Amid the chaos and tragedy of the Russia-Ukraine war, a new silver lining narrative has begun to emerge: That, at the very least, supply disruptions will catalyze a true new energy revolution in the US and Europe. That sounds great. The problem is that the money isn’t there to back it up. The emerging energy revolution matters, critically – for the climate, geopolitical competition, and global security. But while the US, and the West more broadly, are happy to do lip service to that reality, they are failing at the major industrial investments necessary to spark and to lead real change – and to win the competition for tomorrow’s energy.

Competing for the new energy revolution requires deliberate, and extensive, capital investments in the real economy: Minerals have to be mined and processed, technologies developed and matured, products manufactured and deployed. Throughout the process, we need new infrastructure systems – think electric vehicle charging stations — which themselves demand material inputs, new technologies, and large-scale construction. In other words, this energy revolution is expensive.

But investment in it promises to pay off, in spades. The green economy constitutes an enormous, growing, and largely untapped market opportunity – to the tune of trillions of dollars. It’s also an opportunity for geo-economic power: A new global energy, and with it industrial, landscape is taking shape. With appropriate and sufficient investments, a country can maneuver to control tomorrow’s supply chains and manufacturing capacity, and therefore to project influence internationally.

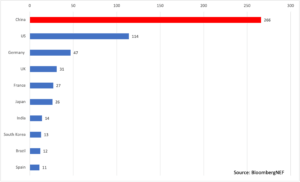

Right now, the country making those investments is China. In 2021, China dedicated 266 billion USD to investment in energy transition – compared to 114 on the part of the United States, a country with a GDP more than 5 trillion USD, or 33 percent, bigger. Even the combined investment in energy transition of the US, Germany, United Kingdom, and France continues to lag well behind China’s, 219 billion USD to 266.

The problem isn’t that the US – its allies and partners – lack the money. It’s that the money is not going to the real economy. All the incentives are for fast cash and flashy virtual investments; for metaverse and web3 buzzwords. As DealBook put it recently in discussing Europe’s climate economy: “In the competition for capital, green energy is losing out to ‘fast money’ investments in sectors like crypto and the metaverse.” And even what investment does flow to new industry-relevant targets, those tend to be early-stage technologies rather than their matured applications, upstream inputs, or the infrastructure necessary to back them up.

Investment in Energy Transition by Country, Billions USD (2021)

As long as this gap goes unaddressed, the US will fail to capitalize on the energy revolution. More dangerous yet, Beijing will continue to steam ahead toward global energy dominance. The current disruption of the Russia-Ukraine war, and the failure of the West decisively to punish Moscow, underscore the consequences: An authoritarian adversary that controls critical supply chains can wreak havoc on the world.

But it’s also not too late. The US is, still, the epicenter of relevant technological development. It still has industrial champions positioned to capitalize on today’s opportunity. And both the public and the private sector are waking up to the imperatives of dedicated investments in new energy and industry.

Government should help speed that process: It should use policy to incentivize private investment in the new energy industry. The Biden administration resuming oil leases on federal land offers such an example. So does the UK planning new nuclear reactors. Those moves should be paired with expedited permitting processes, tax breaks, and targeted government grants, including matching funds. At the same time, the US, its allies, and its partners should work together to launch a larger-scale, coordinated project – think Marshall Plan but for the energy revolution or, perhaps, a reboot of the World Bank and IMF.

However, government policy can only go so far. The private sector is the dominant force in today’s industrial landscape; it will be private sector that determines whether the US is able to lead the new energy charge. That means that Wall Street and Silicon Valley need to get the hint. They need to look past their quarterly returns and recognize that it is investment in the real economy, not web3 and the metaverse, that promises success in the long-term. They also need to recognize the massive opportunity presented by today’s supply chain disruptions, geopolitical tension, and skyrocketing inflation: The world needs supply. They’re positioned to deliver it. They just need a new investment thesis.

(Photo by Pexels)