A Chinese home appliance giant wants to acquire a Swedish home appliance brand—and it’s not as mundane as it seems. Meanwhile, China goes big on oil drilling, positions to leapfrog on EVs, and cements (steels?) its partnership with Riyadh. Plus: Rate hikes, another Goldilocks jobs report, and EV makers’ direct sourcing ambitions.

DISHWASHERS, FRIDGES, AND STRATEGIC COMPETITION

China’s Midea eyes Sweden’s Electrolux

Chinese home appliance maker Midea Group is reportedly mulling an acquisition of the luxury Swedish brand Electrolux. Sources tell Bloomberg that Electrolux has so far not been receptive to the proposal, but the company’s shares jumped anyway on news of the Chinese takeover approach. Any deal would have to be approved by regulators.

At first glance, this is just a question of dishwashers and vacuum cleaners. But under that home ec veneer are real strategic implications.

Midea is closely tied to China’s military-civil fusion system and industrial policy more broadly — and has a track record of international investment intended to support both. For example, in 2016, Midea acquired German robotics manufacturer Kuka. Since, Kuka has been integrated into Beijing’s military-civil fusion infrastructure. Kuka also now counts major Chinese and international EV makers including BYD and Tesla as its customers, increasing Beijing’s footprint in that growing, strategic industry.

And Midea’s broader set of subsidiaries is also aligned with Beijing’s industrial objectives. Consider MR Semiconductor, which Midea established in 2018 and aims to grow into a leading global brand. “MR Semiconductor’s path towards a breakthrough is to take the home appliance chip as the entry point,” the company notes, and then progress toward chips for IoT and electric vehicles by 2024.

There’s also Midea’s car components subsidiary, Welling Auto Parts. Chinese media present the company as a vital node in China’s EV supply chain, developing critical components like drive motors and electric compressors to eliminate import dependencies and “end the historical chokehold” on the Chinese auto industry.

We could go on. The bottom line: Midea might take domestic appliances as a starting point, but it is an industrial giant serving Beijing’s industrial strategy. And whether dishwashers are directly relevant to military-civil fusion or not, any international acquisition promises to increase Midea’s access to R&D, influence in global markets, and supply chain leverage.

FACTORS

FACTORS

FACTORS

FACTORSDrill, China, Drill

China is going full tilt toward ensuring energy security by securing sufficient fuel supplies from both home and abroad.

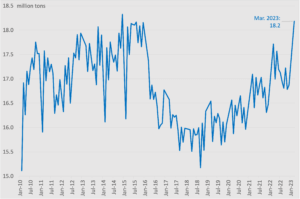

The country’s domestic crude oil output hit 18.2 million tons in March, the highest level since December 2014, according to official data. Meanwhile, China’s crude imports are also set to hit record highs this year, even as domestic production surges. To source those imports, China is signing big deals overseas, including with Saudi Arabia. Last month saw the signing of two mega deals to supply China with crude and petrochemical feedstock from Saudi Aramco. Aramco is also expanding its China footprint with two refinery deals, and is eyeing a listing on Hong Kong’s stock exchange.

China crude oil output, 2010-2023

Source: Chinese National Bureau of Statistics

Baosteel plots its global expansion plan

The deepening Sino-Saudi relationship goes far beyond oil barrels.

This week, Chinese steel giant Baosteel—the world’s top steel maker—signed a joint venture deal with Saudi Aramco and the kingdom’s sovereign wealth fund to set up an integrated steel plate manufacturing plant in Saudi Arabia. Baosteel will own 50% of the project, while the Saudi partners will take 25% each.

Aramco says the deal will “improve supply chain localization.” It will also help the kingdom in its goal of becoming a net exporter of steel by 2030, an objective under the national Saudi Vision 2030 plan.

For Baosteel, the project is the company’s first fully integrated steel plant overseas and represents a major step in its push to expand globally. The company has made clear that internationalization is a strategic priority; Chinese media report that Baowu has set up a working group focused on promoting overseas business opportunities. The “go out” push is due in large part to stalling steel demand at home. It also comes with the added effect of weaving Baosteel ever more deeply into global supply chains.

Japan needs less LNG…eventually

Japan’s biggest utility JERA says it expects to divert more LNG to other Asian countries over time as domestic demand declines thanks in part to a nuclear revival and a shrinking population. That’s good news for Japan’s neighbors, which are still in the process of ramping up renewable sources to replace coal.

For now, though, Japan still needs a steady source of LNG imports. Its switch away from natural gas won’t happen overnight, and the country’s gas demand is forecast to decrease by only 11% from 2022 levels by 2032. Underlining that reality, JERA just last week signed a 20-year supply deal with US company Venture Global.

And now more than ever, Japan will need to build a portfolio of diverse LNG supplies from overseas. That’s especially so as uncertainty hangs over Russia’s Sakhalin-2 project, from which Japan sources about 10% of its LNG demand. The Russian export facility is set to conduct its annual maintenance this summer—without any foreign contractors for the first time.

MARKETS

MARKETS

MARKETS

MARKETSRates, rates, rates

Even with economic indicators flashing signs of slowdown, major central banks are still sounding hawkish notes.

The US Federal Reserve announced its 10th consecutive increase of its benchmark interest rate this week, to a range of 5% to 5.25%. Fed chair Jerome Powell hinted that a pause on hiking might now be on the horizon, but wouldn’t be pinned down on an answer.

The jobs market will, as always, be an important consideration for central bankers. Data earlier in the week showed job openings falling to their lowest levels in two years, while layoffs rose sharply.

But Friday’s stellar jobs report blew economists’ expectations out of the water with 253,000 newly added jobs in April and unemployment ticking down to 3.4%, the lowest since 1969. Markets liked the news, but the Goldilocks jobs report will likely complicate Fed discussions.

Across the Atlantic, the European Central Bank followed the Fed with its own quarter percentage point hike to 3.25%, and signaled that more is still to come. And over in Australia, the Reserve Bank of Australia surprised markets with a 25 basis points raise, foiling traders’ expectations of a pause.

US EV startups struggle, China’s EV leapfrog

The rapid departure from years of near-zero interest rates has rattled businesses, with Big Tech and Silicon Valley Bank being prime examples. Electric vehicle startups haven’t been spared the pain.

Over the past two years, shares in companies like Canoo, Nikola, Rivian, and Faraday Future have plunged by high double-digit percentages – a function first of supply chain snags and production challenges, then rate hikes. Ohio-based electric truck maker Lordstown even warned this week that it’s at risk of bankruptcy after its investment partner Foxconn accused it of breaching their contract by letting its stock price fall too much.

All the while, China EV Inc. and China Battery Inc. are expanding at home and abroad. Last week, Beijing published measures aimed at supporting Chinese EV exports. Those measures include directing state banks to offer financial support to Chinese carmakers overseas, having local governments provide direct marketing support, and brokering preferential deals between car companies and shipping firms. As the auto sector embraces EVs, Beijing is positioned to leapfrog.

Percentage change in share prices of US EV startups, May 2021 – May 2023

Source: Sentieo

Slowing down less quickly

South Korean exports in April fell for the seventh straight month, the longest losing streak in three years. The decline was driven largely by falling sales to China, where factory activity fell unexpectedly in April to 49.5 on the official PMI. Together, those numbers indicate persistently weak global demand. That’s especially so given that South Korea’s exports of semiconductors, displays, and refined oil underpin much of the world’s economy.

But here’s the silver lining: If the numbers are adjusted for working day differences, South Korea’s exports decline of 10.4% from a year earlier is actually the smallest drop since December.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSDirect from source

One way electric vehicle makers try to preempt and minimize supply chain disruptions is to source critical minerals for batteries and magnets directly from suppliers. Major carmakers have all commented publicly about direct sourcing. But how far along are they actually in achieving that?

Tesla’s latest impact report, published last week, shows the company made significant progress last year in the direct sourcing of critical minerals. The company now sources over 45% of its nickel directly from mining and refining companies, up from 30% in 2021. And it sources over 55% of its cobalt directly, up from 50% the year before. Meanwhile, its direct sourcing of lithium hydroxide remains at over 95%.

Similar stats for other automakers don’t appear to be readily available. BMW says it sources “all critical raw materials” for its current fifth generation motors directly from raw material suppliers. Meanwhile, as of last year, Mercedes-Benz says it is still working on “establishing direct sourcing activities for cobalt.”

(Photo by Ekaterina Belinskaya/Pexels)