Ford and CATL are teaming up to build a EV battery factory in the US, and it’s a new lightning rod for the US-China competition. Meanwhile, Europe has survived the winter with gas inventories chock full but its gas dilemma remains — while the US reasserts itself as the global oil price maker. Plus, another week of a mixed bag of economic data, and US fund manager VanEck might be getting cold feet on China.

THE FORD-CATL DANCE

Ford taps Chinese technology for a new battery plant – enter geopolitics

Ford announced this week that it will build a 3.5 billion USD EV battery factory in Michigan. According to the company, the new facility will be America’s “first automaker-backed [lithium-iron-phosphate] battery plant.” Buried 13 paragraphs down in the announcement (though headlining news reports): The factory will rely on technology licensed from Chinese battery giant CATL.

The Ford-CATL deal represents a turning of the commercial tables, of sorts. Back in 1924, Sun Yat-sen wrote to Henry Ford asking the industrialist to invest in China to help the country build a “new industrial system.” Ford didn’t bite. Now, almost exactly a century on, it’s an American firm looking to China as the US tries to rebuild its domestic manufacturing base. But that’s if the project goes ahead at all: Senator Marco Rubio has called for an official review into the deal and Senator Joe Manchin says the new plant shouldn’t be eligible for Inflation Reduction Act incentives. Plus, in a move that should be (we argue) interpreted as trolling more than anything else, Beijing will reportedly review the tie-up to “safeguard Chinese technology.”

Why do we smell trolling in Beijing’s review? Because other Chinese sources suggest that the Ford-CATL deal is seen as a net strategic positive in the effort to establish footholds in, and ultimately control over, the US electric vehicle landscape. As the tech outlet 36Kr put it: “If CATL gives up the US market and allows South Korean manufacturers to develop and grow in the US, the leadership of China’s new energy industry may be overtaken by South Korean manufacturers.” And even though CATL won’t own any part of the new Ford battery plant, it will earn licensing fees from sharing its technology. The business news site Huxiu calls this move “entering the US at a curve” (or indirectly) —in a move that “has more strategic significance than commercial value.”

Regardless, the key takeaway: The Ford-CATL deal is about to find itself at the cross-hairs of the US-China competition. This is just the latest evidence that that geopolitical contest will rope in, and be waged over, the commercial sector — whether companies want that or not.

FACTORS

FACTORS

FACTORS

FACTORSEurope’s big energy bill

Europe has racked up a huge bill shielding its citizens from runaway energy costs: 768 billion euros (825 billion USD) since September 2021, according to Bruegel. Germany was the biggest spender by far, earmarking over 264 billion euros—far higher than the next highest spenders UK, Italy, and France, and also significantly higher in terms of GDP share.

But while the massive spending has helped Europeans weather the energy crisis, a long-term solution demands a fundamental rethinking of Europe’s energy policies. And on that front, much work remains…

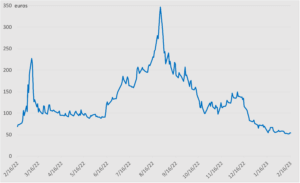

Lots of gas in reserves, not enough gas contracted

Take gas reserves, for example. Europe entered the winter with some of its highest gas stockpiles in years. Those supplies are now essentially stuck as European gas prices have fallen to an 18-month low. That means gas used to fill the inventories was purchased at much higher price, so sales from the stockpile will come at a huge cost—to the tune of billions of euros—to energy users and taxpayers.

Meanwhile, Europe will continue to need more gas—but it hasn’t signed enough long-term contracts with LNG producers to secure supplies. Data from the Shell’s latest LNG Outlook report show that Europe’s long-term contracts barely cover 20% of projected LNG demand in 2030. That compares with roughly 80% for Japan and 75% for China. Without enough long-term supplies locked in, Europe is exposing itself to the volatile spot market—”a recipe for sustained insecurity,” as Greece’s chief energy advisor put it.

Austria presents another kind of cautionary tale. Prior to the Russia-Ukraine war, the country relied on Russia’s state-owned Gazprom for 80% of its gas imports. That level fell in the months following the invasion, but is now back up and nearing pre-war levels. And the Austrian government is reluctant to stop the inflows of cheap Russian gas, citing long-standing contractual obligations between the country’s energy major OMV (about one-third state-owned) and Gazprom.

Dutch TTF Natural Gas Futures

Source: MarketWatch

The US, global oil price maker

Surging US oil exports are strengthening America’s global pricing power of the fuel. Producers, refiners, and traders, looking to hedge bets, are piling into contracts for West Texas Intermediate Crude sold at the Texas hubs of Houston and Midland. The surge in daily trading of these contracts is quickly marking the “rebirth of US oil as the driving force of global oil price,” as an S&P Global analyst put it. Plus, Midland crude’s forthcoming inclusion in the Brent global benchmark in June will further formalize US oil exports’ influence on worldwide prices.

China’s big grain push

Beijing this week published its “No. 1 central document,” the first key policy statement released each year. Following last year’s run up in global food prices, food security is a major priority in the document (as it was in the previous edition). The policy statement calls for boosting grain production capacity by 50 million tons, roughly an 8% increase from current capacity. Authorities want to expand soybean and oilseed planting, and speed up the commercialization of GMO grains. The government will also increase soybean and corn subsidies and pilot new insurance schemes. Meanwhile, China is reportedly back in the market for US soybeans, at least for now, as a result of delays in Brazilian shipments.

MARKETS

MARKETS

MARKETS

MARKETSSticky inflation, bumpy disinflation

Another week, another batch of data with which to try and make sense of the economy. January’s Consumer Price Index was a mixed bag. Consumer prices rose 0.5% on the month, the most in three months, up from 0.1% in December. Meanwhile core inflation (excluding food and energy) stayed at 0.4%. The annual inflation rate hit 6.4%, higher than expected.

Those numbers, alongside January’s red-hot jobs report and a larger-than-expected jump in retail sales, don’t necessarily indicate an immediate re-acceleration of inflation. But nor do they point to a smooth disinflation story. That will keep the Fed busy as central bankers continue to thread the needle of taming prices while avoiding a harsh recession.

Another complicating factor: A metals rally. A basket of industrial metals that trades in London – including copper, aluminum, and zinc – recorded its best January in more than a decade. Prices are being pushed up by China’s pandemic reopening, as well as low global supplies. Pricey metals could make stubborn inflation even stickier. They could also be a leading indicator of a newly-open China’s potential to exacerbate inflationary trends.

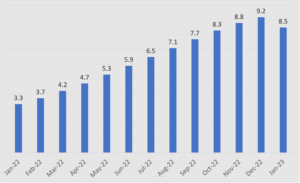

Has European inflation peaked?

Across the Atlantic, the European Commission believes the that bloc will avoid a technical recession, inflation has peaked, and prices could fall faster than thought. Inflation is now forecast to be 5.6% within the eurozone and 6.3% across the bloc for 2023, down from the eurozone’s 10.6% in October. But this inflation outlook risks being deceiving. Much of the drop in inflation has been driven by declining energy prices; core inflation may still climb some more.

EU27 CPI, 12-month average rate of change

Source: Eurostat

VanEck re-examines its China footprint

In 2020, China lifted ownership caps on foreign-owned futures, fund, and securities management firms servicing retail investors. A number of foreign financial players have since received approval to run wholly-owned mainland entities, including Standard Chartered, Schroders, and Fidelity.

But it seems that not everyone is so eager for more China exposure. The US fund manager VanEck, which has a pending application submitted in 2020, has reportedly paused the process and is considering terminating the whole project altogether. Separately (but relatedly), Singapore’s sovereign wealth fund GIC has reportedly paused private investments in China as it steps up scrutiny of risks and rethinks its China strategy.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSTech’s loss, agriculture’s gain?

Over in the US, farming could get an indirect boost from tech sector turmoil: Major farm equipment manufacturers say they’re actively recruiting Silicon Valley workers who have been laid off recently. That will help the likes of Deere, Caterpillar, and CNH Industrial swoop up engineers to plow ahead with developing cutting-edge machinery like autonomous tractors and weeders to increase crop yields and alleviate farm labor shortages. CNH, for example, hired over 350 new engineers last year, including some from Microsoft and Amazon. And Deere will have a busy year ahead: It just beat its earnings forecast and raised its 2023 profit outlook.

(Photo by Victor Miyata/Pexels)