Is the West buying laundered Russian oil? Plus: Caveats to China’s GDP rebound, copper supplies are tightening, Chile wants to nationalize lithium, hurdles for US LNG projects, and CXMT’s IPO.

OIL SHENANIGANS

Russian oil and five “laundromat” countries

It’s counterintuitive, but good business: The oil-rich petrostates of Saudi Arabia and the United Arab Emirates are snapping up steeply discounted Russian oil products for domestic consumption and refining.

According to data provider Kpler, Russian oil exports to the UAE tripled to 60 million barrels last year, while exports to Saudi Arabia are on pace to hit 36 million barrels this year, up from insignificant pre-war levels.

Other eager buyers of Russian oil are China and India, which together have bought the majority of Russian oil this month at prices above the West’s price cap. That’s bringing in strong revenues for the Kremlin, undermining the West’s attempts to starve Moscow’s war machine.

And, to add insult to injury, Western countries are indirectly funding the Kremlin as well. The G7, EU, and Australia have banned or limited imports of Russian oil and oil products. But the sources that those countries have turned to to replace Russian oil are themselves buying from Russia: According to a new report from the Center for Research on Energy and Clean Air, the price cap coalition countries have significantly increased imports from countries that are gobbling up Russian crude.

The report identified China, India, Turkey, the UAE, and Singapore as the five “laundromat countries:” They have increased purchases of Russian oil, which they then “launder” into products shipped to other nations—with the price cap coalition being major buyers. This indirectly finances Putin’s war chest. It’s also not exactly a surprise. None of the policy measures employed by the price cap coalition countries have changed the fundamental truth that Russia is a global energy giant. And nothing comes of nothing.

FACTORS

FACTORS

FACTORS

FACTORSCritical condition: global food security

The UN’s Food Price Index is now below where it was in March 2022, when Russia invaded Ukraine. But it remains considerably above 2020 and 2021 levels. And as the International Food Policy Research Institute notes in a report published this month, the world’s food security outlook remains critical.

For one, global stock-to-use ratios for grains remain below the levels of recent years. And they could fall further still due to any number of shocks: significantly reduced harvests in Ukraine, projected droughts in the Southern Hemisphere, decreased fertilizer use due to high prices, extreme weather events, and direct and knock-on effects of wars and conflict.

The past week’s moves by Poland, Hungary, Slovakia, and Poland to ban Ukrainian grain imports highlight the continued volatility of the global food situation. The countries say the ban is temporary and is needed to protect local agricultural sectors amid a glut in Ukrainian produce—cheaper than that grown in the EU—caused by Russia’s Black Sea blockade.

Meanwhile, the Black Sea grain export deal continues to hobble along on thin ice. Just this week, ship inspections were halted for two days—which Kyiv blamed on Moscow—before resuming on Wednesday (Apr. 19).

Tight on copper

The world is facing its tightest copper supply in nearly two decades: Stockpiles of the metal in London Metal Exchange inventories currently stand at less than a week’s worth of consumption. The crunch exacerbates the problem of critical raw material shortages facing clean-energy projects, with demand for everything from lithium to rare earths set to far surpass supply in coming years.

The solution is simple: Increase mining and processing. But execution of that solution is decidedly not simple. And there’s been a lack of new copper mining activity. Plus, mine production isn’t the only bottleneck. While copper powerhouse Peru has seen its production of the metal rise after several months of declines caused by protests, its copper exports have plummeted due to lingering logistical snarls.

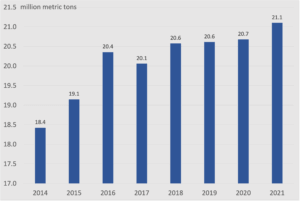

World copper mine production

Source: International Copper Study Group

US LNG projects are getting expensive

A dramatic ramp up in US LNG exports became Europe’s lifeline last year after Russia throttled gas supplies. But major multi-billion dollar natural gas projects on the US Gulf Coast now face delays amid intense competition among developers for long-term offtake deals and escalating construction and financing costs due to inflation and higher interest rates.

According to Wood Mackenzie, the US could triple its LNG capacity by 2030 if every potential project comes online—but analysts now expect many of those projects to fail. Part of the challenge stems from European buyers being reluctant to sign long-term deals for the fossil fuels that US sellers need to finance their projects. As Columbia University’s Ira Joseph tells the FT, “Each side is perceiving their needs very, very differently of what they deem as energy security.”

MARKETS

MARKETS

MARKETS

MARKETSCaveating China’s economic rebound

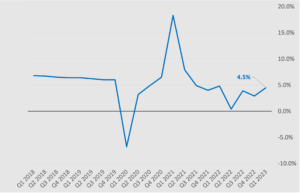

China’s GDP grew 4.5% in the first quarter from a year ago, beating economists’ estimates of 4%. At face value, that would suggest a big rebound in the Chinese economy as it shakes off years of disruptive Covid doldrums. And that’s the prevailing narrative in markets right now. But as with all official Chinese economic statistics, proxy measurements round out the picture with a hefty dose of caveats.

Consider, for example, that the number of trucks running on Chinese highways fell 8% in the week ended April 9. Youth unemployment is up for a third straight month. Property investment is down. Entrepreneurs are feeling hesitant: private sector fixed asset investment is up only 0.6% in the first quarter, versus a 10% increase in state-led investment).

China quarterly GDP growth, Y0Y

Source: National Bureau of Statistics via Investing.com

An IPO for CXMT

The Chinese memory chip maker ChangXin Memory Technologies (CXMT) is reportedly set to IPO in Shanghai at a valuation of at least 14.5 billion USD.

A bit of background on one of China’s largest makers of DRAM storage chips: It is government-launched and continues to have major state-owned shareholders; it advertises its chips as “military-grade” and is closely integrated with Chinese government military and surveillance entities; and more generally, it is regarded by China as a critical node in the country’s push to develop indigenous semiconductor capacity.

In other words: The West needs to play close attention to CXMT—not least because it’s part of Beijing’s playbook to identify competitors’ critical nodes as targets for “surgical” retaliation and points of leverage.

Plus, current US semiconductor restrictions are clearly insufficient: Lam Research and ASML both said in their latest earnings calls that they expect booming sales of chipmaking tools to China, despite US export curbs on such equipment.

Divergent US manufacturing snapshots

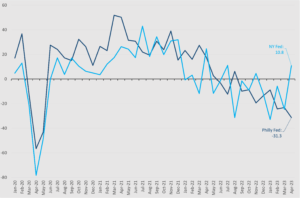

Is US factory activity rebounding or slumping? Two figures out this week paint very different pictures.

The New York Fed’s Empire State index, regarded as a gauge of national manufacturing activity, jumped 35.4 points to a reading of 10.8 this month. That’s far above the -18.0 that economists polled by Reuters had predicted, and the first increase in five months as new orders and shipments increased. By contrast, The Philly Fed’s general activity index, which measures activity in the mid-Atlantic region, plunged to a nearly three-year low of -31.3 in April.

New York Fed and Philly Fed manufacturing indices

Source: NY Fed and Philly Fed via Investing.com

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSCATL’s mysterious battery reveal

China’s CATL unveiled a new product at the Shanghai Auto Show this week: what it calls a “condensed battery” that the company claims can eventually power electric civilian aircraft. One might say that’s big if true, with potential to disrupt the battery industry—plus the aviation, electric vehicle, and energy storage sectors.

But for now, CATL has revealed precious few technical details. As yet unknown is the cost of this powerful new battery; what its electrolyte, anode, cathode, and separator are made of and if they include critical minerals; what the supply chains are for these components; and the life cycle of the product.

Chile wants to nationalize its lithium industry

Chilean president Gabriel Boric said on Thursday that he plans to nationalize the country’s lithium industry. Investors reacted by dumping shares of US-headquartered Albemarle and Chinese minority-owned SQM, the top two lithium miners in Chile. While a shock to the industry, the president has long pushed for a state-owned lithium company. His nationalization plan still needs to be approved by lawmakers, and there’s no guarantee it will pass especially given the constitutional assembly’s rejection of a similar proposal last year.

Regardless, countries are eager to take greater state control of mineral resources: Mexico nationalized lithium last year, Zimbabwe has banned raw lithium exports, and Indonesia bars exports of numerous unprocessed minerals.

(Photo by Elevate/Pexels)