Sequoia’s China spin-off is searching for investment targets worldwide, underlining private capital flows as an arena of geopolitical competition. Meanwhile, a fertilizer shock could raise global food prices, Japan deals with an inflation and deflation dilemma, BYD spots another IRA backdoor, and US inflation rears its stubborn head. Plus: oil and gas volatility.

HONGSHAN’S GLOBAL AMBITIONS

Chinese VC giant eyes global targets following its split from Sequoia

In June, global venture capital giant Sequoia Capital separated its China and US businesses, and spun its Indian and southeast Asian businesses into a third entity. Back then, we wondered whether the split would allow Sequoia China (now named HongShan) to secure workarounds to US regulations on Chinese investments and invest without Washington oversight.

We don’t have clear answers yet, but contours are coming into view. The Financial Times reports this week that HongShan is seeking business opportunities and investments worldwide. Sources with whom the FT spoke suggested that HongShan would scope out targets in beyond southeast Asia to include Japan, Europe, and the US.

If the decision to split Sequoia’s three ways was driven in part by US-China geopolitical tensions, it’s unlikely to have done much to change the calculus around capital flows as an arena of strategic competition between nation-states. How HongShan decides to deploy its 9 billion USD war chest will offer useful indicators of alignments between private market capital flows and national strategic objectives.

FACTORS

FACTORS

FACTORS

FACTORSMounting minerals bets

Companies and governments are increasing investments into minerals to ensure adequate supplies for EV and other clean energy transition needs:

- Automaker Stellantis and Rio Tinto venture Nuton just raised their stakes in McEwen Copper, which owns a giant copper deposit in Argentina, to 19.4% and 14.5% respectively.

- Meanwhile, the US government is recently hosted workshops in Zambia and the Democratic Republic of Congo in a bid to deepen ties with mineral-rich African nations. This follows last month’s 150 million USD funding approved by Washington for a graphite-mining project in Mozambique.

- And BYD is eyeing lithium assets in Brazil, where the Chinese EV giant has already announced it will build a three-factory industrial complex to build hybrids and EVs.

Another fertilizer shock

Israel is one of the world’s top producers and exporters of potash. Now, the conflict between Hamas and Israel threatens to disrupt global supplies of the key fertilizer ingredient, Bloomberg reports. Another fertilizer input, nitrogen, could also be impacted if key regional supplier Iran gets drawn into the conflict.

That could crimp crop yields, and ratchet up inflationary pressures on food prices. Recall, too, China’s recent suspension of nitrogen fertilizer exports to rein in soaring domestic prices. It all makes for a fragile environment for global food supplies.

More immediately, Israel’s seaborne imports of grain seeds and other foods face disruptions as key ports enforce restrictions amid the fighting. Meanwhile, Gaza has been cut off from food and fuel supplies and a humanitarian crisis is rapidly expanding.

MARKETS

MARKETS

MARKETS

MARKETSThe yen’s dilemma

The Bank of Japan is contending with both rising and falling prices—what Nikkei Asia calls the “yen dilemma.” The country has been saddled with a decades-long deflationary trend that years of negative interest rates have failed to reverse. Yet the US Fed’s rate-raising campaign has caused the yen to tumble. That in turn has made imported goods more expensive, driving up inflation. But it’s not the kind of demand-, growth-, and wage-driven inflation that Japanese central bankers want. In the meantime, Tokyo has likely stepped in to prop up the yen (but won’t say whether they intervened in the market), and has signaled it will continue to maintain its ultraloose monetary policy.

Stubborn inflation

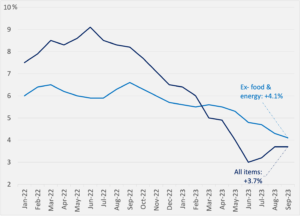

US inflation for September came in higher than expected, sending Treasury yields up and stocks down. The consumer price index (CPI) rose 3.7% on the year last month—on par with August but above economists’ expectations of 3.6% and an acceleration from 3.2% seen in July. Excluding food and energy, the core inflation fell to 4.1% from 4.3%.

The quick takeaway: price increases are down from the eye-watering levels of 2022, but inflation is proving more stubborn than would be hoped for. Together with last week’s blockbuster jobs report, that means the Fed must push on with its inflation fighting campaign.

US CPI, January 2022 – September 2023

Source: Bureau of Labor Statistics

BYD spots another IRA backdoor

In August, we highlighted BYD’s talks with South Korean car maker KG Mobility Corp. to build a joint battery plant in South Korea—a setup that potentially allows the Chinese EV maker to benefit from US Inflation Reduction Act tax credits. Now BYD is pursuing another backdoor lead: its battery unit FinDreams is partnering with South Korean conglomerate LG Electronics to target US and EU markets, CNEVPost reports.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSOil and gas volatility

Much of the attention this week was paid to the Israel-Hamas war’s potential impact on global oil prices. But oil isn’t the only fuel that’s seeing market gyrations. In Europe, natural gas prices soared to their highest point since March on worries of global supply disruptions due to pipeline snags and the potential for a broader regional conflict in the Middle East.

Already, the Israel-Hamas conflict has forced Chevron to halt production at its Tamar gas reservoir project, located off the coast near the northern boundary with Gaza and responsible for more than half of Israel’s annual gas production. And because Israeli typically exports gas to Egypt by pipeline, the production suspension at Tamar will hinder Egypt’s abilityto export LNG to the global market.

Dutch TTF futures

Source: Investing.com

(Photo by Pixabay/Pexels)