The business of moving critical minerals around the world can be as important as digging them out of the ground—and Chinese logistics firms are making investments in ports and roads around key mines. Meanwhile, Petrobras’s ambitions, Indonesia’s dream minerals deal and Europe’s stress signals. Plus: a Red Sea hijacking could disrupt Asia supply chains.

ANOTHER POINT OF DEPENDENCY

Digging for ores is step one. Next: transporting them.

Chinese miner MMG Ltd clinched a 1.88 billion USD deal to buy Canada-based Cuprous Capital, which owns the Khoemacau copper mine in Botswana. The transaction marked a successful end to the company’s year-long hunt for copper assets, and MMG shares popped on the news.

And while headlines are often focused on acquisitions of minerals assets, developments in the business of transporting and exporting the minerals warrants attention, too.

Chinese control of infrastructure critical to getting minerals from mining towns to ports for export could represent another source of supply chain vulnerability and dependence, even if Western companies clinch better access to upstream resources.

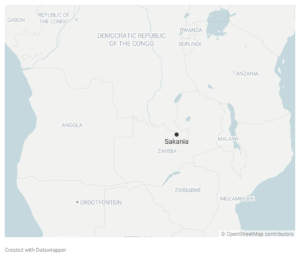

Take the example of Jiayou International. Last month, the Chinese logistics firm announced (link in Chinese) it was investing in a 76 million USD project to build a dry port in Sakania, on the Zambia-DRC border, as well as a major road, to link copper-cobalt mining towns. The Zambian government has granted Jiayou’s subsidiary, Jaswin Ports Ltd., a 22-year concession for the project, ensuring that company can use the site “without any obstruction.”

FACTORS

FACTORS

FACTORS

FACTORSBrazil wants to be a global energy power

Rising crude output from deep water reserves under a thick salty crust of sodium chloride offshore Brazil could propel the Latin American nation to the fifth-largest crude oil producer worldwide by 2030, with national energy giant Petrobras potentially becoming the third-largest oil-producing company. Petrobras plans to invest in more platforms to boost extraction from what’s called pre-salt oil. And as the Financial Times notes, the pre-salt assets are now “a cash gusher—both for the national coffers and outside investors.”

Indonesia itches for a critical minerals deal with the US

Indonesia is planning to trace its nickel ore sales and get certifications from global mining standards bodies as the country vies for a critical minerals deal with the US, which would allow the Southeast Asian nation’s producers to enjoy subsidies under the Inflation Reduction Act.

Indonesia has made some progress on this front, with a Jakarta-Washington bilateral meeting last week resulting in a joint statement saying the two will keep an eye on “establishing the foundation to launch future negotiations on a critical minerals agreement.” That sounds like a slow-track plan to make a plan—prudent given Chinese companies’ big footprint in Indonesia’s minerals sector.

MARKETS

MARKETS

MARKETS

MARKETSStress signals in Europe

The European Central Bank is warning of “early signs of stress” on the balance sheets of eurozone banks as loan defaults and late repayments inch up. The good news: the ECB says the banking system is “well placed” to cope with worsening asset quality thanks to its “strong capital and liquidity levels.”

The bad news: the ECB’s warning comes just as Germany faces a budget crisis, triggered by a court ruling last week that blocked the transfer of leftover funds from the pandemic to green investment, leaving a 60 billion euro (65.5 billion USD) hole in the government’s finances—and prompting warnings about growth in the EU’s largest economy. Berlin is now scrambling to propose a supplementary budget, which would ease the current freeze on future spending across ministries.

Argentina presents: Javier Milei

Argentinian television personality Javier Milei is now the Argentinian president elect, winning 56% of the votes in the presidential election. The far-right, libertarian outsider has vowed to overhaul the government and the economy. Markets liked the news.

As numerous headlines framed it, the South American nation is having its own Trump moment. Having vowed to cut ties with China and called its second-largest trade partner an “assassin,” Milei has now softened his tone, sending “sincere wishes for Chinese people’s wellbeing.” And if Milei does have true Trumpian tendencies, we can expect many more abrupt flip-flops and U-turns—at the very least in posture, if not in policy.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSA ship hijacking in the Red Sea

A Japan-operated, Israel-linked cargo vessel was reported seized by Yemen-based Houthi militants last Sunday in the Red Sea. The Houthis have warned that they could seize more ships. That’s sparking renewed concerns of threats to Asia’s supply chains, as the Red Sea represents a chokepoint for international shipping from Europe to Asia. Already, two ships have changed course in the Red Sea and the Gulf of Aden, Reuters reported this week.

(Photo by Tiana/Pexels)