It’s been a big week on the global monetary calendar: China turns on the stimulus spigot, the US takes a pause, Europe hikes, and Japan stays as dovish as ever. Meanwhile, oil demand is sticky and it’s boom time for LNG. Plus, Toyota’s strategic pivot and France’s push for tariffs on Chinese EVs.

CHINA SHARPENS ITS ECONOMIC STIMULUS TOOLS

Will rate cuts repair business and consumer confidence?

While central banks worldwide have waged a rate-hiking campaign, China is now going in the opposite direction.

On Thursday, the People’s Bank of China cut its medium-term lending rate. That followed Tuesday’s surprise trim of its seven-day reverse repo rate. Economists expect the benchmark loan prime rate to be cut next week, too. And major state-owned banks just slashed deposit rates last week.

But the rate cuts alone are unlikely to juice private sector investment and consumption. Interest rates aren’t the problem; fragile consumer and business confidence are. Rate cuts won’t repair the damage that years of unpredictable policy changes has wrought. Beijing has convened urgent meetings with business leaders to seek ideas on how to revive the economy. Those same business executives have likely been deeply rattled by Beijing’s policy U-turns.

Plus, China faces the risk of a balance sheet recession. That’s when household and business assets collapse in value, forcing more saving, crimping investment and consumption, and throttling economic growth. Even low rates don’t incentivize borrowing. In fact, facing weaker returns, savers may become even more reluctant to spend. (Meanwhile, the yuan is tumbling as Chinese and global rates diverge. So much for de-dollarization, quipped one economist this week.)

Now, Beijing is ready to turn on the fiscal stimulus firehose too, according to the Wall Street Journal. Measures will likely include billions of dollars of spending on infrastructure projects, and looser rules on real estate investments. But the property market is only a symptom of China’s deeper economic problems. And infrastructure buildouts will mean still more overcapacity, with low returns on investment and more distortions to global trade dynamics.

FACTORS

FACTORS

FACTORS

FACTORSEnergy majors are sticking with their bread and butter

In yet another indication of oil’s staying power, Shell announced this week that it will keep oil production steady or slightly higher through 2030, reversing its earlier pledge to slash annual oil production by 1% to 2%. The energy giant is making the move as it reaps soaring profits from oil and gas and contends with poor returns on renewables.

And Shell isn’t alone in doing so. Italian energy group Eni is reportedly looking to sell a stake in its renewables business. Meanwhile, the International Energy Agency predicts oil demand growth through 2028. Peak global oil demand is imminent—but the energy majors know there are still several years of lucrative profits to be made.

Boom time for LNG…

In other fossil-fuels news: The number of LNG tankers is set to surpass oil supertankers by 2028. That means that in the next five years, the number of LNG tankers worldwide will nearly double, while their oil counterparts will grow at a fraction of that rate. The rapid expansion comes as LNG enters what some have called a golden age for the super-chilled fuel, spurred by Europe’s urgent need to replace Russian pipeline gas supplies with imports from elsewhere.

And LNG projects are going full steam ahead. The French group TotalEnergies, the world’ third-largest LNG player, just bought a 17.5% stake in US LNG developer NextDecade for 219 million USD. The deal includes a 5.4 million ton supply commitment from the US firm—the largest such supply contract it has secured so far—and helps NextDecade’s Rio Grande LNG project to proceed.

…while Asia and Europe compete for supplies

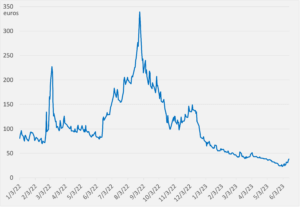

One challenge facing LNG producers and traders: volatility in prices for the chilled fuel. While European gas prices have dropped over 90% since last summer’s peak, this week saw a rally of as much as 20% on hot weather forecasts, heightened Asian demand, and supply outages in Norway.

For Europe, this could throw a wrench it its plans to enter winter with gas storage at least 90 percent full by November. Running down those supplies would mean yet another red-hot competition between European and Asian buyers of LNG, driving up prices as each tries to price the other out. In short, the global competition for LNG is not over yet.

Dutch TTF natural gas futures

Source: Investing.com

A critical minerals SPAC

Carmakers know they have to source minerals directly to secure their EV supply chains. The latest iteration: Stellantis and Volkswagen, along with global miner Glencore, are backing a one billion USD SPAC deal to buy two mines, of copper and nickel, in Brazil. Under the deal, Glencore will use some of the mines’ output for its refineries in Europe and North America.

At the center of the transaction is the London-based blank-check firm ACG Acquisition; its Russian metal industry veteran CEO Artem Volynets say that the deal will position the company as the “premier supplier of critical metals into the western EV value chain.” The deal comes as mining mergers and acquisitions have picked up in pace.

MARKETS

MARKETS

MARKETS

MARKETSUS Fed: Hold my rates

The Federal Reserve decided to skip a hike, keeping rates steady after 15 months of hikes. But don’t mistake it for dovishness. Officials signaled that more tightening is coming to cool inflation, and analysts now expect two quarter-point raises, or one half-point hike, before the year is out. Markets cheered the hawkish skip anyway, with the S&P 500 jumping to a 14-month high.

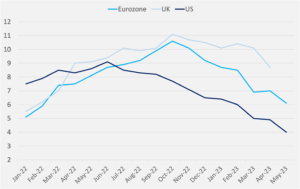

The Fed’s decision comes a day after the latest consumer price index data showed inflation slowing to 4% on the month in May, the lowest level in about two years. But core inflation, which excludes energy and food, is proving stickier: It rose 5.3% on the year, similar to preceding months so far this year.

No pause or skip in Europe

Meanwhile, across the Atlantic, the European Central Bank raised rates again, bringing the benchmark rate to a 22-year high of 3.5%. And another rate hike in July is “very likely,” says ECB President Christine Lagarde. While eurozone inflation is down from October’s record 10.6%, its current 6.1% is markedly higher than in the US. Policymakers are worried about the stickiness of elevated price pressures—and Beyoncé can’t shoulder all the blame.

Over in the UK, another hike is all but certain after chancellor Jeremy Hunt says the country has “no alternative” but to raise rates—especially after wage growth hit a record pace in the three months to April. Markets are now pricing in a peak of 5.71% for the benchmark rate by year-end, pushing to the pound sterling to a 14-month high.

US, UK, and eurozone monthly CPI, 12-month percent change

Source: US Bureau of Labor Statistics, Eurostat, UK National Office for Statistics

Toyota’s pivot

Toyota got off to a slow start in the EV race. Now it’s making a strategic pivot and hoping to make up lost ground. This week, the Japanese auto giant announced a plan to commercialize its breakthrough technology high-performance solid-state batteries by 2027/28, and to redesign its factories to slash production costs. Investors were happy: The company’s shares are up nearly 12% this week, and shareholders backed the board and rejected an activist push to compel greater transparency on the firm’s climate lobbying.

Toyota may also get a bit of a tailwind from the Bank of Japan’s decision to keep rates at ultra-low levels (-0.1% for short-term rates and a cap of 0% on 10-year bonds), despite inflation exceeding the central bank’s 2% target for 13 straight months. The BoJ’s move sent the yen to a 15-year low against the euro—potentially a boon to big Japanese exporters, like Toyota. And it doesn’t hurt that Tokyo just pledged nearly 1 billion USD in new subsidies for Toyota and other EV battery manufacturers.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSBringing trade defense tools to a gun fight

France wants the EU to use its new trade defense tools to hit back at Beijing’s unfair trade policies, especially China’s state-supported auto industry allowing it to flood European markets with cheap EVs. The European Commission says it’s “very much in favor” of an anti-dumping investigation, though France will need broad support from member states if it wants to see tariffs on Chinese EV imports.

But while Chinese carmakers no doubt enjoy unfair and distortive advantages thanks to Beijing’s industrial policies, focusing only on anti-dumping tariffs without seriously rethinking European industry’s big China footprint—not just in the auto business, but also strategic sectors like chemicals to aviation—will do nothing to improve the EU’s economic security.

(Photo by Tima Miroshnichenko/Pexels)