Big Oil is here to stay, for now—but it’s hedging its bets with investments in Big Shovel, while Big Auto wants minerals in spades. Meanwhile, Asia gobbles up Russian fuels, China bans Micron as Nvidia soars, and the US economy faces tough choices. Plus: How a drying Panama Canal could derail global LNG markets.

BIG OIL, BIG SHOVEL, AND BIG AUTO WALK INTO A BAR…

Everyone wants in on critical mineral mining

The coda to Big Oil won’t be written anytime soon. But Big Oil certainly doesn’t want to miss out on Big Shovel.

This week brought news of Exxon Mobil buying drilling rights to 120,000 acres of lithium-rich land in Arkansas, where the oil major is expected to leverage its expertise in drilling for, piping, and processing liquids to extract the battery metal from underground brine.

Other oil and gas companies are also hedging their bets as the world slowly shifts from a fossil fuel-intensive energy system to a critical minerals-intensive one.

The Argentine state oil company YPF is exploring lithium deposits in the country’s Catamarca province, and has plans for a lithium-battery manufacturing plant. Similarly, Occidental Energy subsidiary TerraLithium is working on extracting lithium from underground brine, while Pioneer Natural Resources is looking at pulling lithium out of oil field wastewater.

Of course, Big Oil will remain loyal to its Big Oil roots—for now. Global upstream oil and gas spending surged by 140 billion USD in 2022 and 2023 over the previous projected two-year total before the Russia-Ukraine war broke out. And fossil fuels will certainly still be in demand to make plastics and petrochemicals even after a full transition to a renewables-powered grid. Chevron understands that: It is shelling out 76 billion to buy shale producer PDC Energy to boost production, capital expenditures, and cash flow in the US.

FACTORS

FACTORS

FACTORS

FACTORSBig Auto does business with Big Shovel

Then there’s Big Auto, which is desperate to secure battery mineral supplies from Big Shovel. At its latest investor day, Ford announced a string of lithium deals with miners, including the US-based Albemarle and Chile’s minority-Chinese-owned SQM. The automaker’s other supply agreements are with Utah-based Compass Minerals, California-based EnergySource Minerals, and Canada’s Nemaska Lithium.

Another development that will help Big Auto: a US-Australia pact to coordinate policies and investment in critical minerals, with president Joe Biden pledging to push for Australian minerals to be treated as a “domestic source” under the US Defense Production Act, and to allow Australian miners to tap Inflation Reduction Act tax incentives.

Canberra is thrilled: Its resources minister called the deal “historic,” adding that Australia’s potential to “become a critical minerals and renewable energy superpower cannot be underestimated.”

Congo wants a bigger slice of the minerals resource pie

Over in the Democratic Republic of Congo, the government is looking to increase its stake in its copper and cobalt joint venture with Chinese firms to 70% from 32%. According to Reuters, the DRC sees the current JV structure as “lopsided,” leaving the country shortchanged in the true value of the resources that are being mined and exported. The JV, called Sicomines, is currently minority owned by Congolese state mining company Gecamines and dominated by Chinese companies Sinohydro and China Railway.

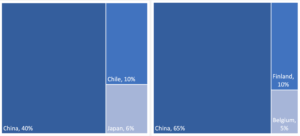

Of course, even if Congo manages to negotiate a large stake, the reality is that China still dominates processing: The country commands 65% of global cobalt processing capacity, and 40% for copper. China’s share of battery manufacturing is even larger.

Still: Could this China-Congo friction be a chance for the US to swoop in?

Processing capacities for copper (L) and cobalt (R)

Source: International Energy Agency

Asia is gobbling up Russian oil

Global oil flows are getting majorly rejigged as India and China snap up cheap and sanctioned Russian oil spurned by western nations.

Data from Kpler show that China and India sourced over 30% of their combined oil imports from Russia, Iran, and Venezuela in April, up from 12% last February. Concurrently, their oil purchases from West Africa and the US have fallen significantly. Meanwhile, record high temperatures in Asia mean that countries there are increasingly turning to Russian oil, gas, and coal, to meet energy demand.

Russia is all too happy to sell. It needs the revenue. And deepening reliance from its customers means it can use energy as leverage to pressure countries, including India, to undermine financial sanctions against Moscow.

MARKETS

MARKETS

MARKETS

MARKETSChina bans Micron. Now what?

Less than two months after China’s cyberspace regulators launched an investigation into Micron, Beijing has banned some of the US memory chip maker’s products over their “major security risk.” The obvious takeaway: China will readily weaponize its cybersecurity law against foreign companies.

Shares of South Korea’s SK Hynix and Samsung Electronics rallied—and for good reason, given that Seoul has indicated that it won’t stop its domestic firms from filling the gap left by Micron. Chinese chipmakers including Hua Hong Semiconductor and SMIC rallied, too. CXMT, another memory chip maker, is preparing for an IPO, and likely also stands to benefit from the Micron restrictions.

Meanwhile, China is pressuring the Netherlands to drop its export restrictions on lithography machines, having previously threatened the Dutch with retaliation if they block advanced chipmaking equipment. Japan is also gearing up to curb sales of chipmaking machines to China from July. Expect Beijing to dial up the temperature on Tokyo, too.

Nvidia soars

A blockbuster earnings report and sales outlook sent Nvidia shares surging some 28% on Tuesday, catapulting the maker of chips that power AI towards a trillion-dollar market capitalization—a vaunted club whose membership includes Apple, Microsoft, Alphabet, Amazon, and Saudi Aramco.

That’s exciting. But risks also lurk: Nvidia relies on China for a significant chunk of its revenue. And if Beijing is ready to take aim at Micron, Nvidia could also be in the line of fire.

Unsurprisingly, then, Nvidia CEO Jensen Huang has warned of “enormous damage” to US tech if chip export restrictions escalate. And more generally, US chip companies are pressing Washington for looser guardrails so they can continue expanding their business in China while benefiting from CHIPS act incentives. Left unsaid: the potential damage from enabling China’s technological ambitions on the back of foreign technology.

Still-hot economy, still-elusive debt-limit resolution

By many measures, the US economy continues to look robust: Consumer spending jumped 0.8% in April from the previous month, adding to a 13-month high in business activity this month and a stellar jobs report last month. Again, this puts the Fed in a tough spot regarding whether to hike or pause.

Even tougher is hashing out a seemingly elusive debt-ceiling deal. President Biden says a deal is “very close”—only about 70 billion dollars of discretionary spending away from an agreement, according to Reuters. Also very close is the default date: June 5, says Treasury secretary Janet Yellen.

Germany’s malaise

We’ve already seen signs of sputtering industrial momentum in Germany. Now the EU’s largest economy has slid into an outright recession, with the economy shrinking by 0.3% in the first quarter following a 0.5% contraction in the final quarter of 2022. High prices and muted consumer spending have weighed on growth, and while overall inflation is slowing, core inflation excluding food and energy shows few signs of letting up.

Another worrying data point: an 11.3% drop in German exports to China in the first four months of the year—an indicator of a slumping industrial sector as German companies are hit with a double whammy of shrinking market share in China and high energy prices at home.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSThe Panama Canal dries up

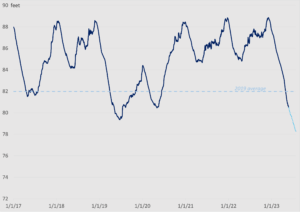

The Panama Canal faces disruptions thanks to extreme weather. A drought has caused low water levels in Lake Gatun, at the center of the canal, forcing authorities to lighten vessels’ cargo loads and limit their draft, or how vessels settle in the water.

The restrictions will likely increase shipping rates just as shipping demand picks up for the summer. They could also have knock-on effects on global energy markets: LNG carriers are highly reliant on the canal, and bottlenecks could slow US LNG exports to Asia in the coming years.

Elsewhere, droughts are poised to wreak large-scale havoc: Disruptions to the Hindu Kush-Himalayan water system are threatening the energy security of 16 Asian countries; South America is buckling under a multi-year dry spell; and the drought-stricken Horn of Africa urgently needs billions in aid.

Historical and projected water levels at Lake Gatun, Panama Canal

Source: Panama Canal Authority

(Photo by Michael D. Camphin/Pexels)