Measuring US supply chains’ exposure to China—and why a secure industrial strategy requires investments in both upstream and downstream nodes. Meanwhile, US LNG dominance rises, Sinopec and Qatar Energy sign another big contract, and China’s imports of semiconductor making equipment from the Netherlands soars. Plus: Australia shuts four key ports following a cyber breach.

UPSTREAM EXPOSURE, DOWNSTREAM DEPENDENCE

Securing supply chains means addressing all critical nodes

How exposed are US supply chains to China? A new working paper published by the National Bureau of Economic Research suggests the exposure is far greater than it would first seem.

“[T]aking account of the Chinese inputs into all the inputs that American manufacturers buy from other foreign suppliers – what we call look through exposure – we see that US exposure to China is almost four times larger than it appears to be at face value,” write the economists Richard Baldwin, Rebecca Freeman, and Angelos Theodorakopoulos.

That kind of “hidden exposure,” as the authors dub it, is something that we pay close attention to. After all, any technology, no matter how cutting-edge, is only as good as its weakest upstream link. Case in point: US-made EVs dependent on Chinese batteries.

The reverse also holds true: while a secure industrial strategy starts at the upstream, developing a upstream asset in the US (say, a critical mineral deposit) will do little to cut China dependence if China dominates downstream processing—in which case the minerals find no other significant buyer other than China, which in turn captures most of the value by turning the minerals into high-purity metals.

Case in point: a splashy profile this week in the Wall Street Journal of a 37 billion USD rare earth mine in Wyoming. Left unexamined: does the US have sufficient capacity to process the rare earth ores? Note that in 2022, 50% of China’s rare earth imports by quantity came from the US. Discoveries of rare earth deposits invariably grab headlines. But without sufficient processing and downstream manufacturing know-how and capacity, the West will only be feeding China’s raw materials appetite.

FACTORS

FACTORS

FACTORS

FACTORSThe rise and rise of US LNG…

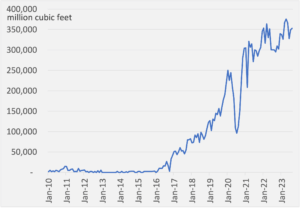

American LNG is becoming ever more important to the global energy markets as Europe turns away from Russian supplies, and as potential disruptions loom over Strait of Hormuz, a vital fuel transit chokepoint as a result of the Israel-Hamas war.

Meanwhile, whipsaw volatility in Europe’s gas benchmark, the Dutch Title Transfer Facility (TTF), means European utilities are venturing further upstream and signing US LNG sales and purchase agreements. That increases demand for US LNG—and increases the significance of US LNG export facilities set to come online next year.

US LNG exports

Source: US EIA

…and China buys more Qatari LNG

Meanwhile, China’s state-owned Sinopec on Nov. 4 signed a new 27-year LNG supply contract with Qatar Energy. Under the deal, the firms will cooperate on phase two of Qatar’s North Field expansion project, which will supply 3 million metric tons of LNG per year to Sinopec. The deal comes after a first 27-year deal inked between Sinopec and Qatar Energy last November, and follows a similar 27-year LNG deal that China National Petroleum Corp. signed with Qatar Energy in June.

The deals aren’t just about getting fuel. For one, the larger imports help China take a more active role in global LNG trading, which in turn gives it greater sway in international pricing. The imports also generate business opportunities for Chinese shipping companies. Figures from the China Association of the National Shipbuilding Industry show that Chinese shipbuilders accounted for nearly 50% and 70%, respectively (link in Chinese), for newly constructed ships and new ship building orders in the first seven months of 2023.

Albemarle’s lithium warning

The world’s largest lithium producer, US-headquartered Albemarle, is warning that tumbling lithium prices could mean it will lose market share to Chinese competitors. Prices of lithium have dropped over 70% this year, weighing on Albemarle’s income and forcing it to pursue a more conservative strategy.

Meanwhile, Chinese competitors are pushing ahead with development plans. And falling lithium prices could also mean a consolidation in the Chinese market (link in Chinese), eliminating smaller players while leading companies cut costs, raise efficiencies, and grab market share.

MARKETS

MARKETS

MARKETS

MARKETSForeign firms are yanking their profits out from China

A Wall Street Journal analysis of Chinese data shows that foreign companies pulled more than 160 billion USD in total earnings from China during six successive quarters through the end of September. The outflow underlines China’s weakening attraction for foreign capital—even as Beijing tries to drum up excitement among foreign executives.

Still, despite the increasing risks of doing business in and with China, US chipmakers and other foreign firms have flocked to China’s import expo. US semiconductor firm Micron Technology—which Beijing said it would ban, then indicated that it would warmly welcome—attended the fair for the first time.

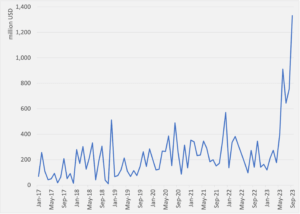

China’s soaring Dutch lithography machine imports

Chinese exports fell for a sixth straight month in October amid tepid global demand, shrinking 6.4%. Chinese imports, meanwhile, unexpectedly grew 3%, breaking a seven-month streak of declines and hinting at recovering domestic demand.

An interesting picture emerges from looking at China’s imports from specific trading partners: in the first ten months of 2023, imports from the EU fell 2.1% year-on-year, but imports from the Netherlands jumped 29.3%. Driving that increase are imports of Dutch semiconductor-making equipment: China imported 1.33 billion USD of the goods in September, up over nine times over the same period in 2022.

Chinese imports of semiconductor-making equipment from the Netherlands

Source: Chinese General Administration of Customs

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSAustralian ports hit by cyberattack

Australian authorities closed four of the country’s major ports, following a cyberattack targeting ports operator DP World Australia. The intrusion was detected on Friday morning (Nov. 10), and officials have convened a crisis meeting to coordinate a national response to what the government called a “nationally significant cyber incident.” While DP World says it’s working “around the clock” to restore normal operations, the incident is expected to disrupt goods transport for days.

(Photo by Tom Fisk/Pexels)