Dampening inflation spurs enthusiasm, but where is the attention to contraction in the US manufacturing index? Plus we have a roller coaster week for the growing US-EU trade spat, signs of relaxations in China’s COVID Zero restrictions, and escalating protests in Brazil – paired with dropping oil prices, an LNG deal for Germany, a possible agreement to restore Russian ammonia exports, and a nascent EV industry shift to sodium-ion batteries.

CHECKING IN

The state of the US economy

Several economic readings this week show welcome – albeit tentative – signs of slowing in the US economy. But the labor market is still hot, and far more so than the Fed and markets would like. And, of course, there’s the question of what slowing is good slowing.

Inflation: Inflationary trends appear to be dampening. The core Personal Consumption and Expenditures Index, which excludes food and energy, rose 0.2% in October after two consecutive months of 0.5% increases.

Hikes: Apparently in response, central bank chair Jerome Powell said in a Wednesday speech that he is prepared to slow the pace of rate hikes next month. Markets cheered, sending the Dow up 700 points, S&P500 up 3.1%, and Nasdaq Composite up 4.4%.

Jobs: That said, the Labor Department’s employment report showed 263,000 jobs added last month, few signs of severe hiring slowdowns, and a 0.6% rise in average hourly earnings for private sector workers. In other words: A hot labor market. That’s despite the labor market churn data from earlier this week showing a slight slowdown in the number of job openings: 10.3 million in October, versus 10.7 million in September, but still above the level in August.

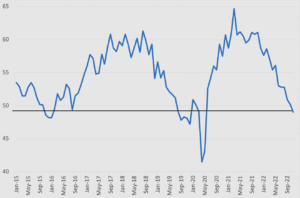

Manufacturing: Not all economic slowing is something to cheer. And some of the indicators are worrying, suggesting that the Fed’s efforts to cool the economy risk hurting precisely the parts most necessary for continued resilience. The Institute of Supply Management’s factory activity gauge showed its first contraction last month since 2020. That’s hardly a surprise considering the macro-economic environment, including a strengthening USD that undermines export competitiveness and high inflation that raises cost of production. But as we’ve noted before, to fix inflation, the US must fix supply. And to fix supply, the US must grow its physical production capacity. A contracting PMI suggests the opposite is happening.

ISM Manufacturing Index

Source: Institute for Supply Management

FACTORS

FACTORS

FACTORS

FACTORSSinking oil prices

Oil prices have erased almost all of their gains this year, though this week did see several consecutive days of climbs. China’s continued pandemic restrictions have dented demand, and widespread protests (more on that below) have further weighed on investors’ outlook for the Chinese economy. But three other wildcards are in play. All eyes are on an OPEC+ meeting today (December 4): There’s speculation that the cartel may announce further production cuts. Plus, the G7’s price cap – finally set at 60 USD – on Russian oil takes effect on Monday (December 5). And this week, China made slight adjustments to its COVID-19 restrictions, including lifting the negative COVID test requirement for public transport in Beijing and Shenzhen, that could signal an overall opening.

One outstanding question is what the White House should do in the face of falling oil prices. The administration has previously said that it will begin buying back crude oil to refill the Strategic Petroleum Reserve when prices reach between 67 to 72 USD per barrel. WTI prices are now within dollars of that range. In fact, the White House now wants to halt SPR sales so it can focus on refilling it. And as Employ America notes, showing that there is a plan to make good on its repurchase promise would bolster the administration’s credibility and help incentivize domestic production.

Crude Oil WTI (USD per barrel) Front Month

Source: MarketWatch

Germany secures some LNG

Germany has managed to secure itself a long-term source of LNG supply after Qatar Energy and ConocoPhilips signed two sales and purchase agreements for the fuel’s export over 15 years. Under the agreements, Qatar will send up to 2 million tons of LNG a year to Germany beginning in 2026. That said, this is a small portion of overall German demand. And the deal comes days after China signed a 27-year LNG supply contract with the state-owned Qatari energy giant, the longest such deal ever signed.

Securing LNG supply is just one piece of the puzzle. The other piece is ramping up regasification capacity. On that front, Europe is set to expand its LNG import capacity by one-third by the end of 2024. The CEO of Italy’s Eni, for example, wants to see the country add at least four new LNG terminals.

Plus, another piece of natural gas news: Japan is considering setting up a national strategic LNG reserve. One proposal being floated by the government is to secure a “strategic buffer LNG,” with the state helping domestic firms to buy excess supply of the fuel.

Chinese companies eye sodium-ion batteries

Chinese battery makers are upping investment in research and production of sodium-ion batteries, hoping to develop a new branch of the electric vehicle industry as costs of lithium-based energy storage rise. Contemporary Amperex Technology Co., Ltd (CATL), a Chinese State-backed battery giant and the world’s largest battery manufacturer, has announced that it intends to launch mass production of sodium-ion batteries next year. Rumors are circulating that BYD, too, intends to produce sodium-ion battery cells in 2023 and use them to power its own electric vehicles.

This new line of effort is not unique to Chinese players: European and US start-ups are also investing in sodium-based battery technologies, in order both to avoid high lithium prices and to circumvent reliance on China. But the growing Chinese focus on the field could suggest a real trend shift in the EV industry. It may also indicate that Chinese players are on the verge of co-opting nascent investment and technologies in the US and Europe.

Russia’s ammonia exports

Russian pipeline exports of ammonia – a key ingredient in nitrate fertilizer – may start flowing through Ukraine again as the United Nations said it was “quite close” to brokering a deal. That would add to a grain export deal that the global body negotiated over the summer, then extended by 120 days earlier this month. One of Russia’s original demands in return for committing to that grain export deal was to increase its ammonia exports; it appears Moscow will now get what it wants. This will have significant impact on global food markets. The UN has warned that continued interruptions of Russian fertilizer exports would cause food availability problems in 2023.

MARKETS

MARKETS

MARKETS

MARKETSTurmoil in China…

Protests against continuing pandemic restrictions flared up across China last weekend, sparked by a deadly blaze in Xinjiang where fire trucks could not get close enough due to lockdowns. And the protests haven’t fully abated: There were reports of clashes between protesters and police on Tuesday night (Nov. 29).

These – on top of the COVID restrictions themselves – are directly impacting production in China. Apple is the prime example: The company is expected to be hit with a production shortfall of six million iPhone Pros this year as a result of anti-COVID protests at the Zhengzhou plant of its supplier Foxconn.

Meanwhile, China’s November manufacturing PMI came in at 48, a second straight month of contraction and below economist expectations.

…But is there calm on the horizon?

Chinese authorities vowed earlier in the week to continue sticking with “dynamic” zero-COVID policies. But a top official also hinted that the country might “optimize” COVID restrictions as the pandemic enters a “new stage.” And this week ended with a series of relaxations of COVID restrictions, potentially hinting that a softer regime might be on the horizon.

Further suggesting as much, this week the Chinese National Health Commission signaled a push to accelerate a vaccination drive among the elderly. Low vaccination rates among the elderly, and corresponding fears of a major spike in severe COVID cases if and when restrictions are lifted, are considered to be one of the major factors driving China’s draconian policies.

The Hang Seng, Shanghai, and Shenzhen indices have all notched gains this week on hopes that Beijing will finally take necessary steps to maneuver out of its COVID zero freeze. Another metric that jumped this week: copper prices, which are on track for their best month since April 2021, on hopes that China’s reopening will boost demand.

A roller coaster for the US-EU trade spat

This week has been a roller coaster for the intensifying US-Europe trade spat. EU nations are up in arms over “Buy American” provisions in the Inflation Reduction Act (IRA) that they argue discriminate against foreign companies, especially carmakers, threatening to drive investment out of the EU and into the US. But during his state visit to Washington, DC this week, French president Emanuel Macron managed to get his counterpart Joe Biden to say that the US can make “tweaks” to IRA subsidies that can “fundamentally make it easier for European countries to participate.”

However, this doesn’t mean that the EU-US spat is over. In a remarkable move, European Commissioner Thierry Breton announced on Friday that he would pull out of the upcoming EU-US Trade and Technology Council (TTC) meeting on December 5, saying that not enough time had been dedicated to ongoing disputes over the IRA. (Again, though, one data point only means so much: EU sources did say that part of Breton’s reason for cancelling his trip was that he had not officially been invited to the so-called Kennedy Center Honors.)

Regardless, Beijing is eyeing any potential US-EU trade fight with schadenfreude. Chinese president Xi Jinping urged European Council president Charles Michel to keep up EU investments in China, insisting that “China will remain open to European companies” — a not-so-subtle nod to EU fears of losing investment to the US.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSChina’s cold snap

While continued uncertainty over China’s pandemic trajectory is a key factor in assessments of global oil markets, another flashpoint looms for Chinese commodities: a severe cold snap hitting most parts of northern China. Xinhua News Agency reported that plunging temperatures had already resulted in deaths of seven road workers in Xinjiang, while hundreds of livestock were reported dead or missing.

The cold weather will drive up demand for fuels, including coal. Meanwhile, Beijing is scrambling to ensure increased pipeline gas deliveries from Kazakhstan — China’s third largest source of pipeline gas imports — and earlier this month effectively shut gas exports to guarantee sufficient domestic supplies.

Escalating protests in Brazil

For the past three-plus weeks, supporters of incumbent Brazilian President Jair Bolsonaro – who refuse to accept his October election defeat – have been protesting across the country, blocking roads, camping outside military buildings, and calling for intervention from the armed forces. Now, those protests are beginning to grow violent. Federal highway police say that protestors have used homemade bombs, fireworks, nails, stones, and barricades made of burnt tires to block highways; violence has also targeted soy trucks from Grupo Maggi, a tycoon who declared support for President-elect Luiz Inácio Lula de Silva.

Bolsonaro has largely stayed silent. But in rare addresses since his defeat, he has called the protests legitimate. He is also challenging election results. Altogether, the posture combines enough encouragement with enough ambiguity to incentivize his supporters.

(Photo by Pexels/Karolina Grabowska)