Europe says it’s de-risking its relations with Beijing; Macron’s visit to China suggests otherwise. Meanwhile, Washington wants to build an anti-coercion coalition—but doing so demands a strong industrial base and there, trends aren’t looking so hot. Plus, lithium as the new coal, mineral M&A deals heat up, and the US still needs to refill the strategic petroleum reserve.

THE GREAT DE-RISKING?

Von der Leyen calls for de-risking from China; Macron goes to Beijing

Brussels can’t seem to decide what kind of relationship it wants with China.

In a blunt speech last week, EU chief Ursula von der Leyen called out China’s undermining of the global trading system and laid out the case for “de-risking” relations with Beijing.

This week, von der Leyen, French president Emmanuel Macron, and a delegation of over 50 French business leaders traveled to China on a high-profile diplomatic and commercial mission. Macron claimed that the goal of the visit was to present a united European front on China and to push Xi Jinping to change his position over Russia’s war on Ukraine.

Unsurprisingly, there was no such about-face from Xi. The visit did, though, serve to deepen commercial ties between China and France. On Thursday, Europe’s Airbus clinched Chinese approval for existing jet orders (though no new orders were announced) and declared that it will double production in China with a second assembly line.

And for all of Macron’s talk about a united European front, the openness to commercial engagement suggested during his visit contrasts sharply with policies adopted by other EU member states of late. The Federation of German Industry this week called for a renegotiation of the EU-China investment deal. Italy is reportedly mulling options to curb Chinese state-owned Sinochem’s influence on Italian tire maker Pirelli. Rome also recently intervened to limit Italian robotics company Robox’s software library licensing deal with its major Chinese shareholder, Efort Intelligent Equipment. And then there’s France.

FACTORS

FACTORS

FACTORS

FACTORSFor Australian exports, lithium is the new coal

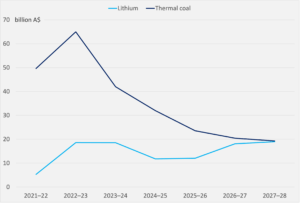

Here’s a data point that illustrates the global energy transition: By 2028, Australian export earnings from lithium will be equal to those from thermal coal, according to data released this week by Canberra’s industry department. In fact, export earnings from critical minerals like lithium, nickel, and copper will within five years equal the export value of both thermal and metallurgical coal.

The changing picture of Australia’s resource exports highlights the country’s critical role in the shift to renewables. But it’s also a reminder of China’s vice grip on the global clean energy industry. Last year, 96% of Australian lithium exports went to China. China accounts for 58% of global lithium processing capacity and 80% of lithium battery manufacturing. Unless other countries can rapidly scale up lithium processing, the bulk of the world’s lithium production will feed China’s industrial machine—and deepen the country’s control of battery supply chains.

Australian exports of thermal coal and lithium, AUD value

Source: Australian Government, Department of Industry, Science and Resources

Red hot copper

Surging demand for copper—essential for batteries, EV charging stations, electrical wiring, and grid infrastructure—is driving a spate of M&A deals around the red metal.

This week saw Vancouver-headquartered Teck Resources publicly reject a 23 billion USD bid from Swiss commodities giant Glencore. Glencore now has three weeks to keep its bid alive. If the deal is successful, it would create a new entity, GlenTeck, with ambitions of becoming one of the world’s largest copper miners.

The Glencore-Teck courtship comes on the heels of several copper-related deals: BHP’s acquisition of OZ Minerals, Rio Tinto’s takeover of Turquoise Hill, and Newmont’s bid for Newcrest. Competition for copper is heating up, and companies with cash to spend are jostling for position.

Argentina’s soy dollar

In a bid to raise central bank reserves and boost farmer sales, Buenos Aires has reintroduced the “soy dollar”—a temporary special exchange rate priced 40% above the current official rate—to increase trade volumes. The situation is getting desperate: The country’s foreign reserves are dwindling, and a historic drought has ravaged the country’s grain crops. Production of soy, the country’s top export product, is set to hit a 14-year low, further crimping supplies of foreign currency. The soy dollar was already deployed twice last year. Will it work again? That will in part depend on whether Argentinian farmers want to sell, and how robust Chinese demand is.

MARKETS

MARKETS

MARKETS

MARKETSWashington floats an anti-coercion coalition

Nikkei reports this week that the US wants to see joint responses to Chinese intimidation: If Beijing targets any G7 member with economic coercion, the group should coordinate countermeasures. And Washington is also reportedly looking to apply a preemptive playbook for deterrence. “By disclosing retaliatory measures in advance,” Nikkei notes, “…Washington seeks to discourage China from economically bullying other countries.” That approach echos US efforts to share declassified intelligence to fight its information war with Russia.

A coordinated defense against economic coercion goes hand in hand with multilateral export controls aimed at China. And on that front, there’s been solid progress: Both Japan and the Netherlands have now joined US-led efforts to restrict Chinese access to advanced semiconductor manufacturing equipment.

Still, if the overall goal is to ensure economic security by reducing reliance on China and minimizing the number of key nodes over which Beijing has control, then the recent flurry of multilateral statecraft must also be paired with a robust industrial base at home. And conditions aren’t looking too rosy, as we detail below.

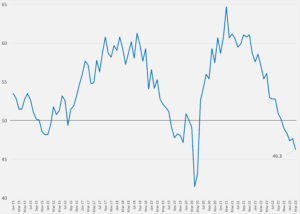

Slumping factory activity

Worryingly, manufacturing gauges are flashing red. The Institute of Supply Management’s US purchasing managers index has recorded five consecutive months of declining manufacturing activity. The March reading slipped to a three-year low of 46.3, down from 47.7 in February. And activity looks set to fall further: The new orders component of the index has contracted for seven months straight, falling to 44.3 last month from 47 the month prior and 53.8 a year ago. As Reuters puts it: “Hard-ish landing has already arrived for US manufacturers.”

There’s slightly better manufacturing news from elsewhere: Germany’s industrial output rose more than expected in February and is set to increase further in coming months. And while Japan’s factory activity is still contracting, the shrinkage slowed last month.

US purchasing managers index

Source: Institute of Supply Management, via Investing.com

The US jobs puzzle

Meanwhile, everyone’s still trying to make sense of the US labor market. The number of job openings fell by 632,000 in February, hitting the lowest level in nearly two years. That would suggest a cooling jobs market as the economy slows and companies dial back hiring. But the number of layoffs fell and voluntary quits rose. At the same time, weekly jobless claims rose from historic lows and topped estimates. Hiring cooled slightly with 236,000 jobs added in March versus 472,000 jobs in January and 326,000 payrolls in February. The labor market is still showing a lot of strength. But are cracks beginning to appear?

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSPlus-sized production cuts

Last Sunday (Apr. 2), the Saudi-led OPEC+ alliance announced a surprise oil production cut of over 1 million barrels per day. It was no belated April Fool’s joke. Prices surged, bouncing from 15-month lows of around 70 USD to hit 84 USD a barrel on Monday. Will we see the imminent return of the 100 USD barrel?

Another question is where this leaves the White House’s buyback. The administration last year devised a new policy tool—fixed-price forward contracts—to sell high, buy low, and refill the Strategic Petroleum Reserve. Yet the Department of Energy has appeared hesitant to buy crude for replenishing the SPR. The FT reports that Riyadh’s surprise cut may even have stemmed from irritation over Washington’s unwillingness to make the purchases. As Bloomberg notes: “By failing to build out the SPR mechanism…we’re still outsourcing energy market stabilization to OPEC.”

The risk of soaring oil prices further complicates central banks’ efforts to tame inflation. Russia’s decision—announced minutes after the OPEC+ statement—to extend its current supply reduction through the end of the year will also tighten global supplies.

(Photo by Dušan Cvetanović/Pexels)