Washington and its allies are questioning the orthodoxy of globalization. Meanwhile, Russia ropes Turkey into its nuclear orbit, China continues its attack on foreign businesses, and the global aluminum market hinges on rains in Yunnan. Plus: Risk of a Marburg epidemic and improving global health security with small vaccine stockpiles.

A MODERN AMERICAN INDUSTRIAL STRATEGY

It’s not just the market economy, stupid

Call it a new consensus or a long overdue moment of reckoning: Washington is finally coming to terms with the reality that unfettered globalization and a maximalist pursuit of market efficiency bring significant risks — and costs that undermine the economic security of the US.

That was the case US national security advisor Jake Sullivan made this week in a major speech framing the Biden administration’s new global economic strategy.

For too long, Sullivan said, the US has operated under the assumption “that markets always allocate capital productively and efficiently —no matter what our competitors did.” The global financial crisis and the Covid pandemic blew those assumptions apart. Now, the US must deploy a “modern American industrial strategy” — one that can effectively compete and defend against the market-distorting behavior of a large non-market player: China. (Which, by the way, has an intricate industrial strategy of its own to exploit the weaknesses of the West’s said economic assumptions.) This, according to Sullivan, will involve government making “targeted and necessary investments in places that private markets are ill-suited to address on their own.”

US allies and partners seem to be coming to the same realization. The EU’s Ursula von der Leyen made points similar to Sullivan’s in a speech earlier this month. And just this week, Nikkei reported that Japan will subsidize up to half of costs for key minerals projects by Japanese companies. Meanwhile, Canada is fast becoming a global leader in clean tech incentives with its new renewable energy investment tax credit.

The concern underlying all of this: That in the haste to defend against China’s market distortions, to defend and to diversify supply chains, and to shore up industrial capacity, the US risks undermining its free market strengths and attempting to mimic Beijing with a hands-on industrial policy.

But that doesn’t have to happen. Sullivan’s recognition, and that of von der Leyen, is not incompatible with a free market system. The end goal for Washington, Ottawa, Brussels, Tokyo, and their allies is simple: To augment the power of markets by using public nudges to crowd in private investments and secure industries vital to national security, all while protecting against Beijing’s distortions.

FACTORS

FACTORS

FACTORS

FACTORSYunnan, swing producer of aluminum

Worldwide aluminum demand is set to increase by 40% by 2030, driven by increased use in transportation, electricity, packaging, and construction. But global production is struggling to keep up.

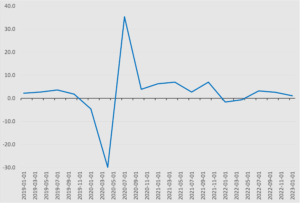

While numbers from the Industrial Aluminum Institute show global output of the primary metal grew by 2% year-on-year in the first three months of 2023, China—which accounts for nearly 60% of total production—saw its output growth rate slow sharply to just 0.9% last month.

The global market for the industrial metal now hinges on China’s southwestern province of Yunnan, which accounts for 12% of the country’s aluminum capacity. A historic drought there is crimping hydro power, which producers have increasingly begun to lean on as Beijing works to cut emissions. That’s making Yunnan a swing producer. And it further amplifies China’s influence over global aluminum production patterns.

Then there’s Russia. With domestic production looking shaky, Chinese imports of refined aluminum from Russia tripled year-on-year in the first quarter. Moscow is no doubt grateful for an eager customer as the West shuns Russian commodities.

The upshot: The US has an opportunity to take a leading role in producing low-carbon aluminum. And, conveniently, Joe Quinn of the SAFE Foundation wrote last month on how the US can address its aluminum production challenge.

Chinese monthly aluminum production, year-on-year growth

Source: Industrial Aluminum Institute

Turkey deepens its Russian energy dependence

A final nuclear plant shuts in Germany. An inaugural one opens in Turkey. Undergirding both developments is Russia’s continuing influence in global energy markets, even as the West tries to limit Moscow’s revenue from fuel sales.

Earlier this month, Germany closed the last of its nuclear power plants—having delayed the closure from October following Russia’s throttling of pipeline gas supplies. Meanwhile, Turkey this week opened its first nuclear plant, built and owned by Russia’s state-owned Rosatom. President Vladimir Putin hailed the project’s “mutual economic benefits” for the two countries.

But mutual benefit or not, it’s clear which party has more leverage: As Moscow pursues its strategy of projecting influence through Rosatom projects worldwide, Turkey—already dependent on Russian gas—will deepen its energy reliance on Russia. Under the terms of the Turkey-Rosatom agreement, Russia could control Turkey’s nuclear energy for the next 80 years.

There’s nuclear will, but where’s the nuclear way?

Over in the US, the public is warming to nuclear. A Gallup poll shows that American’s support for nuclear energy is the highest in a decade, at 55%. But while nuclear is seen as an alternative to fossil fuels that can smooth the energy transition, critical dependencies lurk.

For one, the US is almost entirely reliant on imports for uranium. It also has limited enrichment and conversion capacity. A bipartisan bill aimed at strengthening domestic nuclear fuel production was introduced in the Senate in February. But for the most part, the US response to its uranium import dependence has been what the American Nuclear Society calls “paralysis.”

Europe’s natural gas buyer’s club

Europe this week launched a joint natural gas buying mechanism. Dubbed AggregateEU, about 80 companies have already signed on to the platform, which will begin matching buyers and sellers with tenders beginning early next month. The idea is that joint purchasing could help buyers secure better terms on global gas markets, and especially help smaller, energy-intensive companies from landlocked countries secure fuel.

The big question: Will the buyer’s club meaningfully improve Europe’s energy security? For now, the EU is only aiming to jointly buy 13.5 billion cubic meters of gas—less than four percent of the bloc’s total demand.

MARKETS

MARKETS

MARKETS

MARKETSRecession or resilience?

The US economy grew 1.1% in the first quarter, well below the 2% estimate and a considerable slowdown in the face of rising interest rates. But it’s not all gloom and doom. Residential investment is declining more slowly. Final sales to private domestic purchasers, which show underlying demand of businesses and consumers, rose at the fastest pace since 2021. And inflation-adjusted consumer spending is holding strong. Meanwhile, the Fed’s preferred inflation gauge eased further in March and wage growth remains elevated. Zooming out, global freight is showing signs of bottoming out as freight volumes stabilize across various major transport hubs.

US GDP, quarterly growth from preceding period

Source: US Bureau of Economic Analysis via FRED

China ups the pressure on foreign firms

Chinese authorities raided the Shanghai offices of Bain & Company this month, the latest instance of official intimidation against foreign businesses following the recent detention of five local staff working for US consulting company Mintz Group in Beijing. Meanwhile, the Chinese Communist Party just broadened a spy law, expanding its definition of espionage to include what are otherwise normal business activities. All this comes just months after Beijing assured foreign investors that the country is open for business. It looks more like open season.

Japan stays ultra-loose

All market eyes were on the Bank of Japan’s new governor Kazuo Ueda as he gave his press news conference on Friday. He kept his pledge and delivered no surprises: The central bank will stick with its ultra-loose monetary policy and maintain yield curve control, which caps yields on 10-year government bonds through massive debt purchases. But he did dangle the promise of a “broad-perspective review” of the policy around 12 to 18 months from now. The yen dropped as much as 1% to 133.4 yen per US dollar on Ueda’s comments.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSFirst Republic Bank on the brink

It’s been a brutal week for First Republic Bank, whose shares recorded two separate 50% drops this week—first on news of an exodus of deposits, then on reports that it will be placed under receivership by the US Federal Deposit Insurance Corporation. That would make it the third US bank to collapse since March, following the demise of Silicon Valley Bank and Signature Bank last month (was that really just last month?).

One lesson federal regulators are taking from all this, per a post mortem on SVB released by the Fed on Friday: Banking rules and supervision must be strengthened.

Small vaccine stockpiles vs. big disease outbreaks

Two concurrent outbreaks of Marburg—a deadly virus disease in the same family as Ebola—in Equatorial Guinea and Tanzania threaten to spread further. Authorities are scrambling to contain the outbreaks. They are hampered by the fact that no vaccine currently exists.

There are, however, vaccine candidates that could be ready for testing under an emergency use ruling. But there is no stockpile of such experimental vaccines. That poses a threat to global health security: Small, localized outbreaks are at greater risk of becoming an epidemic or global pandemic. In part, this is because market forces aren’t aligned to incentivize drug manufacturers to develop and maintain a supply of vaccines for low probability yet high cost events.

Will governments step in to establish small stockpiles of vaccines for the nine priority pathogens with pandemic potential?

(Photo by Pixabay/Pexels)