Chip War Weaknesses: The Problem with TSMC’s China Exposure

January 15, 2025Even as Washington pours tens of billions of dollars into domestic semiconductor production, even as Washington strives to build domestic industrial capacity, the US does so on a foundation that Beijing controls.

Orienting Economic Statecraft for China’s Military-Civil Fusion: LiDAR in the Field

September 18, 2024The volume and variety of apparent military applications of LiDAR suggests that China may well have concepts of operations and use cases for LiDAR that could generate surprise on the battlefield – and off.

a/symmetric: “Buy China” vs. “Buy America”

March 31, 2024Beijing has long used policies to favor domestic firms and disadvantage foreign ones

COMAC Comes to Europe: strategic implications of the commercial aerospace battleground

January 11, 2024China co-opted and conquered foreign solar energy and high-speed rail players. Will incumbent aerospace giants fall for the same playbook and spell their own disruption? The question is an existential one, and Western incumbents' survival hinges on weaning off the Chinese market and ceasing cooperation with Chinese players.

Deglobalization Round-Up: July 8

July 8, 2023Chinese state media rebukes Goldman Sachs, US inspectors check in on Chinese firms' Hong Kong audits, and the Japanese manufacturer Nidec Corp. builds a new cutting-tools factory in India. Plus, China sounds an upstream warning with germanium and gallium export curbs.

Deglobalization Round-Up: June 17

June 17, 2023US capital stops flowing to China, Volkswagen builds an EV plant in Canada, and Italy investigates Chinese government access to TikTok. Plus Bunzl's de-risking and restrictions on AI platforms in China.

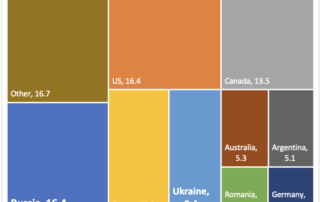

Reshoring Rides the EV Battery Wave, Taking Aim for Another All-Time High

May 24, 2023The latest report from the Reshoring Initiative shows reshoring and FDI manufacturing job announcements continuing to outpace recent records, adding 101,500 jobs in Q1 2023, driven in large part by geopolitical tension and efforts to shore up dependence on an unreliable China.

The Week That’s Done: China’s Midea eyes Sweden’s Electrolux

May 7, 2023A Chinese home appliance giant wants to acquire a Swedish home appliance brand—and it’s not as mundane as it seems. Meanwhile, China goes big on oil drilling, positions to leapfrog on EVs, and cements (steels?) its partnership with Riyadh. Plus: Rate hikes, another Goldilocks jobs report, and EV makers’ direct sourcing ambitions.

How America’s Aerospace Industry Built China’s and a Market-Based Solution

April 18, 2023China is positioning to squeeze international incumbents out of their markets – by leveraging their technology. Corporate leadership should be held accountable for a business model of self-destruction; footprints in and partnerships with China in strategic sectors should be treated as a liability.

The Week That’s Done: China Battery Inc. Eyes the US

April 2, 2023Saudi Arabia and China strengthen their ties, and the world should pay attention. Plus, we dive into US efforts to bring allies under the Inflation Reduction Act umbrella – and China's efforts to crash the party (case in point: Chinese battery companies embedding themselves in the US automotive supply chain).

This Is the Blueprint for China’s Industrial Strategy

March 17, 2023China's "single champions" and "little giants" programs fuel an industrial ambition that entails not merely acquiring dominant industrial capacity, but also establishing positions of leverage in key global supply chains.

Little Giants, Single Champions: China’s Blueprint for Asymmetric Industrial Advantage

March 16, 2023Chinese government programs to promote “single champions” and “little giants” have been under way since at least 2011. But they have received little international attention. This report seeks to resolve that deficit. The list of “single champions” and “little giants” constitutes a detailed operative blueprint of China’s industrial standing, ambitions, and strategy.

All Hat No CATL: Are State Leaders Wising up to China’s Industrial Threat?

March 2, 2023Ford has announced that it will collaborate with a Chinese State-backed supplier in establishing a battery plant for electric vehicles in Michigan. This despite the fact that an EV battery plant dependent on Chinese technology runs contrary to ambitions to shore up dependence on Chinese players and increase sustainable American industrial capacity.

The Week That’s Done: February 5

February 5, 2023The EU goes head to head with the US on industrial policy, right when cooperation is most necessary. Plus, BP says that fossil fuels are out but US oil production surges and the world can't kick coal, China's pending export restrictions on solar and rare earth technology, and General Motors pushes ahead with investments in vertical integration. Plus: spy balloon.

Deglobalization Round Up: February 2

February 2, 2023Nucor sees reshoring pushing up demand for it steel and US forgers call for continuing tariffs on China. Plus, Sony moves out of China, Europe's wake-up, the US courts India, and concerns over TuSimple.

Deglobalization Round-Up: January 19

January 19, 2023Davos might be the symbol of globalization, but even there, the trend toward deglobalization is clear - and MacroFab, GlobalFoundries, and active managers are benefiting (though investors in ByteDance aren't).

Deglobalization Round-Up: January 7

January 7, 2023Dell, Panasonic, Denso all rethink dependence on China, while The New York Times covers a turn to Mexico, China threatens retaliation for COVID-19 travel restrictions, and Moscow and Beijing join forces on propaganda.

Deglobalization Round-Up: December 9

December 9, 2022The EU sues China at the WTO as Beijing's effort to weaponize globalization come into sharp relief. Meanwhile, are semiconductors the canary in the coal mine for deglobalization?

Deglobalization Round-Up: December 2

December 2, 2022Australia prepares to tighten regulations on foreign investment in it critical minerals industry and Canada warns of dependence on unreliable trade partners. Plus former Cisco CEO predicts deglobalization in the tech sector - while Apple's China dilemma and MacroFab's profits prove his point.

Global Gateway Can Succeed – If It Focuses on Trusted Production

November 15, 2022The best prospect for getting Global Gateway going strong would be to understand that it must be turned into a tool that finances the external dimension of a European industrial policy cognizant of the need to diversify, to cut dependencies vis-à-vis authoritarian countries, and to find new ways of partnering with the Global South towards sustainable development.

The Week That’s Done: November 13

November 13, 2022The EU’s ban on Russian petroleum products is a mere weeks away, winter looms, and the energy crisis is a global affair – with developing economies on the frontlines. Plus, deflation in China, competition in major metal exchanges, and the neon market heats up while palm oil cools.

The Week That’s Done: November 6

November 6, 2022Beijing completes its space station and we benchmark the US-China space race – while the Fed keeps hiking, Maersk adds to recession fears, the Black Sea grain deal falters, and Canada orders Chinese lithium companies to divest. Plus: an OPEC for battery minerals?

Free Exchange with China Is Not Free Trade

October 12, 2022China is not a free market. Free exchange with China is not free trade. This is a straightforward reality. It is also one that goes under-stated in American discourse – and that demands spelling out: The short-sighted insistence that free exchange with China is free trade threatens the basic assumptions, and architecture, of international free trade itself.

The Week That’s Done: September 25

September 25, 2022Beijing plays both sides of today’s energy war, while expanding its influence over tomorrow’s markets. Meanwhile, European industry falters and the UK falters, generally; the Fed ups the ante but Beijing and Tokyo continue to sit this round out; and is copper the bargain of the moment?

The Week That’s Done: September 18

September 18, 2022Inflation is up and FedEx is down: US economic indicators have alarm bells ringing – while Latin America faces triple digit inflation and energy crisis pushes Europe to full-on intervention. Plus: Tesla walks the US-China tightrope; coal prices soar while oil production drops, and a decision point nears for metals markets.

Hard Problems: The US Tech Sector Is Ignoring the China Threat

September 16, 2022It is time for the US tech sector to recognize the near and present national security threat China poses; to get on the right side of history. For the US to prevail against a centralized, Communist system, its tech sector will have to lead, proactively. Markets will reward this. The country needs it.

The Week That’s Done: August 28

August 28, 2022Moscow toys with global energy markets and LNG prices surge – with second-order consequences for Beijing’s international influence, global food supply, US inflation. Plus: Drought compounds agricultural crisis, the SPR sits at its lowest level since 1985, Japan eyes nuclear, and China launches a new wave of stimulus. And, of course, Powell says tighten your seatbelts.

The Week That’s Done: August 21

August 21, 2022Record temperature shut down China and squeeze Europe - not the heat the global economy needs. Plus the Chinese central bank cuts rates while UK inflation hits 10.1%, copper miners stay optimistic and the IRA gives them reason, and nuclear fears in Ukraine. Happy weekend!

The Week That’s Done: August 14

August 14, 2022The CHIPS Act is a carrot and Manchin's EV sourcing requirements a stick: US industrial competition could be ready for a comeback - if the private sector is on board. Plus: The energy scramble continues while Turkey plays metals middleman; US inflation relaxes, but so does productivity; and China flexes its delisting muscles

The True Cost of China Exposure and What To Do About It

August 6, 2022US industry is seeing the accumulated debts of decades of offshoring – and decades of offshoring to geopolitical adversaries – reach maturity. It’s time to adopt a new model. Instead of optimizing for the lowest costs, the US needs to start optimizing for resilience

The UK’s New Critical Minerals Strategy Represents a Comeback for Industrial Policy

July 28, 2022The UK government is now demonstrating that it is ready to move, and in lockstep with allies, in setting out the steps to maximize what the UK produces across the value chain and to reduce strategic dependence on China.

A Secure Industrial Strategy Starts at the Upstream

July 26, 2022In everything from batteries to solar panels, the energy sources of tomorrow depend on inputs from China. The good news is that it it's not too late. The US, its allies, and its partners can still compete. But they will have to start with the upstream.

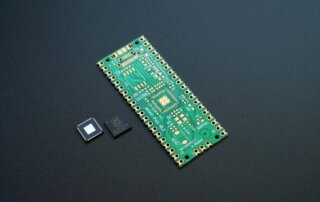

Getting in the Semiconductor Fight

July 2, 2022A global semiconductor strategy, if it could be established, might set the template for how the techno-democracies can compete in today’s industrial era. Emerging industries cannot be pursued by a go-it-alone America. But nor can any be developed without guardrails and a competitive orientation. Welcome to the new globalization.

The Week That’s Done: June 26

June 26, 2022With the energy crisis here to stay, the White House is throwing Econ 100 to the winds; Europe on a quest for new supply; and China sitting pretty atop cheap Russian imports that promise new energy influence, and leverage over the West. Meanwhile we round out the week with economic collapse in Sri Lanka, a COVID pill in China, and a looming critical mineral shortage.

The Week That’s Done: June 19

June 20, 2022Washington brings supply-side tools to a demand-side fight; the EU fares no better. Meanwhile Moscow turns off gas to Europe while Beijing continues to snipe chip tech. Plus: All eyes on Xinjiang, the Yen, and the WTO's pyrrhic victory.

The Week That’s Done: June 12

June 12, 2022Gas prices hit all-time highs as inflation gallops ahead; Washington relaxes solar tariffs while playing softball with Russia's plunder; plus China stocks make (minor) gains, BYD makes bigger gains, and TSX launches a battery metals index

At a Time of Runaway Inflation, Tech Is an Ally Not a Foe

June 11, 2022It’s time for Washington to start working with, not against, big tech; to start leveraging American industrial scale in order to fight inflation and for the global order.

If Washington Wants to Beat Inflation, It Needs to Lean into Tariffs – Not Relax Them

June 6, 2022The answer to inflation is not to ease tariffs. It is to stop with the band-aids. The US should see inflation as the motivation to invest in domestic production; tariffs as the market opportunity to do so.

The Week That’s Done: June 5

June 5, 2022The EU promises that it will block most Russian oil imports maybe – all while production continues to stall and Australia offers worrying indicators of shortage ahead; plus we have European inflation, car companies as space companies, and a pyrrhic victory for the US.

Make the Right Choice for the US-China Tech Competition

May 26, 2022US industry – powered by scale and global reach – fueled the country’s rise. The US needs that industrial strength now. But today, it will come from tech not from steel. And it will only come if that tech operates on big platforms.

Markets Briefing: Week of May 16

May 22, 2022US stocks hit their longest losing streak since the Great Depression – while continuing lockdowns in China, energy dilemmas in Europe, and a continuing failure to invest in domestic production suggest that a reversal of fortune is not on the horizon

Factors Briefing: Week of May 9

May 14, 2022It's shortage everywhere: In agriculture, wheat is the latest victim, threatening tomorrow's food supply while a baby formula shortage wreaks havoc today; meanwhile, China eyes the aluminum vacuum and a South Korea x Canada collab tries to shore up tungsten dependencies.

Tariffs are Not the Reason for Inflation. They’re How to Fix It

May 7, 2022The answer to inflation is not to ease tariffs. It is to stop with the band-aids. It is to keep tariffs up, but also to take the proactive measures that they are supposed to encourage: The US should see inflation as a push to invest in domestic production; tariffs as the market opportunity to do so.

Markets Briefing: Week of April 11

April 16, 2022China's CNOOC grows wary of the US, but not of a global footprint; GM and Glencore announce a flashy new supply partnership; and Beijing signals that there's more intervention in capital markets ahead.

Factors Briefing: Week of April 4

April 9, 2022The global helium shortage puts chaos on the forecast -- and so does the EU's ban on Russian coal; China regains control of a major cobalt mine in the DRC

China’s COVID-19 Lockdown Should Bring Production Back to America

April 8, 2022China’s COVID-19 debacle could be precisely the impetus the US needs to get serious about rebuilding supply chains. These should provide markets a prod to start pricing in the real costs of offshoring – and Washington justification for dedicated, emergency investments in domestic industry.

Markets Briefing: Week of March 28

April 2, 2022The EU makes a long-shot bid for gas market leverage; the Commerce Department wises up to China's solar tariff circumvention; and China's Securities Regulatory Commission looks to cozy up to the SEC

Your March 18 Briefing

March 18, 2022Markets sour on China -- but don't really; the world trudges toward global food shortage; Europe's rare earths efforts risk finding themselves back on square one.