A closer look at Alibaba logistics arm Cainiao’s prospectus—and its strategy for the industrial internet. Meanwhile, LNG developments abound: US exports surge, Asia wants to diversify its portfolio, and the Middle East has big natural gas ambitions. Plus: the state of global manufacturing, and rising rice risks.

THE BIG BUSINESS OF LOGISTICS

Cainiao’s game plan: shipping packages—and dominating the industrial internet

Last month, Alibaba’s logistics arm Cainiao filed for an IPO on the Hong Kong Stock Exchange. Its prospectus offers a glimpse into the logistic company’s capabilities and ambitions.

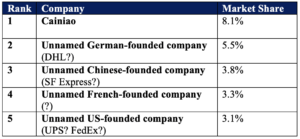

Notably, Cainiao claims to be the largest e-commerce logistics player globally: it delivered 8.1% of all parcels in 2022, ahead of the runner-up, an unnamed German-founded company (likely DHL) with a 5.5% share. And the company also claims to have the most cross-border warehouse space in terms of floor area, and the highest number of pick-up/drop-off stations, globally.

Global e-commerce logistics companies market share by parcel volume, 2022

Source: Cainiao prospectus

But Cainiao isn’t just in the business of delivering parcels. Its logistics operations serve as a springboard to the forefront of the industrial internet—the interconnection of industrial machines and devices to turbocharge efficiency and capacity.

Already, Cainiao has partnered with major domestic and joint-venture automakers to provide logistics services like devising more efficient ways to ferry car parts around factories with Cainiao’s proprietary autonomous robots.

With a global delivery network, Cainiao can glean vast amounts of data on international trade flows. And by tapping into supply chains across key industries, it has a frontrow seat to the global industrial system. All that could give Cainiao an incredible amount of insight—and potentially, leverage.

Case in point: the Financial Times this week reported that Belgium’s intelligence service is monitoring Cainiao’s logistics hub in the country for “possible espionage and/or interference activities.”

FACTORS

FACTORS

FACTORS

FACTORSA brief world tour of LNG: US exports, Asia’s pivot, Middle East’s ambitions

US LNG exports have surged, with more shipments of the liquefied fuel in the first half of 2023 than any other country. That momentum will continue through the decade, putting the US at the heart of the global LNG market, according to ICIS Analytics. (Though September exports dipped due to scattered outages at gas-processing plants.)

The implications are many. Europe’s top energy official last month said that the bloc now expects to rely on US gas for decades, sending a clear signal to US developers that they can expect more supply deals.

Elsewhere, Asian buyers are looking to diversify their portfolios by moving away from additional US LNG commitments, which are linked to the US benchmark Henry Hub, in favor of oil-indexed deals, Energy Intelligence reports.

Middle Eastern LNG suppliers are best positioned to offer those oil-indexed contracts. And this week, the world’s largest oil producer Saudi Aramco finally entered the natural gas market by buying a stake in LNG company MidOcean. Per Bloomberg, Saudi Aramco is looking for more such acquisitions as it sets its sights on becoming a leading global LNG player.

China’s battery dominance extends downstream

China’s dominance of the global battery industry is formidable. And it’s paving the way for Chinese battery energy storage system integrators to muscle into the global top five, according to S&P Global.

System integrators offer a package of downstream services: they procure individual components like battery modules and racks, assemble the system, integrate controls and energy management software, and provide services like project design, operations, and maintenance.

Five years ago, no Chinese player was in S&P’s top five list. Now there are two: Sungrow and Hyperstrong. With upstream inputs and midstream processing manufacturing, Chinese players are now extending their dominance into the downstream—traditionally where profit margins are fattest.

MARKETS

MARKETS

MARKETS

MARKETSGlobal manufacturing is still contracting

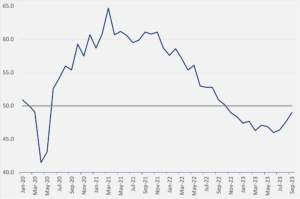

S&P Global’s global manufacturing purchasing manager’s index (PMI) showed factory activity worldwide continuing to fall, registering 49.1 in September. That’s up from 49.0 in August, but still below the 50-level that separates contraction from expansion.

The eurozone saw the steepest downturn, followed by Japan. The US appears to be nearing a recovery: the Institute for Supply Management’s manufacturing PMI showed a climb to 49.0 last month, jumping from 47.6 in August. Meanwhile, China’s factory activity recorded its first expansion since March, with its manufacturing PMI recording 50.2 in September.

US manufacturing PMI

Source: Investing.com

The US gets another rare earth magnet factory

South Korean steel giant Posco is looking to build a rare earth permanent magnet plant in the US with its compatriot Star Group, Korea Economic Daily reports. Texas, Tennessee, and Arizona are being considered as locations for the joint factory, which is targeting up a production capacity of up to 5,000 tons per year. Earlier, Posco had announced it would supply Hyundai’s US plant in Georgia with EV magnet cores—which require rare earth magnets.

If the Posco-Star Group factory takes shape, it will join several other recently announced US-based rare earth magnet manufacturing projects. Those include E-VAC, which just received major US government funding; MP Materials, which is building a plant in Texas; and USA Rare Earth, which is developing a facility in Oklahoma.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSRice risks

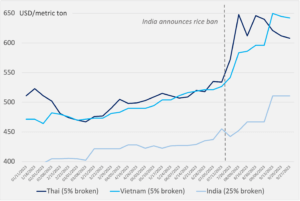

The global rice situation appears to be worsening. Prices of the staple grain have risen following an export ban by India, the world’s largest rice exporter. The move sparked chaos in rice trading in Thailand, the second-largest rice exporter. Myanmar imposed a temporary export ban on rice. Malaysian authorities had to urge consumers not to panic buy. Soaring rice prices drove inflation higher in the Philippines, even after it imposed a month-long price ceiling on the grain. And a strengthening El Niño in coming months could negatively affect rice yields in South and Southeast Asia, which together account for 80% of global rice exports.

Rice prices, January–September, 2023

Source: International Food Policy Research Institute

(Photo by Pixabay/Pexels)