Europe weathered the acute shocks of the energy crisis, but more risks lurk. Meanwhile, markets didn’t find OPEC+’s production curbs very convincing, Middle Eastern funds are flocking to Hong Kong, and Russia doesn’t want to take oil payments in rupees. Plus: the role of bots in oil trading.

IS IT OVER YET?

The acute energy shocks are over, but other challenges remain

The acute phase of Europe’s energy crisis is over, says Reuters energy columnist John Kemp: energy inventories are comfortable, and prices are easing back into pre-crisis levels. “Markets have adapted,” he writes, while caveating that there will “undoubtedly be more shocks in future.”

The big question: will Europe be better poised to cushion those shocks more quickly and effectively the next time around?

Germany, for one, is still feeling anxious. The country’s energy crisis is “definitely not finished,” Olaf Scholz warned this week. Of course, the chancellor has an incentive to make the case that the energy crunch still presents a major risk: he’s pointing to the crisis to justify suspending the debt brake.

Meanwhile, the EU this week decided to extend energy emergency measures by a year, citing the need for additional safeguards as global energy markets remain tight.

Then there’s the risk of not an energy supply deficit, but surfeit. In a new report, the International Energy Agency warns that overinvestment in oil and gas could spell commercial ruin for new projects, and also “[lock] in emissions that could push the world over the 1.5C threshold.” Global crises know no borders, and often it’s hard to tell where one ends and where another begins.

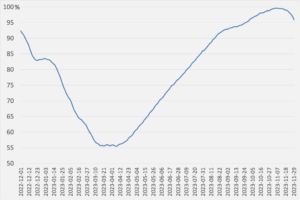

Europe’s natural gas storage, percentage full

Source: Gas Infrastructure Europe

FACTORS

FACTORS

FACTORS

FACTORSThe market thinks OPEC+ is crying wolf

The OPEC oil cartel and its Russia-led allied producers agreed to make additional voluntary cuts in output next year as they try to shore up prices. But the market called its bluff: crude prices actually fell following the announcement due to signs of strains within the group. That dirty laundry was hung out in the open for all to see when OPEC officials said the voluntary curbs would be announced by individual members, rather than the group secretariat. “The market reaction implies disbelief in the full efficacy of the cuts,” said one analyst.

Ironing out some rare earth details

The world’s largest rare earth mine, in China’s Inner Mongolia, is an iron ore mine that produces rare earths as a byproduct—a strategy that keeps mining costs for the critical metals low. Could a similar strategy be applied in the US?

This week brought news that Caldera Holding, the owner and developer of Missouri’s Pea Ridge iron mine—inactive since 2001—is licensing technology for separating rare earth elements in mined ore from Oak Ridge National laboratory. Pea Ridge could potentially yield vast volumes of total rare earth oxides (TREO); whether those can be extracted in a commercially feasible way is another question.

MARKETS

MARKETS

MARKETS

MARKETSMiddle Eastern funds are flocking to Hong Kong

Sovereign wealth funds from Saudi Arabia, Abu Dhabi, and Qatar are establishing themselves as active players in the Hong Kong stock market, Nikkei Asia reports. They have participated as investors in Chinese companies listings, and just this week saw the Hong Kong listing of a new 1 billion USD ETF tracking Saudi equities. Saudi Arabia’s Public Investment Fund was the anchor investor.

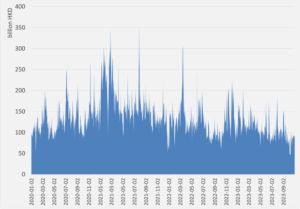

For the Middle Eastern players, the outflow of foreign capital from China presents an opportunity to pick up some good bargains. And for Hong Kong, the influx of the new Middle Eastern investors is helping to prop up a stalling stock marketwhere trading volumes have slumped over the past three years.

Daily trading value (HKD) on the HKEX

Source: HKEX

“Pointless” rupees and dollar dominance

India’s insistence that it pay for Russian seaborne oil in rupees didn’t go over well with their Russian counterparts, who thought it was “pointless” to receive revenue in a non-convertible currency with little value outside of India, Reuters reports.

One temporary solution, according to sources Reuters spoke with, was to use: “a combination of the Chinese yuan, the Hong-Kong dollar as a transition currency into the yuan and the UAE dirham, which is pegged to the US dollar.” Of the three currencies being used as stopgap alternatives, the latter two are essentially proxies for the US dollar. The takeaway from this anecdote: US dollar dominance isn’t being shaken.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSBlame the bots?

Back in September oil prices were nearing 100 USD a barrel. Then they plunged to the seventies-range last month. And according to Energy Voice, futures have swung by more than 2 USD a daily 161 times, a big jump from previous years. Some are blaming the heightened price volatility on bots trading on algorithms, which have a tendency to amplify trends: piling onto heavy sell-offs and crowding into dizzying rallies. Citing an unnamed source, Energy Source reports that certain White House officials think these bots played a significant role in the oil price run-up this year.

(Photo by Pixabay/Pexels)