Water crisis in Jackson, Mississippi hammers home the national infrastructure plight and the challenge of addressing it. Plus: The yen continues to slide and global bonds enter their first bear market in a generation; Pakistan and Sri Lanka secure IMF loans while Russia wreaks havoc on the European energy market (price cap be damned); and new battery plant announcements and chip export restrictions in the US suggest industrial policy at work – but is it working?

THE BIG CRISIS

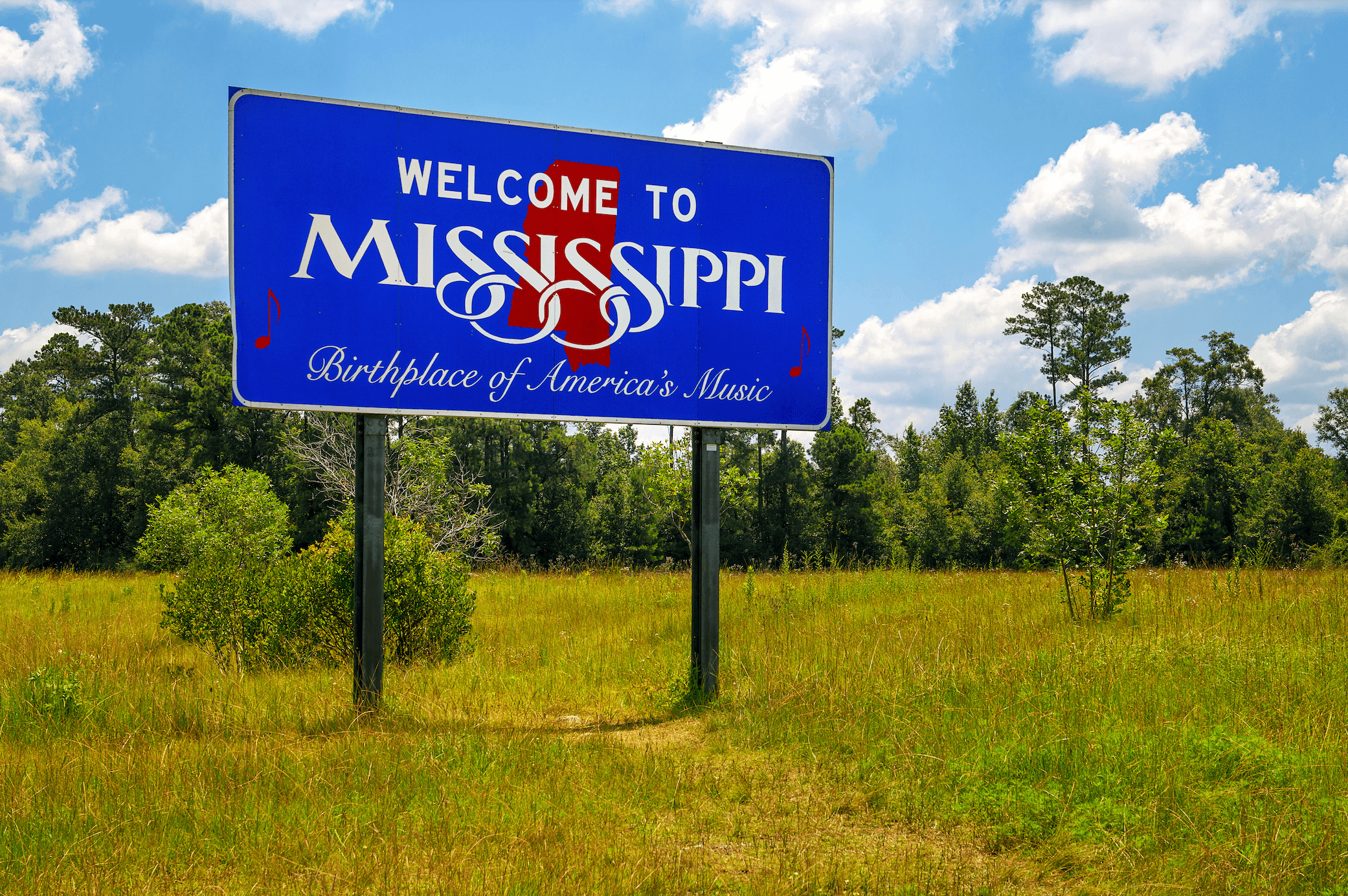

Jackson, Mississippi is the canary in the infrastructure coal mine

This week, flooding knocked out a decaying water plant in Jackson, Mississippi, leaving over 150,000 people without drinking water. One week in, the crisis continues. President Biden has approved declaration of a state of emergency for Jackson. Mississippi will use state resources, including the National Guard, to respond. And while city officials now say that most residents should have water, additional, knock-on risks loom. Efforts to increase pressure in the city’s decaying water infrastructure could lead pipes to burst. (“We know that we have brittle pipes,” said the Jackson mayor, “we have aged pipes just as our water treatment facilities are aged.”)

Moreover, as that line suggests, Jackson’s water crisis goes well beyond the disaster of the past week. The city has faced decades of water troubles compounded by underinvestment in infrastructure, poor local management, and a stream of affluent residents leaving for the suburbs, taking utility money with them. Jackson has been under a boil-water notice for over a month, since July 30, due to high manganese levels. A 2021 winter storm left residents without water for a month after pipes burst. In 2020, the Environmental Protection Agency found that Jackson’s drinking water had the potential to host harmful bacteria or parasites. This is a systemic problem in Jackson.

Jackson’s plight also reflects a systemic problem across the United States – where decades of underinvestment in infrastructure are coming to a head, with the potential for large-scale, rippling, economic and social consequences. According to the American Society of Civil Engineers, every two minutes see a new crack somewhere in the US buried water pipe system. Since 2021, residents of Benton Harbor, Michigan have had to rely on bottled water because of high lead levels in the city’s water. Earlier this summer, floods in eastern Kentucky left some 25,000 people without water; more than a month later, thousands of customers are still being told to boil their water. And it’s not just water infrastructure, either: Remember the 2021 Texas power outage in which millions of homes and businesses were left without power for days.

With the worsening of this national infrastructure crisis has come growing recognition of it. Last fall, President Biden signed a 1.2 trillion USD infrastructure bill that included 55 billion for water systems. But for all the zeroes behind that figure, it’s likely a fraction of what the country needs. In Jackson alone, it would cost some 1 billion USD to fix the water distribution system, not to mention the broader structural issue. Plus, the devil is in the details and implementation of the federal infrastructure funding is chock-full of tough details: How is the money to be allocated and its deployment monitored; how to balance state and local needs; how to grapple with the reality that the localities most in need of government support are the same ones that can’t afford to hire application-writers? And, of course, infrastructure investment is a long-term project. Funding, no matter how much, is a future solution to a now problem – one that is literally foundational but that has no immediate answer.

Jackson risks being the canary in the coal mine. Is there an exit path?

MARKETS

MARKETS

MARKETS

MARKETSPakistan and Sri Lanka secure IMF loans

Pakistan received a lifeline this week as the International Monetary Fund approved its bailout plan, allowing the release of 1.1 billion USD in funds to the struggling economy. Sri Lanka also reached a preliminary IMF deal for 2.9 billion USD in loans. These moves, albeit temporary band-aids, will help avert near-term defaults. Both countries’ economies have buckled under the strains of the global energy and food crises, as well as domestic political turmoil. On top of that, Pakistan is dealing with devastating floods, which have destroyed major export crops, including cotton and wheat. That’s forcing the country to turn to Russia for wheat – which Islamabad insists it can do without violating sanctions on Moscow.

Still, the underlying risk remains. IMF bailout cushion or not, both Pakistan and Sri Lanka remain acutely vulnerable to further external shocks. And these economies could be the tip of the iceberg in terms of instability in emerging markets – they’re certainly not the only ones that have seen uncertainty, political crisis, and economic challenge over recent months slash years. A chain of defaults across lower-income countries is still possible, with unpredictable ripple effects for the already volatile global economy.

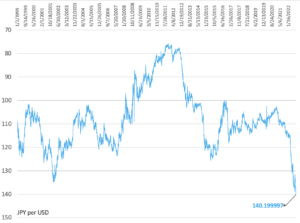

The yen keeps sliding, and so do global bonds

The Japanese yen breached the 140 yen per dollar mark this week, the lowest since 1998. The decline shows the market impact of Jerome Powell’s hawkish address at Jackson Hole last week, with further aggressive rate hikes expected from the US Fed even as Tokyo maintains its ultra-loose monetary policy. The weak yen helps Japan’s exports. But it also makes already-pricey energy imports and raw materials even more expensive. Tokyo has said it is watching foreign exchange rates with a “high sense of urgency.” Still, it is unlikely to be in any rush to raise rates, given the government’s goal of achieving sustained 2 percent inflation levels.

Plus, another consequence of Powell’s address – and the ultra-tight monetary policy being adopted internationally that it reflects: Global bonds fell this week into their first bear market in four decades, pressured by rapid interest rate hikes. European bonds have been hit hardest, thanks to Russia’s invasion of Ukraine and the resultant energy crisis.

JPY per USD, 1999-2022

The parade US battery investments continues

This week brought two more mega investment announcements of US EV battery plants by foreign companies. On Tuesday, Japanese carmaker Honda and South Korea’s LG Energy Solution pledged jointly to invest 4.4 billion USD to build a battery facility in the US. Japan’s Toyota followed the next day with news that it would double its investment in a North Carolina battery plant, first announced last December, from 1.29 billion to 2.5 billion USD. Plus, as we noted last week, Tesla supplier Panasonic is reportedly planning an additional 4 billion USD battery plant. These latest investments are clear responses to the Inflation Reduction Act’s carrots mechanism, a sign of real change catalyzed by the legislation. Still, the lingering question: Where will these plants source key upstream battery inputs from – and will US government investments help shore up those upstream dependencies in the supply chain? Will these battery plant announcements be followed by new mineral extraction and processing investments from automakers and suppliers?

The US rolls out new chip export restrictions

The US Commerce Department this week barred the American companies Nvidia and Advanced Micro Devices from selling a certain type of high-end chip, known as graphics processing units or GPUs, to China and Russia. The restrictions target Beijing’s semiconductor and AI development. They come mere weeks after Washington imposed export restrictions on electronic design automation software to China and other countries. This week’s GPU restrictions sent both Nvidia and AMD’s stocks tumbling, with the former—which derived over a quarter of its fiscal year 2022 revenue from China and Hong Kong—hitting a 52-week low. That market response might be an overreaction to this precise set of restrictions. Chinese and US companies are adept at finding workarounds. And there are loopholes in the restrictions themselves. Nvidia, for example, has received permission to continue to develop its H100 GPUs in China, though sales to Chinese customers will be restricted.

Share prices of Nvidia and Advanced Micro Devices

Source: Sentieo

Still, this latest set of restrictions does signal that the US might be getting more serious about cracking down on tech, including semiconductor, ties to China – likely in no small part a function of the billions of dollars that the CHIPS Act is funneling into relevant US capacity, and fears that Beijing will succeed in siphoning the results.

FACTORS

FACTORS

FACTORS

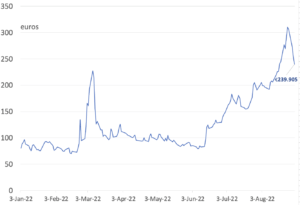

FACTORSRussia toys with Europe’s energy market, calls the price cap bluff

Moscow has shut the taps again as it continues its economic war on Europe. No natural gas flowed through the Nord Stream to Germany for much of this week as Gazprom halted supplies for “maintenance.” The Russian state-owned energy giant is also curbing supplies to French utility Engie, ostensibly over missed payments. In spite of these supply disruptions, Europe is on track to meet its gas storage goals of filling reserves to 80 percent capacity, and two months ahead of schedule to boot. But that will only help so much: With limited Russian supplies, and without slashing consumption, the stored fuel is unlikely to last through the winter. And there’s no telling whether Moscow will decide abruptly and fully to halt supplies.

Meanwhile, international leaders seem still convinced that they can fight fire with regulations. G7 finance ministers this week announced that they had agreed to impose a price cap on Russian oil, an alternative to an all-out ban intended to balance reliance on Russia energy with the goal of squeezing Moscow economically. This is largely a symbolic agreement. Cap level and enforcement remain undetermined. Regardless, it’s unclear how such a price cap could work. Enforcement will be near-impossible. China and India will not comply, and likely will lean into positions as re-sellers. And Russia is calling the West’s bluff: Moscow has said that it will not sell oil to countries that impose price caps.

And in an era of chaos, energy markets follow rules of chaos

Speaking of regulatory “solutions” to supply challenges: On Monday, EU president Ursula von der Leyen pledged an “emergency intervention” to the bloc’s power market to curb skyrocketing prices. Details of what this market intervention will entail are scant for now. It could involve an EU-wide energy price cap. Already, a number of member states have taken such steps on their own: Spain and Portugal got the green light from Brussels to cap natural gas prices; France put in place a national energy price cap in January. Austria is pushing for a bloc-wide cap to “stop the madness” in energy markets. Regardless, the prospect of market intervention was enough to send natural gas prices tumbling this week, even as Russia cut off flows – a perverse development that signals how chaotic current energy markets are. And, the real issue: While overhauling the EU electricity market might dampen wild swings in power prices, it will not resolve dependence on Russian fuel, the fundamental threat to Europe’s energy security.

Dutch TTF Gas Futures Prices, euros per megawatt hour

Source: Investing.com

Meanwhile, the Japanese government will reportedly intervene to buy LNG if and when private companies can no longer afford to do so. Under a new framework, the state-owned Japan Oil, Gas and Metals National Corporation would procure LNG on behalf of private firms in order to avoid a supply crunch. One thing that’s working in Tokyo’s favor, for now: Russia this week approved Mitsubishi and Mitsui’s stakes in the Sakhalin-2 project, a major source of LNG for Japan. The London-based Shell was less lucky. It had tried to sell its 27.5 percent stake in the project, but is now walking away with nothing after Russia seized its shares.

A goldilocks jobs report – but the era of scarcity continues

Figures released by the Labor Department on Friday showed that the tight national market has loosened somewhat. Employers hired fewer workers and wages rose at a slower price than in recent months. Employers added 315,000 jobs in August, compared to 526,000 in July; the jobless rate rose to 3.7 percent from 3.5 percent, largely a function of more workers entering the labor force; and average hourly earnings were up 5.2 percent year-over-year, compared to a peak of 5.6 percent in March. This could be a goldilocks labor report, just in time for Labor Day: It shows a still-strong jobs market but one slowly cooling.

Still, of course, the structural challenges facing the national economy go well beyond the tight jobs market. They revolve around inadequate supply, across all factors of production not just labor, and insufficient investment in production. And there are also growing concerns about the future of US labor supply. COVID-19 has set the US back some two decades in terms of human capital. For children, two years of pandemic disruptions have undone two decades of math and reading performance among nine-year-olds, according to testing data from the National Assessment of Educational Progress. More broadly, preliminary data released this week by the US Centers for Disease Control and Prevention show a continued decline in life expectancy from 2020 into 2021, with life expectancy for Americans now at 76.1—the lowest level since 1996, and a full year behind that of China.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSIt’s wildcards aplenty in oil markets

A new source of volatility hangs over global oil markets: Heightened political turmoil in Iraq, OPEC’s second-largest producer. On Monday, protesters stormed the presidential palace in Baghdad after a prominent Shiite cleric resigned from politics, leading to violent clashes with security forces and at least a dozen dead. Crude oil futures shot up on the uncertainty, before subsiding after the cleric urged calm. But tensions and violence could still spill over unpredictably. Already, clashes have spread to Basra, the country’s main oil hub. Plus there’s the Iran wildcard: If Tehran reaches a nuclear deal with major powers, it could add up to two million barrels of oil per day to oil markets. And there’s more uncertainty around the corner as OPEC+ meets next week, with production cuts on the table and especially likely in light of a potential Iran deal.

(Photo by Ingo70/Shutterstock)