Gallium and germanium stole the headlines this week. The even bigger headline, in our view: China’s asymmetric play underlines the importance of investing in upstream resources. Meanwhile, Europe dubs aluminum a critical raw material, Moderna takes a chance of the China market, and Toyota claims a battery breakthrough. Plus: what to make of news about mineral deposit discoveries.

CHINA FLEXES ITS UPSTREAM LEVERAGE

Beijing applies its asymmetric playbook to gallium and germanium

This week’s big news is China’s decision to restrict exports of gallium and germanium, two strategic metals used in semiconductors, defense technologies, and renewable energy products.

To be sure, Beijing hasn’t (yet) banned exports of the metals. Beginning August (link in Chinese), Chinese sellers will have to submit certificates of end use and end users to apply for a dual-use export license from the ministry of commerce. That gives the Chinese government greater discretion on which foreign buyers can obtain the metals, and in what quantities.

And China needs to balance trade-offs, too: crimping gallium and germanium too much could constrain the availability of chips for EVs, in turn limiting EV production and concurrent rare earth magnet demand, which would hurt China’s magnet industry just as global demand is taking off.

For now, it’s unclear how the curbs will ripple through supply chains. The US primarily sources gallium from China. The Semiconductor Equipment Association of Japan says it’s difficult to know if this will cause shortages. Taiwan’s TSMC and Dutch-based NXP Semiconductors say they don’t foresee direct impact. Dowa Holdings, the world’s top producer of high-purity gallium, says it’s investigating.

One thing is clear, though: China has built up asymmetric control over upstream nodes. That gives China outsized leverage over supply chains, even in industries where they do not currently dominate higher-value-add, downstream segments.

Plus, China has proven capable of turning its upstream influence into total dominance. Take rare earths: China’s 2010 ban on rare earth exports roiled global markets, sending prices of the metals skyrocketing before they crashed—forcing non-Chinese producers into bankruptcy. That suited China just fine. Over time, it built up near-total control of midstream processing and downstream magnet-producing capacities. In fact, it now snaps up rare earth raw materials from abroad.

The big lesson? Industrial power is built on upstream foundations.

FACTORS

FACTORS

FACTORS

FACTORSThe global LNG trade boom

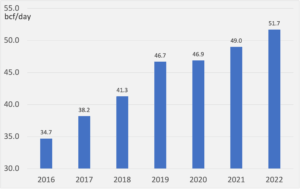

The US has a major upstream point of leverage of its own: natural gas. Global LNG trade volumes set records last year, hitting a high of nearly 52 billion cubic feet a day, driven by additions to liquefaction capacity in the US. American LNG export grew 16% over 20221, the largest increase among all LNG exporters.

One implication of the American LNG export bonanza: China and Europe are racing to secure long-term supply deals for the fuel, and together accounted for nearly 40% of US LNG supply contracts signed between 2021 and late June 2023. The purchase agreements help finance expanding LNG projects in the US, but also give China bigger sway over the global LNG market as a major buyer. Just this week, China’s Zhejiang Energy signed a 20-year deal for LNG with the Texas-based Mexico Pacific.

Global LNG trade volume, annual

Source: US Energy Information Administration

“Market certainty” for clean hydrogen

America’s clean hydrogen industry will soon get a major boost. The Department of Energy announced a program to invest up to 1 billion USD to guarantee sales of clean hydrogen, providing “market certainty [to] unlock private investment.”

Creating demand for a nascent industry is often key to getting it off the ground: while the government has already committed 7 billion USD to build clean hydrogen hubs nationwide, private companies need sales locked in to justify the necessary big ticket investments.

There will be challenges. One is water scarcity. Nearly a third of the 33 projects shortlisted as potential hydrogen hubs are in water-stressed regions, according to energy consultancy Rystad, including the drought-hit Corpus Christi in Texas.

Meanwhile, Europe is annoyed that US incentives are steering hydrogen investments away from the EU and to the other side of the Atlantic. Perhaps Washington and Brussels will have to hammer out differences, as they have done with critical minerals. Plus, the EU can compete by offering better incentives.

Aluminum makes the cut

Aluminum—a foundational industrial input into key products of modern society— is now on the EU’s critical raw materials list. Upstream feeds to the metal, bauxite and alumina, are also newly added to the list. The continent’s aluminum industry group is cheering the news, having previously called the metal’s exclusion “the opposite of what should be done.”

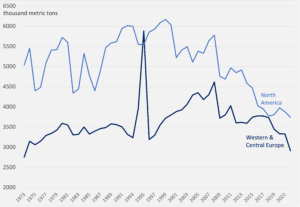

The addition is timely: demand for aluminum is set to grow 40% by 2030. Yet western European aluminum production is at a low, squeezed by years of Chinese exports and then dealt another hit by the 2022 energy crunch. The US also faces an aluminum production challenge. The remedy for both: deploy incentives and investments to make domestic production of aluminum a good, viable commercial endeavor.

Annual primary aluminium production

Source: International Aluminium Institute

MARKETS

MARKETS

MARKETS

MARKETSModerna heads to China

The US drugmaker Moderna has signed a deal to research, develop, and manufacture mRNA drugs in China. Chinese media report that the biopharma firm could invest as much as 1 billion USD under the agreement, though Moderna hasn’t confirmed that number. Either way, Moderna is taking a big bet on a country that hasn’t been the friendliest to foreign biotech firms.

And perhaps it needs to: the company’s revenues are tanking as demand for Covid vaccines fall, and expects a possible net loss this year. But there are risks. Moderna tried to negotiate sales of its Covid jab in China, but talks collapsed when it refused Beijing’s demands that it hand over the vaccine’s core technology. China’s procurement policies have also priced out foreign drugmakers from the market.

Meanwhile, Beijing is rolling out the welcome mat for foreign pharma. This week, the Chinese commerce minister met representatives from major players like AstraZeneca, Pfizer, and Novo Nordisk. But China’s strategic goals are to produce homegrown drugs, reduce foreign dependency, and sell the products overseas. For foreign drugmakers, relying on the Chinese market seems like a short-sighted game plan.

Global factory activity is slowing

Factories output is slowing down worldwide, according to latest business survey results.

In the euro zone, manufacturing activity contracted faster than expected, with the June PMI falling to 43.4 from May’s 44.8. British manufacturing in the doldrums, with its PMI hitting 46.5 from 47.1 the month prior.

Asia is also struggling: South Korea’s PMI slipped further to 47.8, Japan’s fell back to 49.8 from 50.6, and Taiwan’s climbed slightly but still notched 13 consecutive months of shrinking activity. And over in the US, the PMI recorded a slump to 46, from 46.9.

Toyota claims a big breakthrough

Big news from Toyota: the veteran carmaker says it has made a technological breakthrough, simplifying production to half the cost, size, and weight of its solid-state battery technology. The company says it can manufacturer the batteries giving EVs a range of 1,200 kilometers (745 miles) in a 10-minute charge time by 2027 at the latest. Smaller, faster, and cheaper sound great.

The big question: is this a paradigm-shifting development? Maybe. But the history of battery development is littered with many missed deadlines.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSDisruptive deposit discoveries?

Every so often, a company or country declares the discovery of a major deposit of a critical mineral. In January, Sweden claimed to have found Europe’s largest rare earths deposit. In March, Iran said it had found the world’s second-largest lithium deposit. And this week, Norway’s Norge Mining said it had discovered a massive phosphate deposit large enough to meet global battery and solar panel demand for 50 years.

Of course, none of these discoveries happened as suddenly as headlines would suggest. Prospecting and research will have gone on for some time. And no one discovery will solve the issue of dependence on China for critical minerals, processing capacity, and battery and magnet manufacturing.

Our take: take massive mineral discoveries with a big grain of sodium chloride.

(Photo by Pixabay/Pexels)