Welcome to a/symmetric, our weekly newsletter. Each week, we bring you news and analysis on the global industrial contest, where production is power and competition is (often) asymmetric.

This week:

- China’s AI factory boom: The country is building a lot of what it calls intelligent computing centers. Could it eventually dominate computing infrastructure? And what would that mean for the global AI competition?

- Weekly Links Round-Up: India and China EV partnership, China’s massive petrochemicals projects, geopolitical shifts and shocks, and scrutinizing capital flows.

Nvidia wants ‘AI factories.’ China is building lots of them.

Nvidia CEO Jensen Huang has been talking a lot about “AI factories.” Here he is at the chip firm’s annual developer conference this week:

“There’s a new Industrial Revolution happening in these [server] rooms: I call them AI factories. The raw material that goes in is data and electricity. What comes out of it is data tokens. The token is invisible and will be distributed all over the world. It’s very valuable.”

Industry observers in China took notice. The “AI factory” Huang spoke of “is precisely the intelligent computing centers that have been extremely popular in China in the past two years,” writes Chanyejia (“The Industrialist”), a publication focused on the industrial internet.

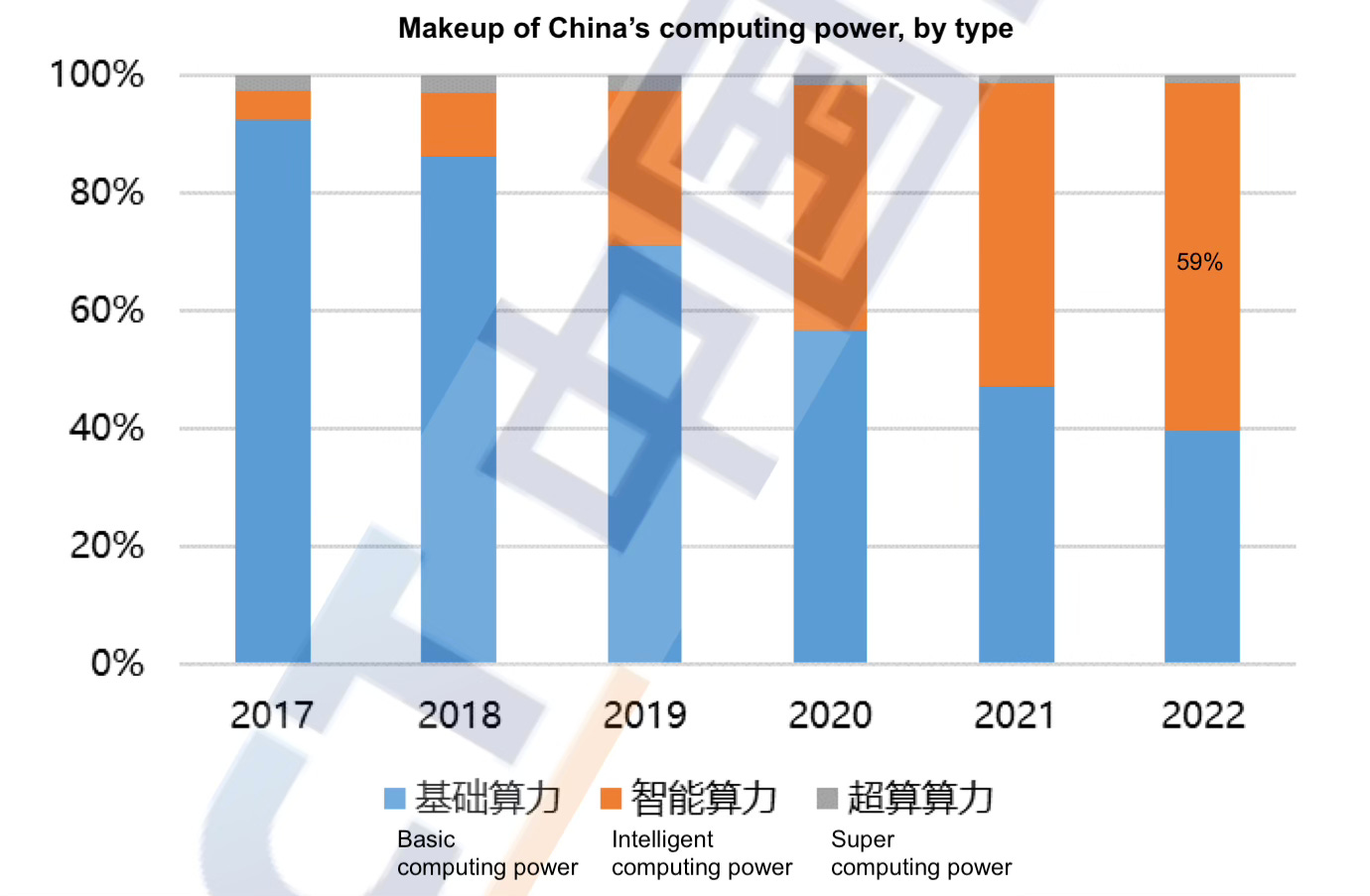

Source: China Academy of Information and Communications Technology; translations and annotations added

China’s ‘AI factory’ boom

China is building a lot of intelligent computing centers. Some are government-led; others are spearheaded by firms like Alibaba, Tencent, Baidu, and SenseTime. As of March 2023, over 30 cities nationwide were building or planning to build one, according to state media.

Intelligent computing centers differ from China’s existing network of around a dozen supercomputing centers: the latter is geared towards scientific research and innovation, while the former is positioned specifically for “promoting AI industrialization, and industrial AI,” per a 2020 guide published by Beijing.

The Chinese government views intelligent computing centers as a new form of public computing infrastructure. And China is good at building lots of infrastructure: think high-speed rail network, 5G base stations, and ultra-high voltage transmission lines. Some of that infrastructure is wasteful and unproductive: think empty airports and bridges to nowhere. But investing in the right kind of infrastructure at the right time and at sufficient scale can grant China greater influence over global industry—even if this isn’t fully reflected in GDP or productivity growth.

Dominance in computing infrastructure

At the most basic, China’s “AI factory” building boom will push the country towards its goal of growing national computing power by more than 50% by 2025.

More speculatively, one might plausibly imagine a world in which China builds so much computing capacity that it dominates global AI computing infrastructure. Or as Kyle Chan of the newly launched High Capacity put it:

“If China does ‘computing infrastructure’ the way it does other kinds of infrastructure, then we’re going to see one of those charts where China eclipses the rest of the world combined in a decade.”

In turn, this infrastructural strength could translate to greater leverage over not just data flows, but also—in an increasingly connected environment where cars, port cranes, and industrial robots are all linked up to the cloud—how that data shapes the physical environment as well as our interactions with it.1

AI factories, AI strategies

All this leaves us with another question: what does China want to do with all the “AI factories” it’s building?

We have previously noted that large language models are just one aspect of AI, and that China’s view of the AI industrial chain goes far beyond the likes of ChatGPT and Bard. Supposing China lags the leading edge in LLM development, could it develop sufficient capacity elsewhere along the AI industrial chain—like building AI factories or deploying industrial AI applications—to gain a competitive edge?

This is of course a crude measure. But it may suggest that Beijing sees greater strategic payoffs from prioritizing the industrial deployment of AI over closing its gap with foreign LLMs.

Weekly Links Round-Up

️ India and China team up to sell EVs in India. A joint venture between Indian conglomerate JSW Group and Chinese-owned British brand MG Motor plans to sell 1 million EVs by 2030 and corner one-third of the Indian market. The partnership helps India ramp up production, while China’s state-owned SAIC gets a foothold in an international market. And as Kyle Chan notes, it just might serve India’s EV ambitions well for it to take a page from China’s industrial playbook. (Reuters, High Capacity)

️ China’s chemical mega projects are swamping global markets. The country’s oil-to-chemical complexes are churning out aromatics in vast quantities. Aromatics are a type of petrochemical, and include benzene, which is a starting point for products like nylon and polystyrene. “Older chemical plants, particularly in Europe and Japan, have been closing in the face of the new Chinese competition,” writes Alexander Tullo. (C&EN)

️ Hedging for shocks, positioning for shifts. Firms, investors, and governments need to manage exposure geopolitical risks while looking ahead for geopolitical shifts, writes David Skilling. “Unlike the Cold War, the current version of geopolitical rivalry involves full-spectrum strategic competition – with economic, financial, and technology flows as core domains.” (small world)

️ Scrutinizing capital flows. Several newly introduced bipartisan House bills will put a spotlight on US investors’ money headed to China—where, according to some lawmakers, those funds risk supporting Beijing’s strategic goals and military-industrial capabilities. One of the proposed bills would bar Chinese companies from US index funds. (Pensions & Investments, CNBC)

(Photo by Taylor Vick on Unsplash)