Huawei will reportedly mass produce in-house designed 5G chips by the end of this year, highlighting the tech giant’s—and the broader Chinese industrial ecosystem’s— resilience against US sanctions. Meanwhile, Volkswagen embraces the “if you can’t beat them, join them” philosophy, Brazil steals soybean marketshare from the US, and General Motors makes progress on directly sourcing critical materials. Plus: India’s rice export ban.

HUAWEI STAGES A COMEBACK

The Chinese tech giant’s self-reliance campaign may finally be paying off

Multiple recent media reports suggest that Huawei is gearing up to mass produce in-house designed, cutting-edge 5G chips manufactured by state-owned SMIC to power smartphones by the end of this year.

If successful, the achievement would mark a major comeback for the Chinese tech giant, some three years after the US blocked its access to US-made chip technology. And it would highlight Washington’s failure to vanquish a perceived technological and geopolitical threat in spite of an arsenal of financial sanctions tools at its disposal.

To recap: Huawei’s access to 5G chips was cut off following US sanctions, which barred Taiwan’s TSMC from producing chips for the telecoms firm. Other supplies like Qualcomm were limited to only providing last-generation 4G chips to Huawei. Huawei’s share of the global smartphone market swiftly plummeted.

But while Washington’s sanctions targeted a surface-level threat—Huawei’s ability to make and sell smartphones—deeper nodes within the Chinese ecosystem were left largely unobstructed.

Huawei took advantage of this oversight. It launched a project to develop hardware free of US technology. It ramped up R&D spending and capital expenditures. It reorganized its R&D structure in search of technological breakthroughs, and to build new revenue streams to make up for the collapse in smartphone sales. And its VC arm got busy with investments in dozens of domestic semiconductor companies. One such investment was a minority stake in a Yunnan-based maker of indium phosphide wafers, a compound semiconductor that could be key to China’s chip ambitions.

It remains to be seen whether Huawei can commercialize its chips at scale. Still, numerous indications would strongly suggest that it’s trending towards not decimation, but survival—and perhaps with greater strength then before.

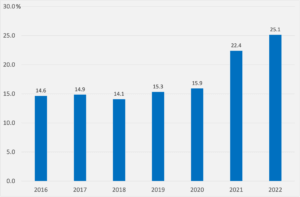

Huawei’s R&D expenditure as share of revenue

Source: Huawei annual reports

FACTORS

FACTORS

FACTORS

FACTORSA step forward for US lithium production

The North Carolina-headquartered Piedmont Lithium obtained a key final permit to allow the company to begin construction of its lithium hydroxide manufacturing plant in Tennessee. The facility will process high-purity lithium ore sourced via an offtake agreement with Atlantic Lithium’s mine in Ghana; Piedmont says it will nearly triple current US production. But the project hasn’t been without hiccups: a short-seller report in March alleged that Atlantic’s mining licenses were obtained via “textbook corruption.”

Meanwhile, Piedmont—in which South Korean cathode maker LG Chem bought a minority stake in February—continues to wait for a permit to begin operations at its North Carolina lithium mine, nearly three years after the firm first applied for it.

GM makes progress with vertical integration

A year after setting a goal of directly sourcing up to 75% of its critical materials need by 2030, General Motors is now more than halfway towards achieving that target, its CEO Mary Barra said in an earnings call this week.

It’s an impressive achievement, and a milestone in the legacy maker’s vertical integration strategy. GM has inked over a dozen long-term supply agreements and investment deals in recent months, including supply contracts for nickel, cobalt, cathode materials, and rare earth permanent magnets, as well as direct investments in lithium producers.

Brazil’s bumper crop, ADM’s bumper earnings

A record soybean harvest in Brazil and robust global demand helped Archer-Daniels-Midland beat analyst expectations in second-quarter earnings as the grain merchant notched higher margins amid larger swings in agricultural commodity prices. “All that volatility and all that uncertainty increase the value of our investments,” said its CEO.

Another beneficiary of Brazil’s surging soybean exports: China. Beijing is trying to reduce its reliance on US grains, and has turned to Brazil—now the world’s largest soybean shipper—for supplies. The flipside: American farmers’ competitive edge on global agricultural markets are being eroded by increased Brazilian production.

MARKETS

MARKETS

MARKETS

MARKETSVolkswagen doubles down on a China turnaround

If you can’t beat them, join them, as the saying goes. Volkswagen is taking that mantra to heart with its 700 million USD investment in Chinese EV startup Xpeng for a 4.99% stake. The two will jointly new EVs using Xpeng’s platform. Meanwhile, the German group’s Audi subsidiary will work more closely with its long-term state-owned partner, SAIC.

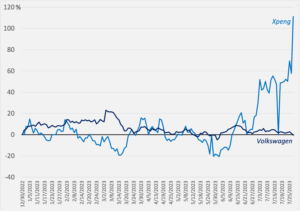

The quid pro quo seems straightforward: Volkswagen can try to turn around its sliding sales in China by leveraging Xpeng’s EV expertise, while Xpeng can tap Volkswagen’s scale and global network for its overseas expansion. The question: who will have the upper hand in this transaction? Xpeng’s shares certainly jumped a lot more on the news.

Japan’s Toyota is taking another approach: it’s beating a retreat in China amid plunging sales there, and this week laid off 1,000 workers at its joint venture with state-owned Guangzhou Automobile Group.

And if Volkswagen is embracing the competitive threat, then Nissan and Renault are doing the opposite: the Japanese and French car makers said they will reboot their troubled alliance to address the “wake-up call” ringing from the rise of Chinese EVs.

Year-to-date percent changes in Xpeng and Volkswagen share prices

Source: Investing.com

The US and Europe inch towards outbound investment screening

The US Senate overwhelmingly approved new rules on outbound investments into China, requiring US investors to notify the Treasury when taking stakes in Chinese companies in strategic sectors like AI, advanced semiconductors, and quantum computing.

But the notification requirement falls far short of actually restricting—or even reviewing—outbound investments over national security concerns. For more clarity on that, we’ll have to watch for president Joe Biden’s long-anticipated executive order on outbound investment screening.

Across the Atlantic, Germany’s recently unveiled China strategy gave a supportive nod to the risks associated with certain outbound investments, while the EU said it aims to propose an outbound investment screening mechanism by the end of the year.

China is making a desperate bid to prop up its economy…

Beijing is rolling out more measures in its attempt to restart the economic engine. This week, the government promised to “adjust and optimize” policies for its ailing property sector. Asian shares rallied on the news.

The move follows Beijing’s bid last week to woo the private sector. And it comes in tandem with authorities’ attempts to get businesses investing in local government projects—widely known to be unprofitable undertakings. As China Beige Book notes with sarcasm: “What a wonderful investment opportunity.”

…while the US economy is proving resilient

The American economy unexpectedly grew by 2.4% in the second quarter from the previous quarter, above the 1.7% annual rate economists had forecast. Robust consumer spending, which increased at a 1.6% rate, powered the bulk of the growth. But business investment is also on the rise: it grew at an annual rate of 7.7% in the second quarter, up from 0.6% in the previous period.

The economy, at least for now, appears to be steering well clear of a recession. But the Fed isn’t done with its tightening campaign yet: on Wednesday, it raised rates to their highest level in over 22 years, and didn’t signal whether it would hike again in September.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSIndia’s rice ban threatens more food inflation

India last week imposed an export ban on non-basmati white rice, citing the need to ensure domestic supplies and control high food prices. The move is estimated to affect as much as 80% of Indian rice exports. Benchmark Thai rice prices jumped on the news, which is further straining global food markets amid extreme weather and Russia’s attacks on Ukraine’s grain export facilities. These multiple factors together can drive up global food costs, adding to inflationary pressures and threatening food security.

(Photo by Stanislav Kondratiev/Pexels)