Global investments in critical minerals are booming, but the midstream processing segment is still dominated by China—which in turn is diversifying its upstream supplies and intensifying competition over mining assets worldwide. Meanwhile, Europe’s industrial natural gas use falls, China muscles into LNG re-exports, and Germany’s new China strategy grapples with asymmetric dependencies. Plus: BYD and Tesla eye India.

THE MISSING MIDDLE OF CRITICAL MINERALS

Mining gets more diversified, processing gets more concentrated

Two key reports published this week offer snap shots of the global critical minerals landscape. The outlook is both encouraging and worrying.

In its inaugural market review of the sector, the International Energy Agency finds a big uptick in global investments in critical minerals: an increase of 30% in 2022, following a 20% jump in 2021. China-based companies led the surge, nearly doubling their investment spending last year.

But while upstream mining projects grow more diversified, “the world has not yet successfully connected the dots to build diversified midstream supply chains,” IEA notes. The pipeline for refining projects makes this clear: China holds nearly half of planned lithium chemical plants, and Indonesia (where Chinese companies have a dominant presence) has almost 90% of planned nickel refining facilities, according to IEA.

The International Renewable Energy Agency makes a similar observation in its new report: mineral processing is even more geographically concentrated than mining, and “any country’s dominance in metallurgy poses significant challenges for resource security and geopolitical dynamics.”

China, for example, controls 100% of global processing capacity for graphite; 100% and 88% for the rare earths dysprosium and neodymium, respectively; and 58% for lithium. And it’s pushing to set up processing facilities abroad, too: Chinese automaker BYD is investing 620 million USD in a massive industrial complex in Brazil that will process lithium and iron phosphate.

In turn, given its grip on refining and processing, China is pushing to diversify its raw material supplies—and intensifying competition for mining assets worldwide.

FACTORS

FACTORS

FACTORS

FACTORSIndustrial Europe is using less natural gas…

High natural gas prices have pulled down Europe’s industrial natural gas use, according to Reuters’ analysis of Eurostat data. The EU’s seven largest gas consuming countries consumed 5 million terajoules in the first five months of the year, down from an average of 5.7 million terajoules in the same period in the decade of 2021. That could have significant long-term implications for Europe’s industrial base.

For now, Europe’s gas prices are falling on weak demand. But supply uncertainty can push prices upwards again. A particularly cold winter could draw down inventories. And geopolitical volatility has become a disruptive constant: Politico reports that Kyiv is unlikely to renew a gas transit deal that has allowed Russian gas to reach the EU using pipelines crossing Ukraine. A complete cut-off could leave Europe with a shortfall in 2025 before new supplies from US and Qatar come online.

…while China gets into the LNG re-export game

Meanwhile, China—the world’s second largest LNG importer last year, after Japan—has capitalized on re-selling the liquified fuel to desperate buyers in Europe, and making handsome profits to boot.

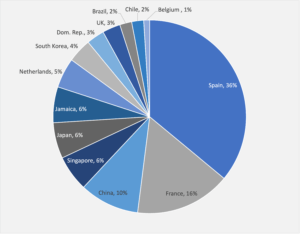

The International Gas Union’s latest World LNG Report illustrates the dynamic more clearly: while China did not re-export any LNG at all in 2021, it became the world’s third largest re-exporter last year, accounting for 10% of all re-exported volumes (after Spain at 36% and France at 16%). Europe was the largest recipient, loading 61% of total re-exports.

LNG re-exports loaded by re-loading market in 2022

Source: International Gas Union

Traders spurn Russian metals

The trade group European Aluminium is considering lobbying the EU for sanctions on Russian aluminum, but would stop short of calling for targeting Russian aluminum giant Rusal, Reuters reports. The attempt at a delicate balancing act highlights the global spread of Rusal’s operations, and the challenge of disentangling them from supply chains.

Meanwhile, data from the London Metal Exchange show the market effects of traders opting for alternatives to Russian metals. Available stocks of Indian-origin aluminum in LME-approved warehouses have dropped to 18% in June from 50% in January, while the share of China-sourced copper fell to 8% last month from 40% in May.

MARKETS

MARKETS

MARKETS

MARKETSGermany’s China strategy

The German government unveiled its first ever strategy on China, which it described as being simultaneously a “partner, competitor and systemic rival.” Berlin’s aims are clear: “de-risking is urgently needed,” the strategy said, noting that Germany must “change [its] approach to China” because “China has changed.”

How Berlin intends to achieve those goals, and what trade-offs it’s willing to make and on what timescale, less so. It will also need buy-in from Germany Inc., which currently isn’t convinced by the de-risking agenda: the Mercedes-Benz CEO said in May that cutting ties with China would be “unthinkable for almost all of German industry.”

While short on explicit policy measures, Germany’s new China strategy does explicitly reckon with Beijing’s asymmetric strategy: “China’s economic strategy aims to make it less dependent on other countries, while making international production chains more dependent on China,” it said. Recognizing that asymmetry is step one. Step two is devising a plan to counter it.

Foxconn dumps India’s Vedanta…

India’s semiconductor ambitions were dealt a setback this week after Foxconn pulled out of a 19.5 billion USD joint venture with Indian metals-to-oil conglomerate Vedanta. The Taiwanese contract manufacturing giant, best known for assembling iPhones and which has been pushing to expand into the semiconductor business, didn’t give reasons for bailing on the partnership. Vedanta says it can turn to other partners to establish India’s first foundry.

India’s technology minister sounded an upbeat note, saying the Foxconn-Vedanta split “doesn’t affect India’s semiconductor program.” Plus, major US companies have invested in India’s chip industry recently: last month, both Micron and Applied Materials said they build major facilities in the country. And Foxconn is still in talks with India to potentially build a semiconductor plant in Gujarat state, according to Reuters.

…while BYD and Tesla wants to make EVs in India

The world’s two largest electric vehicle makers are both eyeing India as the next manufacturing and export base for EVs.

China’s BYD, which last year overtook Tesla in terms of total sales of battery electric and plug-in hybrids, has submitted a 1 billion USD investment proposal to build a EV and batteries factory in joint venture with a local company. BYD’s push into India would give the company a foothold in all major global auto markets other than the US (where it’s taking a slow and cautious approach).

Rival Tesla, which still leads global sales in pure electric vehicles, is meanwhile in talks with the Indian government to set up a factory to produce half a million EVs in India annually.

Cooling inflation, looming deflation

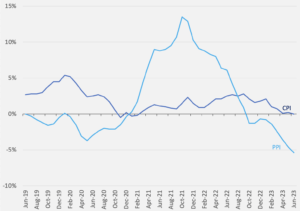

US consumer inflation is finally cooling down. Prices rose 3% in June year-on-year, the smallest increase since March 2021 and down significantly from 4% in May. A caveat, however: month to month, the CPI ticked up 0.2% last month versus 0.1% the month prior.

In any case, signs of slowing inflation have traders betting that the Fed will make this month’s rate hike the last one in a while. Inflation’s easing has also sent the dollar tumbling. That could potentially help cool prices in Europe and elsewhere as dollar-dominated energy, commodity, and food prices get cheaper as a result.

Over in China, risks of deflation keep growing. Consumer inflation fell to 0% in June from a year earlier, hitting a 28-month low. Meanwhile, producer prices feel at their fastest rate since December 2015, sinking 5.4%.

China CPI and PPI, year-on-year change

Source: Investing.com

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSOne strike over, another strike beckons

Canada’s 13-day West Coast ports strike ended on Thursday with a tentative four-year deal. The Canadian labor minister said disruption has been “significant;” ramping back up to clear vessel and container backlogs is expected to take weeks. But it’s no time to take a logistics breather yet: a 10-day United Parcel Service strike now looms in the US, and could become one of the costliest work stoppages in US history.

(Photo by Tom Fisk/Pexels)