There’s new progress in the European and North American rare earths supply chain, but is it enough? Plus we have energy turmoil as China calls dibs on Qatar’s natural gas, Europe’s bans on Russian oil and diesel loom, and the world heads toward diesel shortage – all while strikes threaten US, South Korean, and UK logistics; China’s back in lockdown; the KMT sweeps in Taiwan’s elections; and the OECD summarizes things neatly with a gloomy economic outlook for the year(s) ahead.

THE SUPPLY CHAIN CONTEST

Europe needs more magnet manufacturing capacity

A new rare earths supply chain spanning North America and Europe is taking shape. This month, the Swedish iron ore mining giant LKAB announced that it has become the biggest investor and owner in the Norwegian rare earths processing company REEtec.

LKAB’s 400 million kroner (40.3 million USD) investment will help fund the construction of REEtec’s first rare earths separation facility in Norway, expected to come online in 2024. To begin with, REEtec will source rare earth feedstock from Vital Metals’ mine in Canada; eventually, LKAB will also supply rare earth concentrate extracted as a byproduct from its iron ore mining.

These are promising developments. But there’s a big unanswered question: Given the extremely limited rare earth magnet manufacturing capacity in Europe, who will buy the REEtec’s rare earth oxides? If Chinese firms—which control 93 percent of the global permanent magnet market—are the only sizable customer around, then the supply chain is still reliant on Beijing.

On this front, the Canada-listed Neo Performance Materials — part of another emerging transatlantic rare earths supply chain with its partner Energy Fuels — is making some progress. Earlier this month, Estonia awarded Neo a grant of up to 18.7 million euros (19.5 million USD) to construct a vertically integrated rare earth magnet manufacturing facility, with an operational target of 2025. This is a step forward. But actually developing non-Chinese rare earth capacity will require understanding that the effort, and challenge, are about entire supply chains, not just nodes within them.

FACTORS

FACTORS

FACTORS

FACTORSChina calls dibs on Qatar’s natural gas

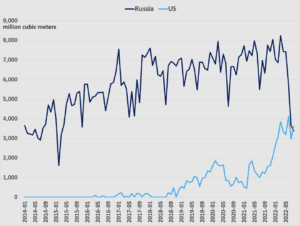

While Europe dithers on signing long-term LNG supply deals, China’s Sinopec has swooped in to snag a 27-year LNG contract with QatarEnergy. It’s the longest such deal to date and locks in a key source of supplies for China amid ongoing market volatility. The China-Qatar agreement is also a sign of the intensifying global competition for LNG, as Europe jostles for supplies to replace Russian pipeline gas.

And the global market is only getting tighter. The US has emerged as Europe’s biggest supplier of natural gas; Asian LNG spot prices jumped this week to a seven-week high as an ongoing outage at the Freeport export plant in the US and forecasts of cold weather in Europe signal potentially fewer shipments to the east. Meanwhile, Brussels is under pressure to set a price cap on imported natural gas. The European Commission unveiled its proposal this week in the hopes of calming markets, but set off a firestorm instead: Proponents of a cap say the cap is set too high, while opponents say any cap would disrupt the market and divert supplies to higher bidders in Asia instead.

EU27 monthly imports of natural gas from Russia and the US

Source: Eurostat

Oil whipsaws while Europe bickers

Oil prices experienced a momentary whipsaw this week on two pieces of news. First, a report that OPEC+ producers were contemplating increasing output sent US benchmark crude oil futures down over 5 percent. Hours later, Saudi Arabian authorities denied that report, saying instead that the cartel may announce a production cut at its December 4 meeting. That sent oil prices back up, erasing earlier losses. Now, the market may get some breathing room, as the US is set to grant Chevron a license to pump oil in Venezuela in a move that signals an easing of Washington’s years-long sanctions.

Meanwhile, an EU meeting on Wednesday failed to reach a deal on the cap level for Russian seaborne prices. That’s not the only question that European governments have to contemplate before the bloc’s ban on seaborne imports of Russian crude takes effect on December 5. Another is what Italy should do with an oil refinery in Sicily owned by Russian oil giant Lukoil. The refinery is Italy’s largest, accounting for a fifth of national refining capacity. Since the war, Italy has continued – and more than doubled – imports of Russian crude. It does not appear to have a plan for what to do with the refinery once the EU ban kicks in.

Saudi Arabia courts Asian oil importers

Saudi Arabia is determined to use its petrodollars as a currency of energy geopolitics. Last week, the kingdom’s crown prince made visits to major Asian oil importers. In South Korea, he signed tens of billions in deals spanning energy, defense, and construction, and announced a separate 7 billion dollar investment to expand capacity at a petrochemicals plant. In Thailand, the two countries pledged to cooperate on energy and tourism. And while a trip to Pakistan was scrapped, there is talk of a 10.5 billion dollar refinery investment there. The overall strategy is clear: Saudi Arabia wants to lock in oil consumption abroad, while using lucrative earnings from those exports to finance the development of its renewable energy industry at home.

MARKETS

MARKETS

MARKETS

MARKETSA US railroad strike looms, again

Another US railroad worker union has rejected a White House-brokered deal. Four unions have now voted down tentative agreements reached in September that temporarily staved off potentially crippling strikes. The prospect of massive disruptions now looms again; strikes can begin as early as December 9 if the two sides can’t reach an agreement before then. Leading to that deadline, freight companies will likely shut down certain shipments in anticipation of a strike. That means at least some disruptions to supply chains even if a full-blown strike is avoided.

Elsewhere, truckers in South Korea this week kicked off their second major strike since June. That’s risking major disruptions to manufacturing and fuel supplies for automotive and battery supply chains, with container traffic at ports already down 40 percent since the strike began. Over in the UK, thousands of postal workers launched a 48-hour strike, and ten additional days of stoppages are planned in the coming weeks. And Britain’s nurses are set to walk out for two days next month in the profession’s biggest ever industrial action.

And China locks down, again

One-fifth of the Chinese economy is now under some form of lockdown as officials scramble to put a lid on surging COVID-19 cases. Anger and resentment are brewing and in some instances boiling over: Protests over the restrictions have broken out at a Foxconn factory in Zhengzhou and at a locked-down district in Guangzhou. Yet these protests only make easing of China’s COVID-19 restrictions less likely.

For foreign companies with operations in China, that means continuing, and growing, uncertainty and disruptions. The Foxconn protests will hit Apple hard: 80 percent of its latest iPhone 14 models are produced at the Zhengzhou facility. This underscores the perils of reliance on Chinese production.

And side bar: Even some of Europe’s most historically pro-China economies are waking up to this reality. The Wall Street Journal reports that Berlin is considering new rules that would require some major companies with significant China exposure to disclose their reliance.

The OECD’s gloomy economic outlook

The Organization for Economic Cooperation and Development has a grim outlook for the global economy. Record inflation, a global energy crisis, Russia’s war on Ukraine, rising interest rates, and sagging confidence are all dragging down prospects of economic growth. While the group doesn’t foresee an outright global recession, it expects world GDP growth to slow to 2.2 percent next year and 2.7 percent in 2024. One silver lining: Inflation, while projected to remain high, is expected to moderate somewhat from 9.4 percent this year among OECD countries to 6.6 percent next year. The OECD’s prognosis comes on the heels of the International Monetary Fund’s forecast last month, which said “the worst is yet to come” and that 2023 will “feel like a recession” for many.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSGlobal diesel crunch

Diesel is heading for a global shortage. That will have widespread effects on the global economy, given the ubiquity of diesel in powering transportation, driving machinery, and heating homes.

A number of factors are coming together to heighten the supply squeeze. Stockpiles of diesel in the US are at decades-lows. Inventories in Europe are low even as traders there rush to hoard Russian diesel; on February 5, the bloc’s ban on Russian diesel will go into effect, worsening the crunch with limited alternative import options secured and the region’s refining system currently already operating well below pre-pandemic levels. Worldwide, refining capacity has been hampered by COVID-19 lockdowns, shipping disruptions, labor strikes, and insufficient investment. Poor countries will be among the hardest hit, beset by inflation, foreign exchange crises, the strong dollar, and their own slumping currencies.

New refinery capacity coming online could help ease some of the shortage. In its latest oil market report, the International Energy Agency forecasts refinery runs to increase by 2.3 million barrels per day in 2022 and by 1.4 billion barrels per day next year. Still, that increase will take time. As the IEA warns: “[U]ntil then, if prices go too high, further demand destruction may be inevitable for the market imbalances to clear.”

A KMT victory in Taiwan’s elections

Taiwanese President Tsai In-wen resigned as chair of her ruling party, the DPP, after the opposition Kuomintang (KMT) won the mayorship of Taipei, as well as a string of victories in local elections on Saturday. This result calls into question both conventional international assumptions about Taiwanese sentiment toward China and the wisdom – in Taiwan and more broadly – of focusing on abstractions of the “China threat” narrative at the expense of tangible local and economic questions. Tsai tried to make the election about China; the KMT focused on local matters. The latter won.

(Photo by Lokseng01/Wikimedia)