Could climate cooperation reset US-China relations? Probably not—and better to focus on how to compete on climate technologies. Meanwhile, the US tries to onshore a graphite supply chain, Russia threatens global food supplies, the UK gets a second gigafactory (with a dose of China dependence), and foreign companies ramp up investment in US manufacturing. Plus: potential freight chaos ahead.

CLIMATE COMPETITION

Beijing snubs Kerry’s overtures for climate cooperation

US climate enjoy John Kerry was in China this week seeking climate cooperation, even suggesting that working together on global warming could help redefine the troubled US-China relationship. Our take: seems unlikely.

Beijing sees energy as a matter of national security and a competitive domain through which to project power, gain leverage, and exact concessions. Singing the mantra of international cooperation to a geopolitical rival determined to take an adversarial approach to the renewable energy transition is likely to dead-end at best.

That’s not to say there’s no place for cooperation, even as Chinese leader Xi Jinping essentially snubbed Kerry’s overtures and said China would go its own way on emissions. But where Washington sees room for climate cooperation, Beijing sees competitive threat and opportunity.

Take methane emissions. Kerry says the issue is “particularly important for…cooperation” with China. Beijing disagrees. An op-ed this week in Chinese state media framed methane emission curbs as a potential “flashpoint in the US-China climate competition,” and also a way for Washington to “exert pressure on China.”

Tackling global warming will require global cooperation. Often, though, the language of cooperation can belie dependence: just look at China’s dominance over vast shares of numerous key clean-energy supply chains. The bottom line: the energy transition also fundamentally a technological and industrial competition with China.

FACTORS

FACTORS

FACTORS

FACTORSOnshoring the graphite supply chain

The US is currently 100% import dependent on graphite, a critical material required in batteries. The Department of Defense is hoping a 37.5 million dollar bet could help change that: this week, it extended a grant of that size to Graphite One, which is developing America’s largest graphite deposit and building a supply chain to process the mined graphite into battery- and industrial-grade graphite. The company projects an eventual annual production of over 55,000 tons of advanced graphite material—more than what the US imported in 2021.

A cautionary note: big-ticket mining projects often rise and fall with volatile mineral prices. And so far this year, natural graphite prices have sunk over 20% thanks increasing supplies from China and slowing EV sales. That puts pressure on graphite miners everywhere.

Russia sabotages the global food chain

World grain markets initially shrugged off Russia’s decision to torpedo the Black Sea grain deal, which since its agreement last July has helped Ukraine export over 30 million tons of grains amid the ongoing war.

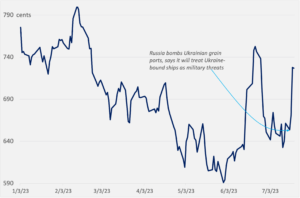

Then markets got a rude shock when Russia bombarded Ukrainian grain ports late Tuesday and early Wednesday, and said it would deem all Ukraine-bound ships as military threats. Wheat prices spiked on the news. Meanwhile, continues to bombard Ukraine’s food export facilities. And with Ukraine gearing up to sow its next wheat and rye crops in a matter of weeks, difficulties exporting those grains mean disruptions to the global food chain and potential knock-on effects on future plantings.

CBOT wheat futures

Source: Nasdaq.com

Europe gets mining

The EU is acknowledging that mining is key to the clean energy transition. The bloc has a complex system, dubbed a taxonomy, that identifies “sustainable” economic activities to be targeted for investments. This week, Brussels made explicit its intention to include the mining of critical raw materials within that green investment taxonomy—a direct nod to the importance of upstream inputs in boosting green technologies. Meanwhile, Chile and the EU just signed a new partnership to strengthen cooperation on raw material supply chains.

Japan and India want to build strategic gas reserves

Japan is working to set up a LNG reserve system this year to stockpile gas resources for “unexpected situations,” according to its minister of economy, trade, and industry. India is also looking to build up its gas storage capacity as a way to boost gas use and hedge against price swings, according to its oil secretary.

And Tokyo sees potential for the International Energy Agency to play a bigger role in gas security, including by enhancing gas storage monitoring and being better prepared for any supply disruptions.

MARKETS

MARKETS

MARKETS

MARKETSThe foreign manufacturing investment boom in the US

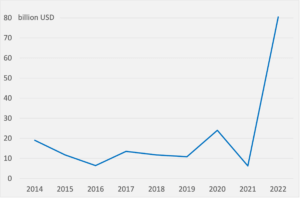

The US is seeing a big spike in foreign direct investment in manufacturing, according to data from the Bureau of Economic Analysis. A Wall Street Journal analysis bears this out too, showing the bulk of spending on clean-energy projects spurred by the IRA come from Japan, South Korea, and China.

Per the BEA, total planned expenditure in greenfield manufacturing projects, which include expansions and establishments of US businesses, jumped to over 80 billion USD in 2022—a big increase over pre-pandemic trends as IRA and CHIPS Act incentives woo foreign companies. Semiconductors and other electronics components manufacturing drove the bulk of the growth.

In less good news: US industrial production is falling. Fed data shows June’s index of industrial production at factories, mines and utilities fell 0.5% for a second month, while manufacturing output sank 0.3% in June, the most in three months. At least defense production is up, hitting a record high last month even amid the vapid industrial landscape.

Total planned expenditures of greenfield FDI projects in US manufacturing

Source: US Bureau of Economic Analysis

The UK gets a second gigafactory

India’s Tata Group is investing over 4 billion pounds (5.1 billion USD) to build a 40GWh capacity EV gigafactory in the UK. It’s a big boost for the British car industry: it’s the country’s second major battery plant, will double the UK’s battery pipeline capacity, and is what prime minister Rishi Sunak called a “massive vote of confidence”—especially after the homegrown battery startup Britishvolt went bust in January.

But the development also underlines the UK’s reliance on China for battery technology: Tata’s forthcoming battery plant will be built by China’s Envision—which also built the UK’s existing Gigafactory in Sunderland supplying Nissan’s car factory there.

Another potential hiccup: finding enough talent to staff the gigafactories. Over in the US, semiconductor giant TSMC said a skilled worker shortage is forcing it to delay production at its Arizona plant. The same could happen with batteries.

Investors pile into Asian debt markets

Investors are betting on Asian bonds: foreigners increased their holdings in Asian bond markets outside China by over 20 billion USD in the first half of 2023, the biggest half-year increase in two years. Bonds from countries like Indonesia and South Korea are looking particularly attractive in light of a weakening dollar, a stalling Chinese economy, and uncertainties over US-China geopolitical tensions. Plus, China’s mediocre second quarter 6.3% year-on-year GDP growthonly added to the bear case for the world’s second largest economy.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSTeamsters’ battles with UPS and Yellow

The showdown between courier giant UPS and the Teamsters union drags on, and will continue into the coming week as both sides are set to resume talks on Tuesday (Jul. 25). Given the scale of UPS operations—transporting about 25 million parcels, or about 6% of US GDP, everyday—a collapse of negotiations and an ensuing strike could cause widespread supply chain chaos.

Meanwhile, Teamsters is also duking it out with the debt-laden and trucking company Yellow, and is threatening to strikeas early as Monday. A UPS strike and a Yellow bankruptcy could deal a double whammy to US supply chains.

(Photo by Siegfried Poepperl/Pexels)