Is biotech the new semiconductor industry? Big Pharma hopes the answer is yes. Meanwhile, Russia’s path to become a Chinese “resource colony,” resurgence in offshore oil and gas, and what’s actually up with China’s domestic Covid vaccine? Plus: Drought in Taiwan threatens semiconductor production and labor tensions at West Coast ports threaten trade flows.

BIOMANUFACTURING IN THE SPOTLIGHT

Is biomanufacturing the next US industrial priority?

Fifty years ago, US scientists pioneered genetic engineering experiments. The US has since become a global biotechnology powerhouse. And it continues to maintain that leadership: Just look at the speed at which US biopharma companies developed and deployed not one but multiple effective Covid vaccines within months of the pandemic’s outbreak.

Yet, echoing a dynamic that has played out across numerous industries, the US lacks the biomanufacturing capacity that underpins the production and commercialization of its biotech innovations. Consider industrial fermentation: The US is a leader in engineering microbes, which are widely used to produce commodity chemicals, but lacks the fermentation capacity to produce chemicals at commercial scale.

The lack of a robust US biomanufacturing base—just as the energy transition is expected to raise demand for biochemicals as an alternative to carbon-intensive petrochemicals—means increasing reliance on competitor countries’ (read: China’s) manufacturing capabilities, and supply chain risks inherent in those dependencies.

The US Department of Defense understands this risk. As its biomanufacturing strategy published this week notes: “To prevent the continued economic loss of US-developed biotechnology innovations to overseas manufacturing , it is critical that the US government become more involved in the race for the industrialization of biotechnology” and to “help shape a potentially different fate for biomanufacturing than semiconductor manufacturing.”

Of course, none of this is a surprise and the Department of Defense strategy is just a document. But it could be a leading indicator that the US government is about to assign the same priority, investment, and regulation to biotech that it has, over recent years, to semiconductors. And Big Pharma is certainly trying to encourage as much, including in the form of a CHIPS Act for biotech, which would feature a 25% tax credit to help offset the cost of building biomanufacturing plants.

FACTORS

FACTORS

FACTORS

FACTORSRussia’s path toward Chinese resource colony

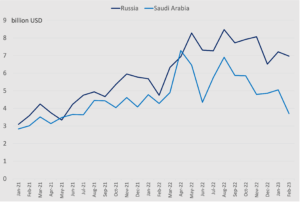

The numbers are in: China splurged on cheap Russian energy last year. Chinese customs data released this week show that the country spent almost 89 billion USD on Russian fuels — including oil, gas, and coal — from March 2022 to February 2023, an increase of over 50% from the same period a year earlier. And the trend looks set to continue: Russia, which has officially edged out Saudi Arabia as China’s largest oil supplier, says it is ready to sell even more oil to China.

But note that Moscow does not call the shots in this relationship. As a reminder of who has the upper hand: At his Moscow summit with Vladimir Putin this week, Chinese leader Xi Jinping made no commitments to buy significantly more Russian gas, and gave no indications of progress on the Russia-Mongolia-China Power of Siberia 2 pipeline. One Kremlin-connected source offered a perfect sound bite to the FT: “The logic of events dictates that we fully become a Chinese resource colony.”

Chinese imports of oil, gas, and coal, monthly

Source: Chinese General Administration of Customs. Note: Data is based on HS27, ex-electrical energy and peat

Offshore makes a comeback

Investments in offshore oil and gas projects are booming. ExxonMobil has projects off the coasts of Guyana and Brazil. Saudi Aramco is betting on expanding its oil production capacity over the next several year via a set of massive offshore projects. Meanwhile, Norway’s Aker BP is investing heavily in projects in the North Sea, and the UK has a roster of projects there as well.

All in, the offshore oil and gas market has more than 200 million USD of greenfield investments lined up by 2025, according to Rystad Energy, on pace for the highest growth in a decade. The Clarkson Offshore Index is up 29% and at the highest since 2014.

E-fuels sneak their way in

The EU last month approved a law that will effectively ban the sale of internal combustion engine vehicles from 2035. Now, a twist: To resolve a spat with Germany and Italy—home to the luxury gas-guzzler brands Porsche and Ferrari—the EU has proposed an exception to the ban for ICE cars that run on carbon neutral e-fuels.

But will there be enough e-fuel production? E-fuels are made by synthesizing captured CO2 emissions and hydrogen produced using renewable electricity. That technology is still at early stages of development.

MARKETS

MARKETS

MARKETS

MARKETSBattery tech investments heat up

Private equity investors directed nearly 650 million USD towards automotive tech startups in February alone, according to Automotive News. Of that, over 70% went to battery tech companies. And the battery manufacturing frenzy shows no signs of letting up. This week, South Korea’s LG Energy Solution announced a 5.6 billion USD investment in a battery plant in Arizona.

The underlying question: What about investments upstream of the battery plant itself, namely in mining and processing and related technologies? While Chinese battery-grade lithium carbonate prices have almost halved since a November peak, as new capacity comes online, demand for lithium is still set to far outstrip supply in coming years.

Scant details on China’s domestic mRNA Covid jab

More than three years into the pandemic, China has finally approved a domestically-produced mRNA Covid vaccine. Beyond the emergency use approval by Chinese health regulators, however, details are scant on Hong Kong-listed CSPC Pharmaceutical’s jab, dubbed SYS6006.

CSPC claims it has completed clinical studies in China with over 5,500 participants. But there are no records of such completed trials on ClinicalTrials.gov, the US-government run database where many reputable foreign trials are registered. Nor has CSPC published detailed results of its trials in a peer-reviewed journal. And there’s no indication of when the vaccine might be available to the public, or what the production timeline looks like. Bottom line: We’ll believe it when we see it.

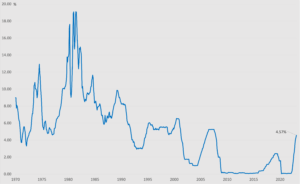

The US and UK keep up the inflation fight

The US Fed raised rates again, this time by a quarter-percentage point on Wednesday. The Bank of England followed the next day, 25 basis points.

The message from both central banks was clear: They see continuing upward price pressures that have yet to be tamed, and they intend to continue to fight those despite turmoil in the banking sector. Indeed, the UK just notched a surprise acceleration in inflation. February’s CPI jumped 10.4% annually, breaking a three-month streak of declines.

And while the scale of the US rate raise suggests it’s adjusting path somewhat for the still-unfurling banking chaos, this remains a raise. The US Fed is signaling that it doesn’t see the risk of contagion as sufficient to force an about-face in monetary policy.

US Federal Funds Effective Rate, monthly, 1970–2023

Source: FRED

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSDrought in Taiwan threatens semiconductor supply

Taiwan’s semiconductor industry is extraordinarily water-intensive. Taiwan Semiconductor Manufacturing (TSMC) is reportedly set to use more than 380,000 tonnes of water per day by 2027, akin to that consumed by some 1.4 million residents. And right now, Taiwan faces intensifying droughts.

Just two years ago, “once-in-a-century” droughts in the island exacerbated one of the worst global semiconductor shortages in memory. Is (very recent) history repeating itself? The hope: The “plum rain” season is expected to arrive in Taiwan in May. And that should bring at least temporary relief.

Bubbling tensions at West Coast ports

Global supply chains are, by one measure, back to pre-pandemic pressures. But wildcards abound, like rising tensions in long-stalled contract talks at West Coast ports that risk spilling over and disrupting US trade flows.

A lunch break dispute is the latest manifestation of the tensions. Unionized workers at the ports of Lost Angeles and Long Beach are currently taking their lunch breaks all at once, rather than in staggered shifts, affecting terminal operations during lunch hours. And because West Coast dockworkers have been working without a contract since the last agreement expired in July, there’s no mechanism to arbitrate the dispute. That means even small spats can spiral into wider disruptions.

(Photo by Chokniti Khongchum/Pexels)