Critical minerals are the foundation for today’s industrial innovation; the necessary, limited, and in many cases consolidated inputs into everything from new energy vehicles to semiconductors to advanced military equipment. In an effort to re-invest in productive capacity for a modern industrial environment, critical minerals are an obvious starting point.

Critical minerals are also an area where US capacity continues to lag – in many cases despite abundant reserves at home or among allied countries – and, worse yet, where the US remains severely dependent on geopolitical adversaries. At a macro level, this reality is increasingly recognized: A February 2022 fact sheet issued by the Biden-Harris Administration noted that “our over-reliance on foreign sources and adversarial nations for critical minerals and materials posed national and economic security threats.”

But, despite the existence of ample data, more granular detail on US vulnerability goes under-communicated.

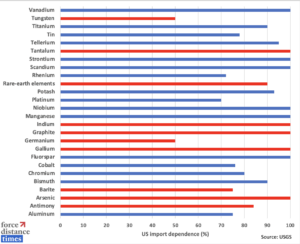

The chart below shows the critical minerals for which the US is at least 50 percent dependent – in total, 26 out of the 32 minerals that the 2022 US Geological Survey publishes data on, or 81.25 percent. Of those, China is the top source of US imports for 11, or 42.3 percent.

Gallium offers a useful case for underscoring quite how severe this dynamic is. Gallium is a critical input into integrated circuits and optoelectronics, among other building blocks of modern industry. Gallium is growing even more critical an input as new technologies increasingly enable it to replace silicon. No US domestic gallium has been recovered since 1987. The US depends on imports for 100 percent of its gallium supply – and on China for 53 percent of those imports. Altogether, China controls 96 percent of the global gallium market.

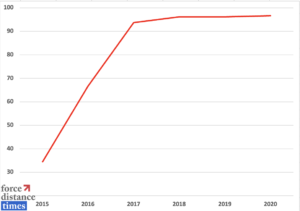

This does not have to be the case. Gallium occurs in small concentrations in ores and other metals; it is widely available across the world. But a surplus of primary gallium that lasted from 2012 to approximately 2017 shuttered much of global production outside China, allowing Beijing to develop a near monopoly. And domestic government subsidies, direct and indirect, for gallium production have allowed Beijing to undercut any potential competitors, therefore to maintain its monopoly, even as demand for gallium has grown.

Gallium is just one example. But it underscores the critical mineral threat that the US faces – and also the ready availability of solutions.

What’s the answer, then? For US, allies, and partners to begin with the upstream, and with critical dependencies at the upstream, in their efforts to reinvigorate trusted industry. The CHIPS Act pours some 52 billion USD into the semiconductor industry. It does not resolve upstream, material dependencies. What value are advanced semiconductor technologies without robust sources of gallium – and electronic-grade silicon and neon and other necessary materials? As Chinese media bluntly points out, if Beijing “cuts off supply, the entire world chip industry will collapse.” If the US is going to compete for tomorrow’s industry, the effort must start upstream.

(Photo by Tom Fisk/Pexels)