Europe tries a difficult balancing act as it mulls export controls and outbound investment screenings—while simultaneously deepening ties with China in strategic sectors. Meanwhile, CATL goes upstream into lithium production, Middle Eastern state firms go downstream into EVs, and foreign carmakers try their luck in China. Plus: can spin-offs brush off geopolitical risk?

THE EU’S ECONOMIC SECURITY STRATEGY

While the EU debates, China eyes European targets

The EU has rolled out its economic security strategy. The proposed plan would address risks posed by “certain economic linkages” (read: China and Russia) with export controls, outbound investment screenings, and “dialogue” with the private sector. But will the plan have any bite?

While EU leaders get ready to debate the new strategy at the end of the month, European industrial giants this week pledged to deepen business ties with China. Chinese premier Li Qiang was in Berlin to meet German chancellor Olaf Scholz and executives, and clinched various agreements to further cooperation with industrial heavyweights like Airbus, BASF, Siemens, Mercedes-Benz, BMW, and Volkswagen. Scholz asked China to ensure western companies have a “level playing field” in China. But there are few signs to suggest that Beijing feels obliged to do so.

Meanwhile, Chinese state investors have for years burrowed their way into strategic European industries—and evaded notice. Research from Dutch consultancy Datenna shows that 40% of Chinese investments in Europe since 2010 have high or moderate involvement by state-owned or state-controlled companies, sometimes giving China direct access to critical and strategic technologies.

And investments by private Chinese companies can pose just as much of a risk: look at Midea’s hopes of acquiring Sweden’s Electrolux (though the Chinese home appliance maker has now reportedly dropped the takeover pursuit).

FACTORS

FACTORS

FACTORS

FACTORSChile multitasks on critical minerals

The world’s No. 2 lithium producer, Chile, announced in April that it would nationalize the white metal industry. We now have a a clearer idea of what that will look like.

Beginning in the first half of next year, the government will tender permits for lithium exploration and exploitation permits, with state-owned Codelco tasked with negotiating deals with new companies as well as current miners US-listed Albemarle and Chinese minority owned SQM. At the same time, the Chilean government wants Codelco to boost its copper output. One immediate question: can Chile manage to tackle both metals at once?

Meanwhile, US companies stand a better chance of accessing Chilean lithium thanks to the Senate’s ratification this week of a tax treaty with the South American nation.

CATL heads upstream

CATL just sealed a 1.4 billion USD deal with Bolivia to build two lithium extraction plants, helping the country develop its largely untapped reserves in the Uyuni and Oruro salt flats. The deal comes after Bolivia tapped a CATL-led Chinse consortium in January to develop lithium deposits in a partnership deal.

While CATL has invested in numerous upstream mineral projects, it doesn’t currently produce lithium. With the latest Bolivian projects, the Chinese battery giant will officially produce battery raw materials and directly enter the EV supply chain’s upstream-most node. That means more vertical integration—and more leverage over other industry players.

In other upstream news: California-based KoBold Metals, which uses artificial intelligence to explore for critical minerals, has just raised a 200 million USD round valuing the company at 1 billion USD. Apparently there are unicorns underground, too. Now for the next step: processing.

The Middle East eyes metals, plastics, and EVs

Flush with cash from the high oil prices of recent months, the Middle Eastern state firms are casting about for attractive deals in plastics and metals.

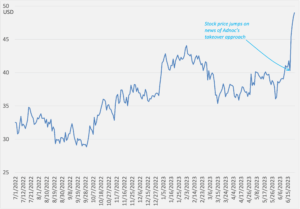

This week, Abu Dhabi energy giant Adnoc made an initial 11 billion-plus USD takeover approach for Covestro; the German chemicals maker reportedly spurned the offer within days. Meanwhile, Saudi Arabia’s sovereign wealth fund wants to buy a stake in Brazilian mining giant Vale’s metal unit for 2.5 billion USD.

And the Mideast state investors are looking further downstream, too. The Abu Dhabi government has just taken a 7% stake in Chinese EV maker NIO. That follows Saudi Arabia’s 5.6 billion USD investment last week with another Chinese EV firm, Human Horizons. Meanwhile, China’s Qiantu Motors just signed an agreement with Jordan’s Manaseer Group to establish a joint venture in the country, from which it plans to expand into the Middle East and North Africa markets.

Covestro stock price

Source: Investing.com

Successful and failed LNG shopping trips

This week brings a tale of two very different LNG deals.

On the successful front: China National Petroleum Corporation and QatarEnergy sealed a 27-year contract, with CNPC committing to buying four million tons of LNG from Qatar, in addition to taking an equity stake in the Gulf nation’s North Field LNG project.

On the foiled front: no companies responded to Pakistan’s tender to buy six shipments of the chilled fuel for October-to-December delivery. Producers were reluctant to sell reportedly because foreign banks refused to repay funds in case the buyer—the foreign-exchange-starved Pakistan—cannot. Nor has Pakistan managed to secure long-term deals. That’s all bad news, and leaves the country vulnerable to years of energy shortages.

MARKETS

MARKETS

MARKETS

MARKETSChina purports to reject great power competition

The US secretary of state Antony Blinken met with Chinese leader Xi Jinping on Monday. One line in Beijing’s official readout stood out: “great power competition doesn’t align with the trend of the times,” it said.

But China aspires to be a great power. And it wants to be globally competitive across strategic domains. Doesn’t that mean it’s engaged in great power competition? Plus, official entities like state media, government think tanks, and the National Reform and Development Commission consistently talk about industry and supply chains as critical foundations of great power contests.

More likely, Xi’s high-profile rejection of great power competition is directed at an international audience and meant to undermine Washington’s coordinated effort with allies to reduce dependencies on China and restrict technology exports to the country. Reader beware.

Foreign carmakers head to China

Foreign car makers want a slice of the lucrative Chinese EV market. Will they get what they wish for? Or will it be a fool’s errand, with their entry ultimately only serving Chinese industry’s needs—much as foreign legacy auto giants got chewed up and spat out by the China market?

Overseas EV companies have decided to take a gamble. The California-headquartered Fisker is preparing to enter the Chinese market, with plans to open its first delivery center in China this year and sell its all-electric SUV. It could also start manufacturing in China next year. Fisker follows in luxury EV maker Lucid’s footsteps, which announced earlier this month that it will sell imported cars in China and is mulling local production in the country.

Meanwhile, Polestar—the Swedish car brand owned by China’s Geely following the latter’s acquisition of Volvo in 2010—is setting up a 200 million USD software joint venture with another Geely-owned entity.

“The Western catfish are coming,” notes one report in Chinese media, referring to the hope that Fisker and Lucid will spur further development in the domestic EV industry, much as Tesla’s 2018 entry accelerated Chinese EV makers’ growth. The question for the foreign catfish is: will they eventually get eaten up by bigger fish in the Chinese pond?

Percent change in Fisker and Lucid stock prices, one year

Sources: Investing.com

Get hiking

Another week, another flurry of rate hikes. The Bank of England delivered a surprise half-percentage-point increase, raising interest rates to 5%. The hike comes as new data revealed very sticky (or worse, stuck) inflation, with the CPI rising 8.7% on the year in May, unchanged from April. And core inflation, excluding food, energy, alcohol, and tobacco, climbed to 7.1% year-on-year, versus 6.8% the month prior.

Elsewhere, Norway raised rates to a 15-year high of 3.75% while Switzerland opted for a hike of 25 basis points, to 1.75%. And don’t forget Turkey, which did a U-turn on its insistence that cutting rates will fight inflation, and raised rates by 6.5 percentage points to 15%—which, while dramatic, was lower than the median of 21% that economists had predicted.

And in case anyone missed Jerome Powell’s “skip” comment last week: the US Fed chair told Congress that more hikes are coming

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSSpin offs take off

The spin-off strategy is fast going mainstream: earlier this month, global venture capital firm Sequoia decided to split offits China operations. Now, Anglo-Swedish pharmaceutical giant AstraZeneca is reportedly drawing up plans to break off its China business in order to insulate itself against geopolitical tensions and Beijing’s unpredictable crackdowns on foreign firms.

We’ll likely see more multinationals carving off their China arms to avoid getting caught between two sides of a geopolitical duel. Whether that’s ultimately a profitable and strategic move isn’t immediately obvious.

(Photo by ArtHouse Studio/Pexels)