lot of that oil is being bought at discount: its June crude imports from Russia were “the largest volume China has ever imported from any country in any month,” per the US Energy Information Administration. In turn, Chinese diesel exports are surging as refiners take advantage of high margins.

Now, China’s refiners have the luxury of choice. As Reuters notes, they could maintain strong processing rates to meet domestic demand and raise exports to capture strong margins. And if crude prices rise further, China could reduce imports and turn to its robust stockpiles.

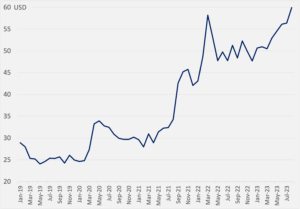

Uranium’s rally

Uranium prices are at their highest since 2011, popping 12% in the past month alone. Resurgent global interest in nuclear power as a way to boost energy independence explains part of the rally. The coup in Niger, one of the world’s biggest uranium producers, has added to upward pressures.

And the rally may just be getting started. Natural resources investment firm Goerhring and Rozencwajg thinks prices of the radioactive metal could rise as much as four-fold in the next few years.

Uranium spot prices

Source: Cameco

Downward pressures on copper

Robust copper demand is often an indicator of a growing economy. By that measure, China’s copper industry is another reflection of the country’s lacklustre economy. While demand from the clean energy sector is helping to prop up the red metal’s market, the overall macroeconomic situation is weighing it down. That’s especially so given that construction accounts for a quarter of China’s copper demand—and that sector is under immense pressure from the ongoing property crisis.

MARKETS

MARKETS

MARKETS

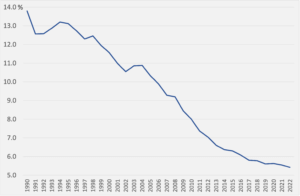

MARKETSCanberra’s manufacturing fund makes its first bets

The Australian federal government this week made its first cash injection of 5 billion AUD to the National Reconstruction Fund, a 15 billion AUD (10 billion USD) approved in March to boost the country’s manufacturing sector. Of the first 100 proposals for the fund, investments in clean energy and advanced technology dominate. Australia now joins a growing number of countries investing heavily in domestic production capacity.

In calling for a “Made in Australia” future, prime minister Anthony Albanese warned of the pandemic that left Australia “vulnerable,” and the risk of future pandemics and other international shocks.

Australia, manufacturing value added (% of GDP)

Source: World Bank

SoftBank’s AI bets

SoftBank has led a 280 million USD funding round for MapBox, as the US location mapping software company deepens its push into the automotive industry. As MapBox puts it, the new funding “accelerates [its] efforts to bring AI into the car.” And for SoftBank, the investment is part of its effort to step up dealmaking in AI. It’s also in line with what the Japanese conglomerate’s founder Masayoshi Son’s pursuit of a “counteroffensive,” the Financial Times reports, after multiple quarters of massive losses. Meanwhile, one thing to remember: competitiveness in AI-powered cars requires robust supply chains across both software and hardware.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSA Saudi-Israeli-American uranium deal?

Citing US and Israeli officials, the Wall Street Journal reports that the two countries are working on a proposal to set up a US-run uranium enrichment operation in Saudi Arabia with an eye to ultimately establishing official diplomatic relations between the two Middle Eastern countries—and ultimately, for other Arab and Muslim nations to follow suit.

Should the plan goes forward, it would upend decades of American and Israeli policy, which has worked to prevent uranium enrichment capabilities in Middle Eastern countries. For Washington, the potential deal could help reinforce US influence in the Middle East at a time when China sees its sway in the region growing.

(Photo by Tom Fisk/Pexels)