Jeep-maker Stellantis shells out for a stake in Chinese EV maker Leapmotor—and what could possibly go wrong? Meanwhile, a mega oil merger, Europe’s battery champion Northvolt eyes a mega IPO, and Russia and China eye ever closer relations. Plus: tensions flare in the South China Sea.

A RISKY DEAL

Stellantis buys a 21% stake in China’s Leapmotor

Stellantis, the Jeep and Chrysler maker, is buying a 21% stake in Chinese EV company Leapmotor for 1.6 billion USD.

The Netherlands-based legacy carmaker, formed from a 2021 merger between PSA and Fiat Chrysler, hopes the deal can boost its measly China sales. The eight-year-old Chinese EV upstart, meanwhile, wants to eat Stellantis’s lunch.

Under the deal, Stellantis will leverage Leapmotor’s EV technology to juice its China sales, while Leapmotor will make use of Stellantis’s global footprint to expand overseas. The two will also form a joint venture, with Stellantis taking a 51% stake and having exclusive rights for the export, sale, and manufacturing of Leapmotor products outside China. (One wonders if this is a ploy to insulate Leapmotor from potential tariffs stemming from the EU’s anti-subsidy probe.)

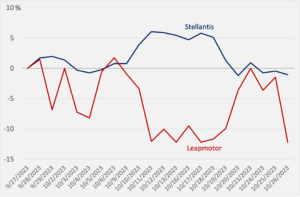

Percent change in share prices of Stellantis and Leapmotor, Sep.–Oct. 2023

Source: Investing.com

The Stellantis-Leapmotor deal follows on the heels of Volkswagen’s investment in Chinese EV maker XPeng this summer. It also comes just months after Stellantis said it is opting for an asset-light strategy in China to “limit exposure to geopolitical risk.” Taking a big stake in a Chinese automaker would appear to increase exposure to such risk.

That’s not to mention that Leapmotor’s founder and CEO Zhu Jiangming is also the founder of Dahua Technology, the video surveillance technology firm tied to Beijing’s crackdown on Uyghurs and sanctioned by the US. Zhu maintains a 4.8% stake in Dahua.

Meanwhile, one prominent Chinese automotive analyst sees the deal as a significant step towards boosting Chinese EVs’ global market share.

“Once overseas users begin to consume and experience the technical advantages of Chinese [EVs], products based on the rule system of multinational automotive enterprises, such as the Volkswagen ID. series, will be eliminated from the market quickly,” wrote Wang Xin, author of the blog Full Chain Car.

FACTORS

FACTORS

FACTORS

FACTORS“A new era of oil megamergers”

Chevron’s 53 billion USD all-stock purchase of Hess is the latest consolidation in the US oil industry—less than two weeks after Exxon’s 59.5 billion USD acquisition of Pioneer Nautral Resources. Rystad Energy says the latest deal the “accelerates a new era of oil megamergers;” the Wall Street Journal calls it the start of an “oil land grab” trend.

Hess’s operations in the Bakken region in North Dakota and its exploration scheme in Guyana help to diversify Chevron’s portfolio. And as Reuters notes, the two also make for unusual bedfellows: “The deal will oddly put Chevron in partnership with its biggest rival, as the Exxon/Hess/CNOOC tie-up is the only major operation in Guyana.”

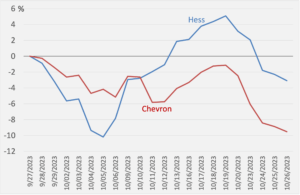

Percent change in share prices of Chevron and Hess, Sep.–Oct. 2023

Source: Investing.com

Peak fossil fuel demand

World oil, gas, and coal demand to peak by 2030, the International Energy Agency said in its latest annual World Energy Outlook report. That contrasts with OPEC’s projection that oil demand will continue to rise after 2030. Another key forecast from the IEA: China’s total energy demand is set to peak by 2025, as the country’s economic growth slows and its population declines. “China has changed the energy world, but now China is changing,” the IEA said, noting that this will have major implications for the global energy market.

Crowding in private investments in minerals

Australia and the US are considering using public investment vehicles, such as the US Export-Import Bank, to boost investment in critical minerals projects and crowd in private investment. Having public finance shoulder some of the risks is critical, said the Australian resource minister Madeleine King, particularly in small minerals projects that are especially susceptible to price gyrations. That’s especially so due to the presence of “a dominant market player that can change the price of its commodities in basically an instant,” she added—referring to, of course, China.

MARKETS

MARKETS

MARKETS

MARKETSNorthvolt eyes a big IPO

Swedish battery maker is planning a public listing in Stockholm that would value the company at 20 billion USD, the Financial Times reports. The company is backed by investors including Goldman Sachs, Volkswagen, BMW, Siemens, and Blackstone. It announced last month that it will build a fourth gigafactory in Canada’s Quebec, to be operational by 2026—a 5.2 billion USD project that Northvolt is eager to tap public capital markets for. Financing aside, a pressing challenge for Northvolt is sourcing raw materials in enough quantity while cutting reliance on the likes of Russia- and China-owned mining operations.

Russia and China get cozier still

Chinese premier Li Qiang met his Russian counterpart Mikhail Mishustin in Kyrgyzstan this week, pledging to boost trade and cooperation between the two countries and “further align [China’s] development strategies with Russia.”

One such development: Russian aluminum giant Rusal’s purchase of 30% stake in Chinese raw materials suppliers Hebei Wenfeng New Materials (HWNM), a move that Reuters calls “a significant marker in the reconfiguration of the global aluminium map.” With the HWNM investment, Rusal locks in key upstream supplies, plugging lost access from its Ukrainian refinery and an offtake from a joint venture in Australia. And China gets to buy up more of Rusal’s finished products—with more bargaining power as Russia loses other clients.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSSouth China Sea tensions

Last Sunday (Oct. 22), a Chinese coast guard ship and an accompanying vessel rammed a Philippine coast guard ship and a military-run supply boat Sunday off a contested shoal, according to Philippine officials. The Chinese coast guard maintains that the Philippine vessels “trespassed” into international waters that Beijing claims as its own. On Wednesday (Oct. 25), US president Joe Biden warned that the US would defend the Philippines if China attacks.

Needless to say, any armed conflict in the South China Sea would be hugely disruptive. Commercial shippers are taking note: the consultancy Container xChange writes in a recent note that there has been a “noticeable reduction in trade volume” at the Malacca Strait, the security and economic chokepoint connecting the Andaman and South China Seas.

(Photo by Aaron Curtis/Pexels)