Fueled by Chinese demand, Brazil is on pace to tie the US as the world’s largest corn exporter. Is US grain dominance over? Meanwhile a natural gas trading hub in Turkey could help Russia circumvent sanctions, China’s opening threatens new inflationary pressures, Pakistan is desperate for a bail-out, and bird flu warning signals. Plus: Is the cobalt market growing bust?

THE FIGHT FOR GRAIN DOMINANCE

Big grains gains – for Brazil

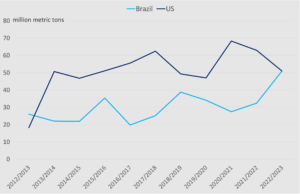

Brazil is set to tie the US as the world’s largest corn exporter in the 2022/23 marketing year (October–September), according to the latest monthly grain markets and trade report from the US Department of Agriculture. Since October 2022, Brazil has exported 25 million tons of corn, and is forecast to hit 51 million tons by September. By contrast, US exports have had a slow start, hampered by lower production and disrupted shipping due to low water levels on the Mississippi last fall.

Nonetheless, US farmers plan to boost corn acreage this year in the hopes of a bumper crop. Large harvests in both Brazil and the US could help ease prices for the staple grain, which remain elevated (though they have fallen from a 10-year-high in the immediate aftermath of Russia’s invasion of Ukraine).

Brazil’s corn export boom is fed in large part by appetite from the Chinese market: China opened up to Brazilian corn exports for the first time in November; the first shipment of Brazilian corn to China took place in January. And with Brazil’s prices lower than those of the US (and Beijing inclined to impose costs on Washington while wooing Brasília), Chinese buyers are opting for purchases from Brazil over the United States. US corn exporters are seeing a steep drop in orders from China this season compared to the previous two years.

The corn case feeds into a larger trend of Brazil has overtaking the US on grain production. In 2017, Brazil displaced the US as the world’s largest soybean exporter. The underlying question: Is this the twilight of US grain export dominance?

US and Brazil annual corn production, million metric tons

US Department of Agriculture

FACTORS

FACTORS

FACTORS

FACTORSCobalt boom and bust?

Cobalt prices are crashing. Having hit 40 USD a pound last May, prices for the critical metal are now at 17 USD per pound. The drop is a function in part of increased supply from the Democratic Republic of Congo and Indonesia; in part of sagging demand growth, especially as Chinese EV makers towards non-cobalt battery chemistries.

There are also a host of supply wildcards clouding the picture. Leading cobalt miner Glencore has lowered its cobalt output guidance this year by about 13 percent. China Molybdenum (CMOC), on the other hand, expects to increase production of cobalt this year by 144% compared to 2022. But those boosted supplies are not certain to hit the global market. That hinges on how the continuing dispute between the DRC state-owned miner Gecamines and CMOC unfolds: The DRC has blocked cobalt exports from the Tenke Fungurume mine, which is 80% owned by CMOC.

Meanwhile, Indonesia has emerged as the world’s second-largest producer of cobalt, after the DRC, according US Geological Survey data. Chinese firms are the dominant players in Indonesia’s cobalt rush, with big investments from nickel giant Tsingshan, cobalt refiner Zhejiang Huayou Cobalt, and battery maker CATL.

Turkey’s gas hub ambitions

Later this month, Turkey will convene a natural gas summit in Istanbul, bringing together gas supplier nations and European consumer countries. The aim is for the oil- and gas-sparse Turkey to become a regional trading hub where the benchmark price of gas is set. That could serve Moscow’s interests as it seeks to skirt Western sanctions, and increase its influence over global gas markets: Last year, Russian president Vladimir Putin suggested establishing a gas hub in Turkey.

How would the gas hub work? There are a couple possibilities. According to Energy Intelligence, Russia’s Gazprom wants to use its proprietary Electronic Sales Platform (ESP) at the Turkey-EU border. But that would likely be a no-go for European buyers. Alternatively, Turkey reportedly wants to use its domestic energy exchange, Epias, to sell gas from various sources. But Gazprom is likely wary of such a scenario, which would strip Moscow of control over the gas hub’s operations.

Refiner tastes

More signs are pointing to robust and growing oil demand in China. Passenger flights and road traffic are up, driving up demand for fuel. That will likely mean an increase in Chinese imports of crude, and a ramp-up in domestic refiners’ processing rates.

Where will Chinese refiners be sourcing their crude? Saudi Arabia just raised prices for Asian buyers of its flagship crude for the first time in six months, reflecting a bullish outlook on demand recovery. That could drive Chinese refiners to look for cheaper options. And it appears they have found one: State refiners are increasing imports of Russian crude, and likely claiming a good bargain in the process.

Regardless, don’t sleep on the impact that increased Chinese demand, for energy and more broadly, is poised to have on global inflationary trends.

MARKETS

MARKETS

MARKETS

MARKETSSlowing global trade…

Global trade could shrink as much as 2.5% this year, according to Maersk’s gloomy outlook. The container shipping giant reported a larger than expected decline in shipping volumes in the fourth quarter, ending a 16-quarter streak of earnings growth. And more headwinds are coming for the shipping industry, including weak consumer demand and a wave of new vessels coming online, which together could push freight spot rates down even more.

But Maersk itself has other options. As reshoring and friendshoring efforts gather pace, the company’s bet on positioning as an integrated logistics provider—as opposed to just a shipping company—could pay off. Companies’ efforts to rely less on China’s manufacturing base could see intermediate assembly steps moved elsewhere, which could raise demand for intermodal transport.

…or solid industrial strength?

If Maersk is one economic bellwether, the industrial sector is another. And on that front, things don’t look too bleak.

Electrical equipment maker Eaton expects 9% organic growth this year; Automatic systems supplier Emerson projects net sales growth of 10%; Grainger, which supplies big manufacturers with factory floor basics, saw sales grow 17% last year and expects to see 11% growth this year. Meanwhile, companies like HVAC leader Lennox and machinery makers Caterpillar and Deere are boosting their capital spending.

These recent indicators from industrial majors may be cause for some cautious economic optimism. They may also lend some credence to the idea that instead of one big demand-destroying recession, the global economy may instead see a series of rolling recessions: numerous slumps rippling in succession across the housing, manufacturing, and the service sectors, but no single hard landing.

Pakistan is desperate for a bailout

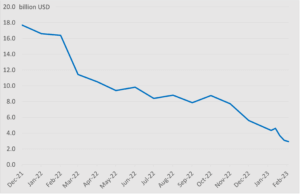

Pakistan continues to teeter on the edge of sovereign default. Its foreign exchange reserves have now dwindled to 2.9 billion USD as of February 3, according to the central bank. The International Monetary Fund just wrapped up a 10-day trip to the country for negotiations on a bailout; while that visit saw progress made, no definitive agreement has been reached.

In addition to floods, power outages, and high commodity prices, Pakistan faces the additional challenge of political turmoil that has strained relations with the IMF. And even a deal with the IMF would only release 1.1 billion worth of funds—a tiny fraction of the country’s 275 billion USD in national debt. Plus China, to which Pakistan owes roughly 30% of its foreign debt, has not offered any help with rolling over its loan. Other distressed emerging markets are surely eyeing Pakistan closely for clues on what a potential debt default wave will look like, and of course how China, a newly important global lender, will respond.

Pakistan’s liquid foreign exchange reserves, billion USD

State Bank of Pakistan

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSFlashing warning signs: bird flu’s chicken or egg dilemma

Bird flu is now spreading among mammals, in addition to wild birds and poultry. Four dead seals in Scotland tested positive this week for the deadly avian influenza H5N1 virus, which causes bird flu. That follows an outbreak of bird flu on a Spanish mink farm in October. These developments are heightening concerns that mammal-to-mammal transmission could spill over to humans and spark another global pandemic.

One reassuring note: There are already several US FDA-approved H5N1 vaccines, including one for which there is a (small) stockpile. The less reassuring note: The approved vaccines use an egg-based manufacturing process. But if bird flu kills all the chickens, where will the eggs come from?

(Photo by Tom Fisk/Pexels)