This week brings a study in contrasts and conveniences. China gives global CEOs a warm welcome, but gives the US defense secretary the colder shoulder. At the same time, follow the money: It’s clear global investors are cooling on China. Meanwhile, Saudi Arabia is both frustrated with Russia’s pumping of cheap crude and happy to snap up cheap Russian diesel, Japan’s big wind power ambitions faces upstream dependencies, and competition heats up in cathodes and anodes.

THE SAUDI-SINO-RUSSO LOVE-HATE TRIANGLE

Riyadh, Beijing, and Moscow’s relationships of convenience and strategy

China has been the big winner from global energy market disruptions caused by the Russia-Ukraine war. It has gobbled up Russian oil at steep discounts, made handsome profits by diverting LNG from the domestic market to foreign buyers, and deepened its energy relations with Saudi Arabia to secure crucial supplies of oil and feedstock.

But while Beijing, Moscow, and Riyadh have their own strategic reasons to deepen trade with one another, not everyone is happy. The Wall Street Journal reports that tensions are rising between Saudi Arabia and Russia over Moscow’s continued production of cheap crude, undermining Saudi-led OPEC’s efforts to prop up oil prices.

Still, underlying the fact that the Saudi-Russo-Sino triangle is in part a marriage of convenience, Riyadh’s displeasure with Moscow hasn’t stopped the kingdom—a leading crude exporter—from buying cheap Russian diesel to fatten its refining profits, according to shiptracking data.

And tensions over cheap crude aside, the Saudi-Russo-Sino trio recognize that the larger goal is to stand up a formidable bloc to challenge the G7 and the West. To that end, the Russian foreign minister met with the China’s deputy foreign minister this week to push for expanding the BRICS bloc to include Saudi Arabia, Iran, and the United Arab Emirates.

FACTORS

FACTORS

FACTORS

FACTORSExxon Mobil doubles down on its China bet

Exxon is developing a multi-billion dollar petrochemical complex in China as it eyes a big expansion in the country. The US energy giant is betting on China’s appetite for petrochemicals, which are critical for making plastics, resins, and fibers—and demand growth for which is expected to far outlast that of oil.

Yes, geopolitical tensions could derail Exxon’s China strategy. But the company’s move shows that the appeal of China’s market endures.

Japan’s wind power ambitions

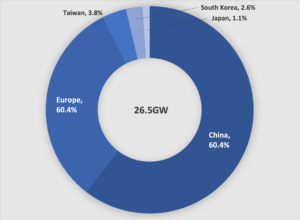

The Japan Wind Power Association just set an ambitious target: It wants wind to provide one-third of the country’s electricity by 2050. That means rapidly scaling up capacity to 140 gigawatts (GW) from under 5 GW now. That’s far more than the current government goal of 45 GW of offshore wind by 2040.

The wind power body’s target comes as global wind turbine order intake hit a record in the first quarter, growing 27% on the year. While increased wind power capacity means less reliance on often volatile fossil fuel energy markets, it also means increased dependence on Chinese upstream inputs. Consider, for example, that the production and processing of heavy rare earths needed for permanent magnets in wind turbine motors are monopolized by China.

Global offshore wind turbine manufacturing capacity, 2021

Source: Global Wind Energy Council

South America’s copper push

Peru is expected to lose its crown as the world’s second-largest copper producer to the Democratic Republic of Congo by 2027, as social and political instability have weighed on production and investment in recent years. But Peru is still drawing major players: Reuters reports this week that Glencore plans to invest 1.5 billion USD to expand its Antapaccay copper mine, one of the country’s largest. And remember that China has a big footprint in both Congo’s and Peru’s copper projects.

Meanwhile, Argentina wants in on the copper rush. The country doesn’t currently produce significant amounts of copper, but wants to be a global top 10 producer by 2030. That will require significant investment just as the country grapples with heightened macroeconomic woes. Companies there are trying, though: A group of them are launching a “copper board” to push for 22 billion USD in investments, and tax deals that will help projects get online faster.

MARKETS

MARKETS

MARKETS

MARKETSBeijing rolls out the red carpet for global CEOs…

China pulled out all the stops for Elon Musk’s visit to the country this week. The Tesla CEO met with the Chinese foreign, commerce, and industry and technology ministers, and was treated to an elaborate dinner with the CEO of battery giant CATL.

The rock star welcome stands in stark contrast to Beijing’s rebuff of Washington’s request for a meeting between their defense chiefs. Plus, Beijing got to claim that Musk said he opposes decoupling, and sees the US and China as two “conjoined twins.” (No one mentioned, though, that it’s typically regarded as a safer bet to separate conjoined twins earlier rather than later.)

Musk’s visit—along with recent trips by other big CEOs like JP Morgan Chase’s Jamie Dimon, Starbucks’ Laxman Narasimhan, and GM’s Mary Barra, plus Apple’s Tim Cook and Pfizer’s Albert Bourla in March—are burnishing Beijing’s narrative that the country is open for business and not in the least hostile to foreign firms.

But it’s certainly not China’s priority to help foreign companies thrive in its home market. Just look at the dwindling Chinese market shares of foreign automakers. To wit: Mitsubishi is extending a production suspension in China as it struggles from local competition—and has to pay a hefty penalty to its local joint venture partner. Meanwhile, the Chinese ministry of commerce is rolling out new measures to help further cement China’s EV export dominance.

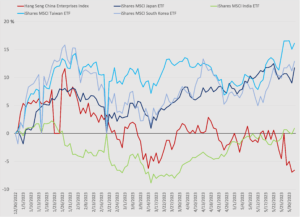

…but global capital is leaving China

While foreign CEOs flock to China, global capital is leaving China in droves. The Hang Seng China Enterprises Index is down some 20% from its recent January peak, while key stock indices in Taiwan, Japan, South Korea, and India have climbed to record highs. According to HSBC data, global fund allocations for China have retreated to October levels, and local fund sales last month fell to their lowest since 2015.

Even as global capital seeks out alternatives to China, Chinese capital is chasing global targets. The Financial Times this week documents how Chinese state-backed funds are pouring hundreds of billions of dollars into western economies through investments in western private equity funds—and in turn gaining indirect stakes in companies in strategic sectors while flying under the radar of regulatory scrutiny.

Year-to-date percent change of major Asian stock indices

Source: Investing.com

Competition heats up in the cathode and anode space

General Motors and South Korea’s Posco Chemical are teaming up to build an EV battery materials plant in Quebec, with the Canadian and provincial government putting up 300 million Canadian dollars (223 million US dollars) to fund about half of the project’s costs. The plant will produce cathode active materials like processed nickel and lithium, which make up about 40% of the cost of a battery.

It’s all part of an effort to kick start a North American EV battery supply chain. But that task faces formidable challengers like Chinese giant Ronbay Technology, which dominates the global cathode market. Ronbay is currently looking at potential factory sites in North America and Europe, and is also ramping up capacity in South Korea—shipments from which the company believes won’t get slapped with US Inflation Reduction Act tariffs.

Meanwhile, Chinese anode maker Putailai New Energy Technology last month announced a 1.3 billion USD investment to build Europe’s largest anode factory in Sweden. The westward factory expansion of Chinese battery suppliers will help lower costs for EV producers. But it also makes it harder for battery makers in the west to compete against Chinese counterparts.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSWheat troubles

Wheat markets just can’t catch a break. China is rushing to salvage its damaged wheat crops, which have suffered from heavy rains and flooded fields. Gaza’s wheat harvest is also shaky thanks to a late winter and unreliable rains. Meanwhile, Ukraine’s wheat farmers have to contend with the risk of unexploded munitions as they tend to their fields. Plus, Moscow is once again threatening to block the Black Sea grain export deal.

(Photo by Burak The Weekender/Pexels)