If the West wants to reduce reliance on China for minerals, it will need to invest some serious money into big mining projects—but so far, investors seem reticent. Meanwhile, risks may be lurking in the tin supply chain, Chinese EVs could threaten European aluminum, and China sees plunging IPOs, inbound FDI, and manufacturing PMI. Plus: the drought-stricken Panama Canal.

SHOW ME THE MONEY

Mining’s financing problem

The pain points in the West’s minerals strategy are by now well known. Production is increasing, but not anywhere near enough. There is a lack of capital to finance large projects. Mining permit approvals take too long. And there’s a missing middle of processing capacity.a

Speaking at this week’s International Mining and Resources Conference (IMARC) in Sydney, HSBC’s global mining head said the bulk of capital available for mining is directed to places like China, Indonesia and Saudi Arabia. Meanwhile, BlackRock warned that investor reticence about mining would hold back the energy transition.

Evy Hambro, a managing director at the global asset manager, noted that the relatively low valuation of mining firms fail to reflect their critical importance to clean energy technologies downstream of them.

“The further you get away upstream from the renewable power companies, the lower the multiples go,” he said. “But you can’t have the renewable power companies or electric-vehicle manufacturers without everything upstream of them.”

The financing issue is a problem that China’s mining industry is grappling with, too. In the past decade, the size of the Chinese capital market has grown four times, while the market cap of all mining companies has only doubled, according to a report on mining finance (link in Chinese) published this year by the Ministry of Natural Resources and the Bank of China.

One idea that industry players are discussing, according to China Mining Magazine (link in Chinese), is establishing a “big fund” for mining—akin to the state-backed semiconductor investment fund that goes by the same moniker.

FACTORS

FACTORS

FACTORS

FACTORSRisks lurking in the tin supply chain

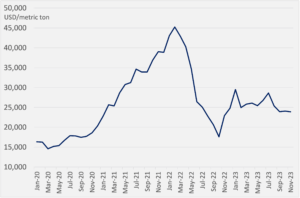

Tin is regarded as a critical (or strategic) mineral by both the US and China, though Europe does not designate it as such. Indonesia, meanwhile, just classified tin as one of 47 critical minerals. And in a poll conducted at a London Metals Exchange seminar last month, tin was regarded as the metal with the second most upside potential in 2024, behind copper.

All of which is to say: tin, often a forgotten critical mineral that’s widely used in electronics soldering and batteries, could be in for an exciting year ahead.

Driving the potential upswing in prices is Myanmar’s mining ban on tin, imposed on the country’s Wa state that’s responsible for 70% of national production of the metal. Already, that has caused a collapse in Chinese imports of tin concentrates. For now, supply chain impacts have been limited due to overall tepid demand, as well as China’s scooping up of the metal earlier this year when prices were low.

Tin futures prices, monthly

Source: Investing.com

A threat to European aluminum

The Chinese EV onslaught isn’t only threatening legacy carmakers. It’s also posing a risk to European producers of raw materials, including aluminum. The Norwegian alumnium company Norsk Hydro has warned that Europe’s imports of Chinese EVs could have a big impact on regional aluminum demand.

“That is a threat that we are following: if European automakers start reducing their demand [for aluminium] because they are outcompeted,” the company’s CEO Hilde Merete Aasheim told the Financial Times.

Plus, the EU’s anti-subsidy probe into Chinese aluminum would offer little reprieve to its own producers if demand for the metal were to plummet.

MARKETS

MARKETS

MARKETS

MARKETSChina’s triple plunge: IPOs, FDI, and PMI

Key indicators of economic health and vitality are trending steeply downwards in China:

- Tech IPOs have plunged in Shanghai as regulators tighten oversight over who’s allowed to list, with the Financial Times citing public records showing 126 firms suspending or cancelling IPO applications in the Shanghai Star Market so far this year.(IPOs that are apparently faring better: those of “little giants,” which now make up half of the listed companies(link in Chinese) on the Beijing Stock Exchange.)

- FDI into China has sunk, dropping 34% year on year in September, according to an FT analysis. Quarterly direct investment liabilities, a gauge of foreign capital inflows, are at a two-decade low.

- Meanwhile, factory activity unexpectedly shrank in October, with the manufacturing PMI falling to 49.5 last month from 50.2 in September.

Are we there yet?

US Federal Reserve chair Jerome Powell this week delivered remarks that some think hint at an end to the central bank’s aggressive rate hike campaign. Markets cheered the news: bond yields receded and the S&P500 ended Wednesday up more than 1%. Others interpret his comments as keeping a door open to still another interest rate increase. Woven between Powell’s lines was also some degree of optimism that the US economy can grow faster than usual right now, without inflationary pressure, thanks to supply-side improvements.

DISRUPTORS

DISRUPTORS

DISRUPTORS

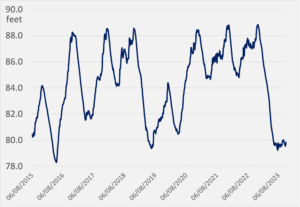

DISRUPTORSThe Panama Canal, parched

Hear it from the Panama Canal Authority: it just saw the driest month of October since 1950, when records began. That poses a two-pronged challenge: ensuring enough water supplies for the country, and maintaining operations at the crucial interoceanic waterway. In response, canal authorities are slashing the number of ships allowed to cross each day in the coming months: from Nov. 3, daily crossing will be limited to 25—down from the already reduced 31—and gradually brought further down to 18 by February.

Water levels at the Gatún Reservoir

Source: Panama Canal Authority

(Photo by Pixabay/Pexels)