Saudi Arabia and China strengthen their ties, and the world should pay attention. Plus, we dive into US efforts to bring allies under the Inflation Reduction Act umbrella – and China’s efforts to crash the party (case in point: Chinese battery companies embedding themselves in the US automotive supply chain). Meanwhile, Europe adds a new tool to defend against economic coercion by rivals but continues to grapple with dependence on Russian energy and the global economy approaches its speed limit.

THE SINO-SAUDI DANCE

Saudi Arabia doubles down on its China bet

It was a week of major developments in a tightening relationship between Saudi Arabia and China.

Two mega investment deals signed over two days will secure the Saudis contracts to supply China with 690,000 barrels a day of oil. For comparison, that’s roughly equivalent to the entire daily consumption of Belgium.

Under the combined deals, state-owned oil giant Saudi Aramco will invest 12.2 billion USD to expand a planned joint venture refinery in northeast China and take a 10% stake in Chinese refiner Rongsheng Petrochemical for 3.6 billion USD.

The Rongsheng stake includes a 20-year crude supply contract, while the refinery deal secures for Aramco storage space in China. In addition, Aramco will supply Rongsheng with petrochemical feedstocks. Rongsheng will in return supply Aramco with plastic raw materials and chemical products. The logic of the deals is clear: China needs to secure feedstock; Saudi Arabia needs to secure demand and lock in long-term customers.

Deepening ties further, Saudi Arabia is joining the China-led Shanghai Cooperation Organization. And these latest developments come on the heels of last month’s Beijing-brokered Iran-Saudi pact.

Both diplomatically and economically, China is building itself a larger role in the Middle East—and signaling that it increasingly prioritizes the region as a key domain of multipolar great power competition. And thematically, China is taking steps to secure for itself an ever-greater role in major, foundational global value chains, as well as the geopolitical relationships behind them.

FACTORS

FACTORS

FACTORS

FACTORSEurope’s Russian LNG habit

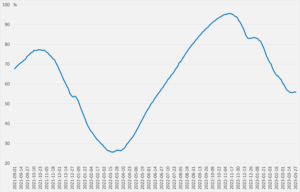

Europe has weathered the worst of winter. Despite being cut off from Russian pipeline gas flows and banning Russian coal imports, it is finishing the season with inventories more than 55% full. That’s the good news.

More worrying is the fact that Europe has yet to wean itself off Russian LNG: Imports are up 40% in a year, and the EU spent five times more on the fuel from January to September 2022 than a year earlier. Now, the EU is looking for legal options short of sanctions to stop Russian LNG imports, including the possibility of banning Russian and Belarusian exporters from booking infrastructure capacity for gas delivery. But designing and approving such a measure could take months.

EU natural gas storage, percentage full

Source: Gas Infrastructure Europe

The US builds its critical minerals partnerships

Washington is slowly knitting together its alliance of critical minerals supply chain partners. It inked a battery minerals deal this week with Japan, which includes commitments to not impose export duties on the minerals and domestic measures to address distortive non-market policies of other countries (read: China). The US is also close to a similar deal with Europe.

Both deals are seen as necessary workarounds to the US Inflation Reduction Act, which only offers tax incentives for EVs built in and battery materials sourced from the US or countries with which the US has a free trade agreement. The thinking is that the Japan and EU deals can count as free trade agreements, thereby granting their companies access to IRA funds—and spurring investments across the value chain.

Meanwhile, the US and Canada are pushing ahead with upstream and midstream collaborations. Come spring, both US and Canadian companies will be able to tap 250 million USD of funding under the US Defense Production Act for mining and processing of minerals for EV and stationary storage batteries.

And China tries to crash the party

But as Washington works to expand access to IRA tax breaks, Chinese companies are devising ways to get in on the tax credit bonanza—directly undermining efforts to reduce reliance on Chinese supply chains.

The Shenzhen-listed battery and metals recycler GEM last week signed a joint venture agreement with South Korea’s SK On and ECOPRO Materials to build a nickel-based battery material plant. The company’s stated goal is to “sell into the US and European market”—and to qualify for IRA tax incentives by basing operations in a US allied country.

MARKETS

MARKETS

MARKETS

MARKETSChina Battery Inc.’s deepening US foothold

China Battery Inc. continues to make inroads into the US market, and further embedding itself in the global EV supply chain.We’ve already discussed at length the inherent risks of Ford’s planned Michigan EV battery plant with China’s CATL. This week, CATL secured another foothold in the US: a deal to supply Dallas-based HGP Storage with 450 megawatt-hours of lithium-ion batteries for a Texan energy storage project.

This comes after a similar deal inked in October, which has CATL as a sole supplier of lithium battery packs to a large battery storage facility in Las Vegas. As a Chinese industry outlet put it: CATL is “using energy storage to accelerate overseas expansion.”

Separately, Ford just signed deal to jointly invest with PT Vale Indonesia and China’s Zhejiang Huayou Cobalt in a 4.5 billion USD nickel processing plant in Indonesia. Ford is separately developing a supply agreement with Huayou for battery materials.

We wonder: Will the involvement of a Chinese company—a “foreign entity of concern”—disqualify Ford from IRA tax breaks under newly tightened rules unveiled on Friday?

Speed bumps ahead for the global economy

In the three decades since 1990, productivity and incomes rose while inflation fell. Now, “nearly all the economic forces that drove economic progress are in retreat,” warns the World Bank in a new report. Growth in total factor productivity is slowing. Investment growth is weakening. The global workforce is aging. Covid’s health shocks and disruptions have triggered reversals in human capital.

The result: the threat of “a lost decade in the making” as global GDP growth is forecast to slow to a three-decade low of 2.2%. And the remedy, per the World Bank: increase investment, cut trade costs, double down on services, raise labor force participation, and strengthen global cooperation.

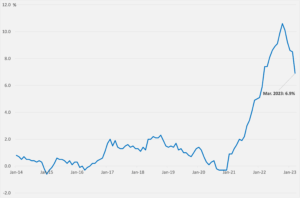

One piece of good(ish) news that could be a sign of where global inflation is headed: Increases in eurozone consumer prices slowed sharply in March to 6.9% year-on-year, even as the core rate excluding food and energy accelerated to 5.7%.

Eurozone CPI, year-on-year percent change

Source: Eurostat

Europe sharpens its trade defense tools

The EU is adding a new tool to its trade defense arsenal, just several months after another defensive measure aimed at distortive foreign subsidies entered into force in January. The new tool is called an anti-coercion instrument, designed to “deter third countries from targeting the EU…with economic coercion through measures affecting trade or investment.”

With the new instrument, Europe can sidestep the World Trade Organization and directly hit back at coercive economic behavior. Among the measures the instrument allows for are increased customs duties, import and export restrictions, and restrictions on services and procurement.

All this is happening as Europe reckons with an assertive and aggressive China. As Ursula von der Leyen, president of the European Commission, said in a speech on Thursday: China’s “imperative for security and control now trumps the logic of free markets and open trade.” The implication is that competing requires reassessing the economic orthodoxy of globalization — or, at least, having options when other players distort that orthodoxy.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSFriendly or predatory?

China has firmly established itself as the international lender of last resort. Data from the AidData research institute at the College of William and Mary show that from 2000 to 2021, China provided 240 billion USD of emergency rescue financing to debtor countries—of which 185 billion USD was extended since 2016. In total, that’s still less than what the International Monetary Fund has doled out, but China’s share is growing fast. And that pace is likely to accelerate as the number of countries facing economic distress climbs. The generous interpretation is that China is taking on more responsibilities as a major power. The more cynical take points to risks of an opaque rival system of governance.

Summer is coming—along with energy security risks

Hot summer months pose energy risks for Europe. Industrial demand for natural gas may tick up, driving up prices. How much Chinese demand will rebound remains a significant wild card. Asian buyers may jump back into the spot market as prices have fallen, increasing competition. Then there’s weather conditions: Heat will mean more demand for cooling, while droughts could disrupt river transportation of oil and coal. And while US LNG exports offered a lifeline to Europe last year, projects are now facing delays amid rising interest rates, turmoil from the banking crisis, and supply chain shortages. In short: Europe’s energy security is still on fragile ground.

(Photo by Pixabay/Pexels)