Italy is reckoning with Chinese corporate influence — but damage can be hard to undo, and interventions now can prove too little too late. Just ask Pirelli. Meanwhile, Saudi Arabia’s production cut sweetens business for some and slashes profits for others, Sequoia splits three ways, and China flirts with deflation. Plus: more West Coast port uncertainty.

CHINA’S CORPORATE TAKEOVER PLAYBOOK

Italy reckons with China’s corporate influence strategy

China has long eagerly eyed Italy’s strategic assets. It wanted to make investments in the ports of Genoa and Trieste. In 2012, Chinese machinery maker Shandong Heavy Industry Group bought a controlling stake in Italian yacht maker Ferretti; the Chinese company has since capitalized on that acquisition with Ferretti’s IPO in Hong Kong last year. In 2018, two Chinese state firms quietly took control of an Italian drone maker. And a Chinese industrial robot maker just unsuccessfully sought to transfer technology from its minority-owned Italian electronic components maker.

Most recently, China-East Resources Import & Export Co. reportedly tried to acquire an entire airport in Turin, in northern Italy. Some reports suggest that China would have used the airport to develop drones and aircraft. Luckily, the regional Piedmont government has rejected the bid.

Now, some who eagerly sold off stakes to Chinese buyers are experiencing seller’s remorse. Take Pirelli. ChemChina bought a 65% stake in the Italian tiremaker in 2015, then took it private. In 2017, Pirelli relisted; ChemChina now has a 37% stake in the firm. Fast forward to 2023: Pirelli’s CEO, the same one who secured the initial ChemChina investment, is pleading for the Italian government to block a power grab by the Chinese minority owner (now Sinochem following a merger), such as by curbing Sinochem’s voting rights or reducing its stake. The Italian government has until June 23 to decide on next steps.

It may be too little, too late. “If the Italian government decides to use the golden powers and stop the Chinese takeover, I don’t think Sinochem will cry foul over the loss,” notes the Italian journalist Giulia Pompili. “They already have everything they need. Rubber, materials, know-how.”

FACTORS

FACTORS

FACTORS

FACTORSSaudi Arabia makes a solo oil production cut

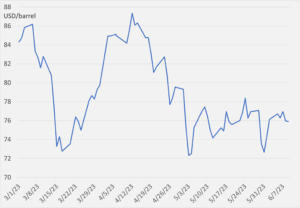

As the Saudi energy minister Prince Abdulaziz bin Salman puts it, the kingdom just handed out a “lollipop” to the world: a one million barrel-a-day production cut in July (and potentially beyond that) to bring “stability” to the market as crude prices continue to slide.

But the Saudi candy handout hasn’t sweetened oil prices quite yet. While prices rose early in the week on Riyadh’s solo cut, they are now on track for a second week of losses thanks to weak Chinese export data and strong output from US refiners.

In short, Saudi Arabia is pursuing a risky strategy: Its deep production cuts, putting the kingdom at a decade-low of nine million barrels per day, mean it could stand to lose lots of petroleum revenue unless prices rally. It’s a trade-off Riyadh appears willing to make as it seeks to support prices in the near-term and secure greater market control.

Source: Investing.com

Brent futures

Winners and losers from the oil output cuts

The surprise Saudi production curbs may be music to the ears of US shale producers. Riyadh’s solo cut comes after OPEC’s surprise supply cut announcement in April. It also coincides with OPEC+’s decision to extend existing supply cuts into 2024. Together, the market tightness could give the US energy industry longer-term price confidence to boost production.

Another winner: the United Arab Emirates, which was allowed under the OPEC deal to bump production by 200,000 barrels a day to 3.2 million from 2024. Meanwhile, Asian refiners are probably less happy: They now face higher crude prices and thinner refining margins.

Qatar sweetens its LNG deals

Just last November, Qatar secured a mega LNG deal with China’s Sinopec. Several months later, it inked another historic deal with China National Petroleum Corp for the liquified fuel.

Now, though, business is looking less effortless for Qatar. Competition from the US is heating up just as Asian LNG demand is falling on slowing economic activity in China and higher nuclear generation in Japan and South Korea.

According to Bloomberg, QatarEnergy offered more lenient payment deadlines than are typical in its long-term deal supply deal with Bangladesh. Qatar is also reportedly offering some Asian customers shorter and cheaper LNG contracts as it tries to seal more deals, particularly as US producers ramp up output and offer flexible terms.

The US needs more power lines

By one measure, the US must more than double the rate of transmission construction over the last decade, or risk squandering 80% of potential emissions reductions from the Inflation Reduction Act.

But last week’s debt ceiling deal didn’t score any victories for power line buildouts: there was no new streamlining of transmission project permitting, only a government study on whether the US should expand long-distance transmission (hint: yes, it should).

One solution is legislation: two recently introduced bills would incentivize power line buildouts with an investment tax credit, and speed up construction by giving the Federal Energy Regulatory Commission (FERC) authority over high-voltage power lines crossing multiple states. Another is to set minimum transfer requirements between regional transmission organizations, which advocates say are key to building more power lines.

MARKETS

MARKETS

MARKETS

MARKETSSequoia’s three-way split

The global venture capital giant Sequoia Capital is separating its China and US businesses, and spinning out its Indian and southeast Asian businesses into a third entity. This is, very clearly, a sign that ties to China increasingly create vulnerabilities for US financial players. At the same time, it could also be a way to secure workarounds to US regulations on Chinese investments: Will the new Sequoia China entity be able to invest without US oversight or regulation?

A pending question: will other VC firms similarly split off its China businesses? More generally, will we see large multinationals break up along geopolitical lines—and do the splits actually change the calculus for China’s strategic purposes? Do they help? HSBC, for example, last month defeated an attempt by its biggest shareholder—China’s Ping An Asset Management—split up the global bank.

China is flirting with deflation

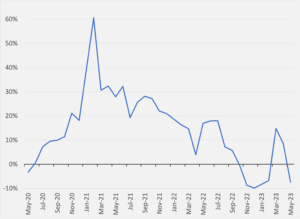

Chinese exports dropped by 7.5% in May on the year, far more than the 0.4% economists had predicted in a Reuters poll. Exports to the US fell 18%, while exports to Europe plunged 26.6%. That makes it look increasingly unlikely that China can depend on robust exports to revive its sluggish economy.

Meanwhile, China’s producer price index for May fell for the eighth consecutive month, dropping 4.6%—the steepest decline since February 2016. The factory gate deflation reflects weak demand and a slowing manufacturing sector. Consumer prices reflect a cooling economy, too: China’s CPI for May rose 0.2%, up from April’s 0.1% but missing a forecast 0.3%. With mounting risks of deflation—which can throttle growth and prove sticky—prominent Chinese economists are calling for interest rate cuts.

Chinese exports, year-on-year percent growth

Source: Investing.com

A mega agriculture trading merger?

The B of global agriculture trading’s ABCD, US grains merchant Bunge, is reportedly finalizing a deal to merge with Canadian grain handler Viterra (previously known as Glencore Agriculture). But the stock-and-cash deal could still fall apart even as it’s on track to be announced next week, according to Reuters.

Plus, it would still have to pass muster with antitrust regulators. If successful, however, the deal would further consolidate global agriculture trading and bring the newly combined Bunge-Viterra entity’s revenues more in line with leading player Archer-Daniels-Midland.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSCargo backlog at US West Coast ports

Over five billion USD worth of cargo at West Coast ports is currently at backed up: Unionized dockworkers deliberately slowed down operations as part of ongoing contract talks, which have hit a snag over wages. The National Association of Manufacturers is urging US president Joe Biden to intervene, especially as negotiations have dragged on and dockworkers and port operators appear no closer to a deal. That’s threatening further disruptions, with major implications for the US supply chain—not to mention complications for the Fed’s fight against inflation.

(Photo by Chanaka/Pexels)