Australian rare earth miner Lynas hits roadblocks in Malaysia, just as the Southeast Asian nation rolls out the red carpet for its Chinese competitors. Meanwhile, battery giant CATL wants to lock in business with cut-rate prices—but only to select EV makers. Plus, natural gas prices tumble, more rate hikes in the US, and a manufacturing slowdown in Japan.

A STICKY DEPENDENCE

There’s no shaking China’s rare earths dominance yet

Despite wide-spread, long-standing concern, investment, and ambitious language, the global rare earths industry continues to feature variations on a central theme: reliance on China.

Recent developments in Malaysia only underscore that reality. Take Lynas, the only rare earths producer with scale outside of China. The Australian company is running into roadblocks in Malaysia, where it has a major processing plant—just as Chinese rare earths players are expanding their footprint in the Southeast Asian country.

Since opening in 2013, Lynas’ processing facility in Malaysia has been dependent on the Malaysian government’s willingness to renew its operating license. Recently, that has begun to present a problem: Authorities granted a mere six-month extension with new conditions in 2019; they then approved a three-year license in 2020—but with an added stipulation that bars Lynas from importing raw materials containing naturally occurring radioactive material.

Lynas says Malaysia is moving goalposts at will: The lanthanide concentrate import ban was never a condition of licenses granted before 2020, and not what the company signed up for when it first chose to invest in Malaysia. If Lynas is forced to shut a key part of its plant, its operations will be disrupted—and reliance on Chinese processors will increase further. The Malaysian government is showing some willingness to bargain. If Lynas can ship out radioactive waste from the country, authorities would “consider” allowing the continued operation of the company’s cracking and leaching unit. But that’s hardly a commitment.

And where Lynas is grappling with licensing headaches obstacles in Malaysia, Chinese companies are getting a warm red carpet welcome. Xiamen Tungsten just signed an MOU last month to mine rare earths in the country. Qingdao Joyful Investment is also mining for rare earths there, as the largest shareholder of a joint venture formed in April 2020 with Malaysian companies.

Both Chinese-linked projects will almost certainly ship raw material back to China, with minimal added value for Malaysia. Plus, the timing of Lynas’s licensing troubles and Xiamen Tungsten’s new MOU raises the question of whether Malaysia is intentionally choosing to prioritize Chinese companies over non-Chinese ones.

FACTORS

FACTORS

FACTORS

FACTORSWhat does bypassing China in rare earths mean?

Over in the US, rare earths miner MP Materials announced this week a deal to ship output from its new processing plant directly to Japan’s Sumitomo for exclusive distribution to Japanese customers. Media reports frame this deal as a move to “skip China;” MP and Sumitomo say it will “stabilize, diversify, and strengthen” the rare earths supply chain.

That sounds great, and is a sign of shifting winds. It also begs the question of how much reliance remains. According to MP’s filings, for the first nine months of 2022, over 96% of the company’s revenue came from sales to Shenghe Resources, the Chinese state-backed mining giant that owns a minority stake in MP.

CATL plays favorites

Chinese battery giant CATL is looking to cement its dominant market share by striking a deal with automakers: It will offer cut-rate prices on its EV batteries to select clients if they can commit to buying 80% of their battery needs from CATL over the next three years, according to media reports.

While CATL hasn’t confirmed details publicly, it’s possible it will only extend this loyalty program to Chinese EV makers like Li Auto, NIO, Huawei, and Zeekr. Tesla, despite having a significant manufacturing footprint in China, will reportedly be excluded. This selective pricing structure would effectively give preferential customers a 20% discount over spot market prices, according to calculations by the consultancy Roland Berger.

The Chinese tech outlet 36Kr described CATL’s plan as a “lithium rebate” program that passes cost savings from its lithium offtake contracts onto customers. Maybe so. It could also be an outright subsidy to select Chinese automakers, positioning them to undercut foreign competitors and in turn bringing increased downstream demand for, and locking in the role of, CATL’s vertically integrated operations. Or as the Chinese outlet 21st Century Business Herald put it, CATL’s pricing plan “has ample lethality.”

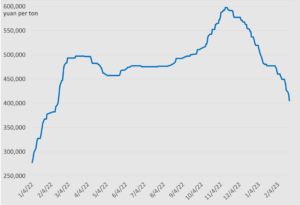

News of CATL’s pricing plan comes as lithium prices in China have slumped 30% in the past three months, falling from November highs to below 400,000 RMB (58,000 USD) per ton. Now, CATL’s offer of discounts—reportedly based on CATL-produced lithium carbonate priced at 200,000 RMB per ton—could put further downward pressure lithium prices.

Chinese industrial lithium carbonate prices

Source: Investing.com

Natural gas prices come tumbling down

Prices of gas in the US and Europe have slumped so much that the fuel is now becoming competitive with coal.

In the US, March Henry Hub futures for gas hit 2 USD per million British thermal units, down from over 9 USD last August and only slightly above the 1.85 USD seen in the crash of March 2020. That has made gas cheaper to burn than coal, as coal-fired plants become increasingly uncompetitive when gas prices dip below 3 USD/MMbtu.

Meanwhile, Freeport LNG in Texas finally has the green light to restart operations at its liquefaction facility and ramp up exports again. That could potentially put a floor on US gas prices. But analysts reckon limits on liquefaction and export capacity will likely continue to weigh on prices.

And in Europe, gas prices have fallen 15% from last summer’s peaks, with benchmark futures hovering around 50 euros. But gas prices may not have further to drop: The lower costs are on track to make gas more profitable than coal for power generation, particularly as prices of carbon permits surge. That could help put a cap on coal’s comeback; countries switched to the dirtier fuel as Russia’s throttling of supplies sent gas prices skyrocketing last year.

MARKETS

MARKETS

MARKETS

MARKETSThe US braces for more rate hikes

The US Fed’s preferred inflation gauge—the personal consumption expenditures index—edged higher in January, sending US stocks sharply down on investors’ concerns that the Fed will have to maintain rates at higher levels. The PCE price index rose 5.4% in January on the year, compared to 5.3% in December. Core PCE is also up, hitting 4.7% compared to 4.6% last month.

The stronger than expected inflation readings will bolster the Fed’s case for continued rate increases. Minutes from the central bank’s latest meeting state that inflation “remained well above” the 2% target, and that labor markets “remained very tight, contributing to upward pressures on wages and prices.” The bottom line: “ongoing” rate hikes will be necessary. The open question: How many more hikes, and at what cost?

US PCE index, year-on-year percentage change

Source: US Bureau of Economic Analysis, via FRED

Japan’s factory slowdown

A warning sign from Japan’s economy: Factory activity in the country contracted at the fastest pace in two and half years, with the manufacturing purchasing managers’ index (PMI) falling to 47.4 in February from 48.9 in the previous month.

That’s the fourth consecutive month that the index has stayed below 50, which separates contraction from expansion. Weak global demand and sluggish exports are dragging down the PMI reading, but a weak yen and high energy and commodity prices have also increased business costs.

Beijing sours on the Big Four

Bloomberg reports this week that Beijing is urging state-owned firms to phase out using the Big Four international auditors in favor of domestic accountants over data security concerns. It’s a clear sign that even as China looks to attract foreign financial management firms to set up shop in the country, authorities want to put a cap on overseas accounting firms’ share of the domestic market.

The authorities’ audit guidance also comes just months after last summer’s preliminary audit deal between US and Chinese regulators, which averted the mass delisting of Chinese firms from the New York bourse. US regulators say they were able to sufficiently inspect Chinese companies’ papers on their December trip to Hong Kong. Whether they can continue to work unobstructed is an open question. One through line runs through these recent developments: Foreign access to the Chinese market is only made available when it suits Beijing’s interests.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSNickel tumult

London’s nickel market is still in shambles a year after a massive short squeeze that nearly toppled the London Metal Exchange. Now, China’s Zhejiang Huayou Cobalt—one of several companies that held small short positions on the metal, alongside Tsingshan’s hefty short bets—will reportedly meet the LME’s chief executive to discuss registering the company’s nickel for delivery on the exchange. That could add much needed liquidity to the market, in turn tempering price volatility and helping trading volumes recover. The LME will also resume nickel trading during Asian hours later next month, another move that could help the exchange recover from last year’s fiasco.

(Photo by Pixabay/Pexels)