US manufacturing is booming—but companies are coming up short on space for factories. Meanwhile, Tesla doubles down on China, Indonesia’s minerals push, and the White House finally funds the search for next generation COVID vaccines. Plus: a wheat blast disease pandemic could threaten global food security.

INDONESIA’S MINERALS AMBITIONS

Jakarta eyes US tax credits

Indonesia wants in on US electric vehicle tax credits. Having seen Washington secure deals with Japan and the EU, Jakarta is moving to propose a free trade deal for some battery minerals shipped to the US, so that Indonesian companies can also benefit from US tax incentives.

The wrinkle: As Indonesia’s metals and mining industry heats up, it’s bringing its deep China ties along. This week saw the public listing in Jakarta of PT Trimegah Bangun Persada, also known as Harita Nickel. Another Indonesian nickel player, Merdeka Battery Materials, is set to IPO next week. Both companies have existing partnerships with Chinese firms. Harita is partnering with China’s Lygend Mining on a nickel and cobalt smelting project, while Merdeka is affiliated with CATL, the Chinese battery giant.

That all leads to a pressing question: Since Indonesia banned nickel ore exports in 2020, Chinese companies, backed by financing from Chinese state-owned banks, have invested heavily in refining facilities there. Will granting Indonesia a free trade deal present yet another opportunity for Chinese companies to take advantage—and undermine the spirit—of Inflation Reduction Act incentives?

FACTORS

FACTORS

FACTORS

FACTORSCritical raw materials export restrictions are on the rise

The number of export restrictions on critical raw materials has grown five-fold over the last decade, according to a new report from the Organisation for Economic Cooperation and Development. Ten percent of global critical raw materials exports now face at least one export restriction measure, with export taxes and licensing requirements being the two most widely used measures.

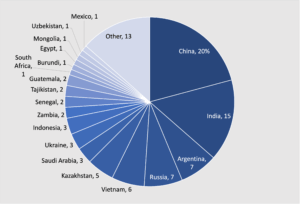

Leading the charge in imposing export restrictions is China, which has dramatically increased its number of restrictions, becoming the country with the most restrictions in 2020.

Share of global export restrictions on industrial raw materials, by imposing country, 2020

Source: OECD

Bad and less bad options for the Colorado River

The Colorado River, on which 40 million Americans depend for drinking water, is dwindling amid overuse, a drought, and climate change. States have blown past deadlines to hash out an agreement for sharing the burden of reducing water use. On Tuesday, the White House proposed imposing even reductions of water allotments as the least horrible of three bad options.

For now, there’s some relief thanks to a winter of heavy snowfall. The melting snowpack can boost water levels at Lake Mead, which fuels Hoover Dam to generate hydroelectricity. But the lake is still at precipitously low levels. The threat of “dead pool”—when water levels in key lakes fall so low that the river stops flowing—continues to loom large.

Building the future grid, pack by pack

The energy transition is transforming electricity systems, which will in turn require grid-scale energy storage to manage the variability of wind and solar generation. And on that front, Tesla is doubling down on its China bet: It’s building a large new factory in Shanghai to manufacture large-scale lithium-ion battery energy storage units, with production set to begin in Q2 2024. The new facility adds to Tesla’s other Megapack factory in Northern California.

Meanwhile, work on sodium-ion batteries—for stationary storage and eventually EVs–is gathering pace. Worldwide, there are now at least 28 sodium-ion gigafactories in the pipeline, and almost all are based in China. Yet there are few sodium-ion startups in the West.

As The Electric’s Steve Levine asks: “The US invented [nickel-manganese-cobalt batteries], then let Japan commercialize it. It invented [lithium-iron-phosphate batteries], but China took over production of it. Is sodium-ion the US’s colossal new battery blind spot?”

In other battery-related news: The White House this week unveiled its proposal to transform the US auto industry by requiring two-thirds of new car sales to be electric by 2032. It’s a lofty goal, and one that will require significantly more battery and magnet production capacity than the US currently has. If the EV tax credits are the big carrot for Big Auto, the proposal to drastically cut conventional vehicle sales is the big stick.

MARKETS

MARKETS

MARKETS

MARKETSWanted: mega sites for mega factories

Speaking of grid-scale batteries: Ramping up the electrical grid will be critical for sustaining the US manufacturing boom. Data from the Census Bureau shows manufacturing-related construction spending last year hit 108 billion USD, 37% more than in 2021.

But announcing investments is one thing, and finding actual, feasible, physical space in which to build factories is another. And it appears companies are quickly running into hurdles identifying so-called “mega sites” with access to transport, cheap and renewable energy, and a local talent pool.

One major constraint is factories’ high demand for electrical power. A report by the Lawrence Berkeley National Laboratory found that a typical project built in 2022 took five years from the initial request to be hooked up to the grid for commercial operations, up from under two years for projects built between 2000 to 2007.

From Operation Warp Speed to Project Next Gen

The White House has launched a 5 billion USD program to speed up the development of new vaccines and treatments for COVID. Dubbed Project Next Gen, the initiative will enable public-private partnerships to develop nasal vaccines and pan-coronavirus vaccines that can be more durable and protective over time and against new variants, as well as new therapies like monoclonal antibodies and anti-viral pills.

Cooling, but still too hot

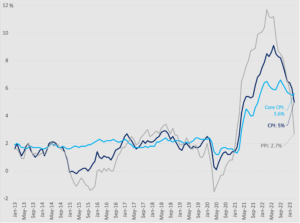

Is inflation finally cooling consistently? The latest CPI and PPI numbers from the Bureau of Labor Statistics offer reasons for some cautious optimism. Consumer prices in March rose 5% year-on-year, the smallest gain since May 2021. Core prices, which exclude food and energy, rose 5.6%, a small acceleration from February’s 5.5%. Meanwhile, producer prices fell 0.5% in March month-on-month, and slowed to a 2.7% increase on the year

The bottom line: inflation remains elevated far above the Fed’s 2% target, and there’s no guarantee prices will trace a straightforward downward trend. Even the failure of two regional banks wasn’t enough to put a pause to hikes in March, though several Fed officials considered such a move. In any case, the Fed will be weighing all this ahead of its policy meeting next month—and a lot can change before then.

US CPI and PPI, 12-month percentage change, not seasonally adjusted

Source: US Bureau of Labor Statistics

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSA wheat disease pandemic?

Scientists are sounding the alarm on a fungal pathogen that could spiral into a pandemic and threaten global food supplies. The “wheat blast” pathogen Magnaporthe oryzae originated in South America but has since spread to Africa and Asia, according to research published this week.

Genomic analysis of the wheat blast fungus suggests that the spread to two separate continents happened independently, indicating that human activity is likely transporting the pathogen across borders.

Bangladesh reported Asia’s first wheat blast outbreak in 2016; Africa’s first reported case came two years later when M. oryzae struck wheat crops in Zambia. Unless carefully surveilled and quickly eradicated, wheat blast threatens to spread globally, disrupting wheat and rice crops in some of the poorest parts of the world.

Elsewhere, another risk to global food security brewing: The Kremlin said this week that prospects for renewing the Black Sea grain export deal are “not so great” and threatened once again to pull out of the arrangement unless the West removes obstacles to Russian exports of grain and fertilizer.

(Photo by Pixabay/Pexels)