Can EU tariffs blunt the threat of China’s EV dominance?Unlikely. Meanwhile, Russia sells pipeline gas to China for cheap, the US and Saudi Arabia mull a minerals partnership, gasoline prices drive US inflation, and China’s urea export curbs threatens more food inflation. Plus: US auto workers strike.

BRINGING A TOY CAR TO AN EV FIGHT?

Europe probes Chinese EV subsidies

The European Commission is investigating Beijing’s massive subsidies for its homegrown eV makers as it tries to stem the “flood” of cheaper Chinese EVs hitting Europe. Per Adamas Intelligence, China has already grabbed one-fifth of Europe’s EV market.

If the EU decides to impose additional tariffs, they would also hit non-Chinese brands manufactured in China—like European heavy weights Volkswagen, BMW, and Renault, as well as Tesla.

Will tariffs solve the long simmering issue of foreign carmakers being undercut by, and also reliant on, Chinese rivals? It’s certainly one tool of trade defense that the EU can use. But it doesn’t solve the broader problem of the West’s dependence on China for numerous critical nodes of the battery and EV supply chains.

Meanwhile, the Chinese EV industry have seen the potential tariffs coming. And they are positioning themselves to evade those levies. China’s largest automaker SAIC, for example, said in July that it will build its first ever European EV factory. Meanwhile, BYD is considering setting up a European plant. Expect more such announcements.

Plus, remember how things in the solar industry played out. Brussels launched a tariff regime on Chinese solar panels in 2013, then scrapped them in 2018 to boost renewables installations.

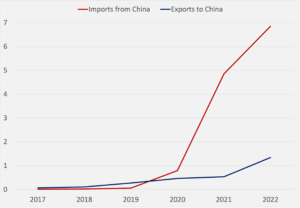

EU electric vehicle imports from and exports to China

Source: Eurostat

FACTORS

FACTORS

FACTORS

FACTORSPrice cap, meet price gap

Citing the Russian government’s official economic outlook, Bloomberg reports that Russia expects to sell its pipeline natural gas to China at almost half the price for Europe in the next three years. Chinese buyers can expect to pay an average of 271.60 USD per 1,000 cubic meters next year, versus an average of 481.70 for European clients. The numbers underscore a crude reality: China’s close ties with Russia mean Beijing is benefiting disproportionately from Putin’s war on Ukraine.

A US-Saudi critical minerals partnership…

The Wall Street Journal reports that the US and Saudi Arabia are mulling a partnership to help both secure metals in Africa. The idea is to have a state-backed Saudi venture buy minority equity positions in African mining assets, giving opportunities for US companies to buy production from the Saudi-owned stakes. If the partnership takes off, it would represent a clear step towards reorienting the US-Saudi relationship away from oil and towards minerals powering the energy transition.

…and a White House proposal for mining royalties

Meanwhile, over in the US, the Biden administration is recommending imposing royalties on US hardrock mining in a bid to boost domestic production by providing funds to agencies issuing mining permits. But it seems plausible that this move could work against efforts to shore up the American critical minerals supply chain.

As Seaver Wang and Peter Cook of the Breakthrough Institute put it this week: “Given the tight margins that many current and future mine operators face, royalties could even push some operations to the point of closure.”

MARKETS

MARKETS

MARKETS

MARKETSGasoline prices pushed up US inflation

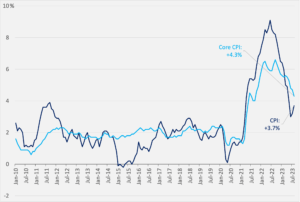

Did this week bring good or bad news on the US inflation front? It depends how you slice it. The consumer price index (CPI) rose 0.6% from July to August, the largest gain since June 2022. In the 12 months to August, it rose 3.7%. That’s a tick higher than the 12 months to July, during which the CPI rose 3.2%. Excluding energy and food, the CPI rose 4.3% in August year-on-year.

Driving inflation high gasoline prices, which surged 10.6% following July’s 0.2% increase. But underlying trends suggest inflation is easing: rents increases are slowing, and both new and used car prices are moderating.

US CPI, year-on-year change, 2010 to 2023

Source: Bureau of Labor Statistics

Washington and Hanoi are strengthening their ties

The US and Vietnam have upgraded their diplomatic relations, boosting the designation to Hanoi’s highest level for foreign partners. The move comes as Washington seeks to build stronger alliances in Asia Pacific in the face of an increasingly aggressive China.

There’s a lot for the two countries to work on. Vietnam presents a viable option for moving more of US manufacturing away from China. American semiconductor firms are also eyeing the Southeast Asian country as a hub for certain segments of chipmaking. Meanwhile, Boeing and Vietnam Air just inked a 7.8 billion USD deal for 50 737 Max jets from the American airplane maker.

A historic strike in Detroit

Some 13,000 US auto workers walked off the job on Friday after contract negotiations with Ford, General Motors, and Stellantis fell apart. It’s the first time in the United Auto Workers union’s history that it has targeted all three Detroit automakers simultaneously. The stakes are high: a 10-day strike could cost 5 billion USD in losses, according to one estimate. And a prolonged disruption to production could bring surging car prices, undermining the Fed’s inflation fight.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSUrea trouble

China, the world’s largest producer of urea, has asked some of its main traders to suspend exports of the nitrogen fertilizer. Now, some half a million metric tons of urea are sitting at Chinese ports, according to Reuters. High domestic prices of urea prompted officials to enforce stricter export limits, which in turn has pushed up prices globally. That spells trouble for global food inflation: farmers may use less fertilizer due to the high cost, crimping yields and disrupting food supply chains.

(Photo by Pixabay/Pexels)