A slowing Chinese economy could worsen its battery overcapacity problem and derail battery projects abroad. Meanwhile, Russia steps up its grains war, consolidation may be coming for US steelmaking, Japan’s GDP booms, and green energy recycling will reinforce Chinese upstream dominance. Plus: Texas grid troubles.

EXPORTING OVERCAPACITY

China’s battery glut

For months, overcapacity warning signs have been flashing red in China’s battery market.

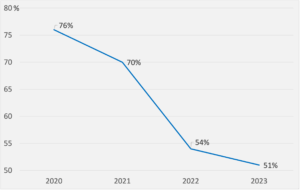

Now add to this China’s economic weakness, highlighted this week by financial stress at a major asset manager and a bankruptcy filing in US court by property developer China Evergrande. A drop in EV sales will further push down battery installation rates (ie. the ratio of batteries produced to batteries installed in cars), which have sunk from 76% in 2020 to 51% in the first five months of 2023.

“The slowdown threatens to exacerbate an overcapacity problem in China, which has its roots in the battery industry’s rapid expansion during the Covid-19 pandemic,” writes Benchmark Mineral Intelligence.

China EV battery installation rates

Source: China Passenger Car Association via China EV100

What’s China to do about the overcapacity? It is already eating into manufacturers’ margins and sending lithium chemical prices tumbling.

One possibility is to redirect resources towards energy storage; major players like CATL, BYD, and Svolt have all made moves on that front.

Another alternative is to export the overcapacity abroad. “Compared with the field of energy storage, overseas markets have greater potential to accept domestic transfer of production capacity,” writes the state-run China Youth Daily. “Opening up overseas market channels will quickly alleviate the pressure on production capacity.”

That also means undercutting foreign competitors and flooding global markets. We’ve seen that play out before with solar panels—and it didn’t go well for overseas players.

FACTORS

FACTORS

FACTORS

FACTORSChina wants more energy secrecy…

The energy transition is at the center of the global industrial competition—and Beijing wants its energy sector to more closely guard its secrets.

In an essay this week, the director of China’s National Energy Administration Zhang Jianhua urges a “confidentiality culture that keeps secrets,” and guards against “negligent leaks and handing over secrets”—particularly in sensitive areas like nuclear energy and oil and gas.

Zhang also singled out “foreign hostile forces” who are looking to “steal and attack” by “closely monitoring China’s energy sector.” That reads like a thinly veiled threat directed at foreign market intelligence firms and NGOs tracking the energy industry, especially in light of recent raids on global consultancies.

…and more green energy recycling

China’s state planner, the National Development and Reform Commission, published guidelines this week on building a national recycling system for obsolete wind turbines and solar panels by 2030. Part of the push will include setting industrial standards and rules for dismantling and recycling the used equipment.

The upshot: more upstream dominance for China as it retrieves and reuses valuable inputs like semiconductor materials, metals, and composite fibers.

Russia steps up its grain war

Moscow appears to be capitalizing on it attacks on Ukrainian agricultural export facilities by selling more of its own grains abroad—and boosting revenues with which to fund the ongoing war.

Data published by the US Department of Agriculture forecasts Russian exports of wheat and coarse grains to reach 48 million tons and 9 million tons respectively in the 2023-24 marketing year, up from 33 million tons and 7.6 billion tons. It’s all part of Moscow’s strategy to “to increase their own market share and keep food prices artificially high” by continuing to attack Ukraine’s export infrastructure, a USDA official tells Politico.

MARKETS

MARKETS

MARKETS

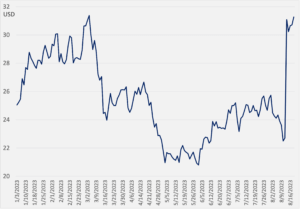

MARKETSA bidding war for US Steel

The Pittsburgh-based industrial icon US Steel has found itself fielding multiple takeover offers. Cleveland-Cliffs made a 7.3 billion USD cash-and-stock offer, which US Steel rejected. Privately held Esmark upped the ante, offering 7.8 billion USD in cash. And ArcelorMittal is reportedly weighing a possible bid. US Steel says it’s exploring its options.

A consolidation would reshape steelmaking in America and globally. Cleveland-Cliff’s pitch is that a merger would provide “a stronger foundation critical infrastructure and national security.” And the two companies do share a similar outlook: they both see deglobalization and the domestic manufacturing boom as a boon to their businesses. Combined, they could grow market share and increase cost efficiencies as one of the world’s biggest steelmakers—and maybe help turnaround US steelmaking’s long-term decline.

US Steel share price

Source: Investing.com

Japan’s GDP booms

The Japanese economy grew at an annual rate of 6% in the second quarter, far above forecasts of 2.9%. A surge in exports drove the growth: net exports contributed 1.8 percentage points to the GDP expansion, versus estimates of 0.9 point, led by vehicle sales to the US and Europe. But uncertainty clouds the export outlook: Japan just posted its first decline in exports in over two years, with July exports dipping 0.3% from a year earlier amid China’s slowdown.

Beijing keeps trying to court foreign investors

China is continuing its campaign to woo overseas businesses as its domestic economy falters. The State Council rolled out 24 guidelines for attracting foreign investment, including protecting foreign investors’ rights and interests and stepping up enforcement of IP rights.

Guidelines aside, however, China is only getting harder and more opaque for foreign businesses to operate in. Authorities’ decision to suspend publication of youth unemployment data is a case in point. And Beijing’s scuttling of a mergerbetween US semiconductor giant Intel and Israeli chipmaker Tower—which had already gotten US approval—is the latest example of Chinese regulators using antitrust reviews to disrupt American companies’ strategic plans.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSThe Texas power grid wobbles

Soaring temperatures and spiking demand are forcing Ercot, the main grid operator in Texas, to deploy its emergency response system electricity reserves dipped below a critical threshold. Spot power prices jumped 6,000% on tight power supplies, and Ercot appealed to households and businesses to voluntarily conserve power.

Another complication: a proposed grid rule change that Ercot says is needed to reduce “tripping” incidents, but whose timeline and scope renewable energy companies say could force renewable resources off the grid just when they are most needed

(Photo by Pok Rie/Pexels)