The satellite space race is heating up—and China sees it as the next battlefield in the mobile communications contest. Meanwhile, markets overreact to Tesla’s announcement of rare earths-free motors, Beijing cracks down on domestic lithium mining, and Britain’s salad crisis highlights food security concerns. Plus, banger factory activity in China, the opposite in the US, and sobering inflation news in Europe.

THE SMARTPHONE SPACE RACE

The satellite-enabled phone race heats up

Chinese media reports increasingly treat satellite connections as the next realm of competition in mobile communications. “The next smartphone battlefield will be in the skies,” notes the tech outlet PingWest. “The battlefield for cell phone manufacturers has escalated from 5G to satellite communications, which is, in essence, a battle for satellite resources,” notes 36Kr, another tech site.

And this week, Chinese phone makers got a leg up on satellite connections thanks to Qualcomm. The US semiconductor maker announced partnerships with Honor, Oppo, and Xiaomi to bring satellite communications to their smartphones. The satellite connection is based on Qualcomm’s high-end Snapdragon chipset. (An aside: This does not exactly support the narrative that recent export controls and the CHIPS Act are creating a semiconductor decoupling between the US and China.)

The news comes on the heels of a flurry of other, recent developments in satellite-enabled phones. In September, Huawei unveiled one-way satellite texting for its Mate 50 phone, powered by BeiDou, China’s GPS alternative. Days later, Apple showcased two-way satellite texting for iPhone 14s, enabled by the US satellite company Globalstar. Apple last week increased its investment in Globalstar, investing 252 million USD in the form of a loan as prepayment for future satellite services for iPhones.

Meanwhile, Britain’s Bullitt last month revealed its new phone with satellite texting capabilities facilitated by IoT connectivity startup Skylo, British satellite service provider Inmarsat, and chipsets from Taiwan’s MediTek. Samsung has also secured a modem, to be integrated with its Exynos chip, that enables direct-to-phone satellite communications.

FACTORS

FACTORS

FACTORS

FACTORSChina’s lithium crackdown

Government officials from multiple Chinese ministries have launched a crackdown on illegal lithium mining in the city of Yichun in Jiangxi, following reports of large-scale unlicensed mining by villages looking to cash in on the critical metal’s spectacular rally. Processing facilities have been ordered to halt operations while the probe is carried out.

A sizable share of global lithium production could be knocked out as a result: A monthlong shutdown of operations would threaten between 8% and 13% of worldwide supplies, per calculations from Rystad Energy and CITIC Securities, respectively. Yichun produced 81,000 tons of lithium carbonate in 2021, over a quarter of China’s national total, according to news outlet China Fortune. Such a shutdown could also pause the recent slide in Chinese lithium prices, which have fallen over 30% since November to hit 12-month lows.

Australia blocks a Chinese rare earth investment

Citing national security concerns, the Australian government has blocked the China-linked Yuxiao Fund, the largest shareholder of heavy rare earths producer Northern Minerals, from doubling its stake to 19.9%. The blocking order was signed last month by treasurer Jim Chalmers following a recommendation from the Foreign Investment Review Board to reject the acquisition.

This is clearly an instance of Australia tightening its inbound investment review. That does not mean, though, that loopholes don’t exist. Take for example Peak Rare Earths, another Australian miner: The Chinese state-linked rare earth giant Shenghe Resources was able to acquire a 19.9% stake in the company last February—without any consultation or negotiations with Peak itself. Months later, a Shenghe executive clinched a Peak board seat to fill a vacancy.

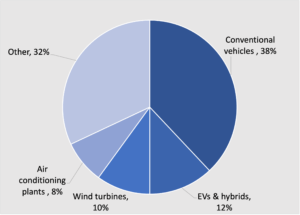

And Tesla eyes rare earths-free motors (maybe)

In other minerals news, Elon Musk announced at Tesla’s investor day that the company is working on a next-generation permanent magnet motor that requires no rare earths. Details are sparse right now on what the rare earth-free alternative would be, what working on it actually entails, and how feasible the project is. That of course begs the question of how much of Musk’s claim is real and how much bluster. But bluster or not, it’s worth exploring what the potential rare earth alternatives would be. One option is ferrite magnets, made of iron oxide; Hitachi Metals (now Proterial) announced in December that it’s developing one for EV motors. Another candidate could be an iron-nitride permanent magnet of the kind being developed by Minneapolis-based Niron Magnetics, which has a partnership with General Motors and in November received a 17.5 million USD grant from the US Department of Energy.

In any case, Musk’s comments sparked a selloff in Chinese rare earth miner shares. Australian miners like Lynas and Arafura crashed, too. Our thinking? Markets are overreacting; we wouldn’t write off rare earths just yet. For one, even if Musk’s claim is serious, Tesla makes up only two to three percent of global permanent rare earth magnet demand. Keep in mind, too, that after years of efforts to develop alternatives to neodymium-iron-boron magnets, no viable candidate has emerged.

Rare earth permanent magnets (NdFeB) end use by sector, 2019

Source: Center for Minerals and Materials, Geological Survey of Denmark and Greenland

MARKETS

MARKETS

MARKETS

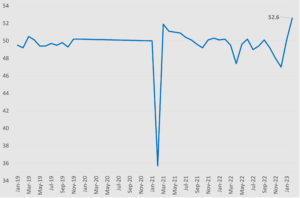

MARKETSIs the Chinese economy finally shaking off zero-Covid?

China’s factory activity has shot up dramatically, accelerating at the fastest pace in over a decade following the dismantling of nationwide Covid restrictions and lockdowns late last year.

The official industrial purchasing manager’s index (PMI) hit 52.6 in February, up from 50.1 in January and far higher than analyst forecasts of 50.5. The 50-level separates contraction from expansion. Markets reacted to the news: Hong Kong stocks jumped 4% on Wednesday, while oil ended slightly higher on renewed hopes of robust Chinese demand.

But a rebound in China has its risks, too, especially in an environment of energy scarcity and related inflation. For example, a sustained Chinese economic rebound could also drive up the country’s LNG demand by as much as 35% compared to last year, injecting a degree of demand uncertainty “greater than the uncertainty associated with the potential loss of all remaining pipeline gas flows into Europe from Russia,” the International Energy Agency wrote in its latest quarterly gas report. PetroChina, China’s largest gas importer, says how much LNG it buys will depend on whether spot prices remain elevated.

China manufacturing PMI

Source: Chinese National Bureau of Statistics

Whither other Asian economies?

In the meantime, keep an eye on whether China’s manufacturing activity rebound will spill over to the rest of Asia. That doesn’t seem to be happening for now: The export-driven hubs of North Asia all notched mediocre scores in S&P Global’s manufacturing PMI.

Japan’s manufacturing output posted the biggest fall in eight months, slumping to 47.7, though companies’ spending on plant and equipment increased in the fourth quarter; Taiwan’s factory activity jumped up to 49 but is still in the red; and South Korea’s remained at 48.5.

Amid a tight labor market, US manufacturing keeps shrinking

Is the US labor market finally cooling? It depends on what metric you use. Data from online recruiting companies ZipRecruiter and RecruitHoldings show larger declines in job postings on their sites late last year than Labor Department job openings numbers for the same period indicated.

That said, another fall in jobless claims applications last week reflects resilient labor market strength, with initial claims for state unemployment benefits remaining below 200,000 for seven straight weeks. The tight labor market and stubborn inflation, alongside a continuing expansion in the US service sector, will likely encourage the Fed to continue hiking rates.

But while services are expanding, manufacturing is still shrinking: The Institute for Supply Management’s PMI showed a 47.7 reading for February, barely above January’s 47.4 and the fourth straight month of contraction. The glass half full take on this downer of a datapoint: A rebound in business spending on equipment suggests that the worst may be over for manufacturing.

Sobering inflation news from Europe

Inflation in the eurozone cooled in February, but not as much as economists had predicted. Consumer prices rose 8.5% year on year last month, down slightly from January’s 8.6% but above forecasts of 8.2%. The more worrying news comes in the core reading, which excludes food and energy: That gauge jumped to 5.6% from 5.3%, highlighting the risk of persistent inflation even as energy prices fall. This could bolster European Central Bank hawks’ case for still more aggressive rate hikes.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSFoxconn’s India push

The Wall Street Journal reports that Taiwanese contract manufacturer Foxconn is considering a major expansion of production in India. Foxconn already produces about 6 million iPhones a year in India. That number could more than triple to 20 million by next year, according to the Journal’s reporting. The company is also reportedly planning a silicon carbide plant and packaging facility for its semiconductor business in India. And Foxconn’s diversification goes beyond India: The firm last month secured a new industrial site in Vietnam, and is set to begin manufacturing MacBooks there this year.

Supply chain diversification is picking up steam. Good. But critical upstream inputs remain decidedly China-dominated—and diversifying those sources of raw materials will require much more than setting up new factories.

Salad crisis in the UK

The Liz Truss vs. lettuce showdown might have played out quite differently had it taken place over the past few weeks: UK supermarkets’ produce shelves have been swept clean as the country faces a vegetable shortage.

The cause are manifold. A cold snap in Spain and floods in Morocco led to poor crop yields. High energy prices crimped greenhouse planting by British and Dutch growers. Then there’s the years-long decline in Britain’s domestic food production; while the country is 54% self-sufficient in vegetables, it’s almost entirely reliant on fruit imports.

The bottom line: Extreme weather and volatile energy markets are poised to present enduring challenges to food security worldwide.

(Photo by Pixabay/Pexels)