Beijing’s new laws increase the already high risks for foreign firms doing business in China—so will companies take the hint? Meanwhile, a US air conditioning startup partners with a Chinese battery giant, raising questions about potential commercial and potential risks. Plus: China snaps up Ukrainian grains, OPEC courts Guyana, and the importance of semiconductor materials.

AIR CONDITIONING AS STRATEGIC EMERGING TECHNOLOGY

Could industrial threats be lurking in ACs?

The world is getting hotter, and people are cranking up the air conditioning to stay cool. As the Wall Street Journal reported this week, startups are trying to invent new ways of cooling the air. Anyone who can figure out how to make super efficient ACs stands to disrupt the industry—and make lots of money.

One such company is Montana Technologies, which recently announced it will try to list via a SPAC in a deal valuing it at 500 million USD. The firm says it has a unique product design, developed by the Department of Energy’s Pacific Northwest National Laboratory and licensed to Montana Technologies for commercialization.

One detail that may not have gotten as much attention: the company has partnered with Chinese battery giant CATL in a 50-50 joint venture to manufacture the AirJoule product in Asia and Europe.

Our question: what commercial and industrial risks might this tie-up pose down the road? Remember, for example, our warnings about the Ford-CATL collaboration.

Plus, China sees value in developing energy efficient ACs and winning market share worldwide. Take Broad Group, a Chinese manufacturer of non-electric ACs, which the Chinese government has designated as a “single champion”—companies selected and supported by the state for their leading position in critical industrial nodes.

That leads to another question: will the Montana Technologies-CATL partnership end up using US resources to advance Chinese strategic aims?

FACTORS

FACTORS

FACTORS

FACTORSChina snaps up grains…

Who has benefited the most from the Black Sea grain deal, which facilitates Ukrainian grain exports amid the ongoing war? By one measure: China. The country has received 7.9 million tons of the grains exported, roughly 24% of total shipments, according to UN data. That makes it the “single largest recipient of food commodities shipped under the plan,” as the US Department of Agriculture put it.

China is also benefiting from disruptions to the global pig iron trade. According to S&P Global, prices of Russian-origin Black Sea pig iron have diverged significantly from US and Brazil markets since last February. And China, “already an emerging market for the CIS pig iron, is likely to become an increasingly important buyer of the Russian material.” Still, a lot will depend on Chinese domestic demand as its economy goes from bad to worse.

…and buys yet more American LNG

Texas-headquartered Cheniere Energy this week inked a 20-year LNG supply deal with China’s ENN Natural gas. The agreement adds to China’s recent string of long-term LNG contracts, including two mega 27-year deals with QatarEnergy signed last week and in November.

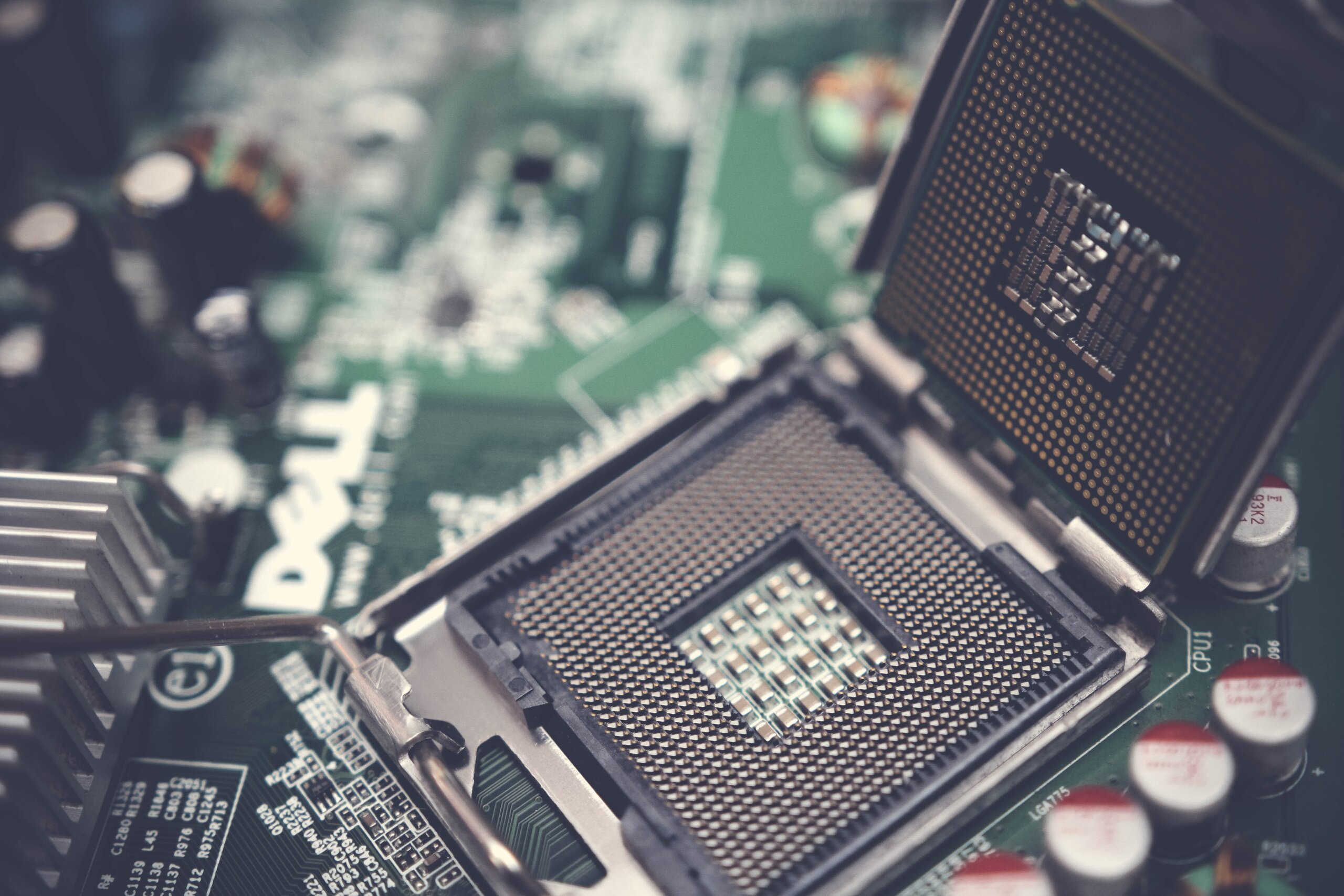

The long-term deals will help China ensure a steady supply of the chilled fuel and provide insulation spot market gyrations. Much of its increase in LNG imports are set to come from the USA and Qatar: according to the Oxford Institute for Energy Studies, 43% and 29% of Chinese LNG sales and purchase agreements signed in 2021-22 were with the US and Qatar, respectively.

That means increasing mutual reliance between the US and China for energy even as they try to decouple on supply chains. “Going forward, the USA and China will be increasingly interdependent for oil and gas. While this creates opportunities, it also creates vulnerabilities for both sides,” writes Michal Meidan in the OEIS report.

China’s LNG sales and purchase agreements 2021-22, by country

Source: Oxford Institute for Energy Studies

OPEC courts Guyana

Oil traders largely shrugged off last weekend’s political turmoil in Russia. But the coup attempt still has implications for global oil markets. For one, the political chaos could further disincentivize Moscow from curbing oil production in line with OPEC+ pledges, straining its relations with the cartel. Plus, Asian importers, who have benefited from discounted Russian fuels, may now rethink that dependency.

Against this backdrop, OPEC wants to court Guyana. The South American country is set to become the world’s largest oil producer per capita. ExxonMobil and its partners Hess and China National Offshore Oil Corp. are investing over 40 billion USD in five oil projects there. OPEC now wants a foothold there, too. For now, Guyana has politely declined.

The semiconductors ingredients list…

Any robust industrial strategy, as we’ve noted, requires starting from the upstream. The semiconductor supply chain is no exception. While the CHIPS Act has provided semiconductor manufacturers with tax incentives, it has not extended those benefits to makers of semiconductor materials.

That’s about to change. Beginning in September, semiconductor material producers looking to build capital intensive projects of 300 million USD and over can apply for government funding. The US can build all the fabs it wants, but without upstream materials—wafers, photoresists, sputter targets, and the like—there will be no chips.

MARKETS

MARKETS

MARKETS

MARKETS…and a Japanese state-backed enterprise acquires a semiconductor chemicals maker

The Japanese semiconductor chemicals maker JSR will be taken private by a the government-backed Japan Investment Corp. in a 903.9 billion yen ($6.3 billion) acquisition. JIC says the move will boost the company’s competitiveness, and more broadly that of the country’s semiconductor materials industry.

The move underscores the strategic importance of securing a full semiconductor supply chain: not just the finished chips, but also key inputs like photoresists—in which JSR commands 30% of global market share—that are used to create circuit lines on silicon wafers.

A note on the timing: the weak yen makes it easier to takeover Japanese companies, and JIC’s acquisition of JSR may be intended to preempt a foreign acquisition, as Takahiro Shinada of Tohoku University tells C&EN.

Lordstown goes bust

The Ohio-based electric vehicle maker Lordstown has gone belly up: it filed for bankruptcy and put itself up for sale, and so far has found no takers. Both Lordstown and its investment partner Foxconn have accused each other of breaching their agreement, and now the former has filed suit against the latter.

Electric vehicle manufacturing is a cut-throat business, and the downfall of Lordstown (one of many upstarts once dubbed “Tesla killer”) is a reminder of the challenges ahead in standing up a robust, non-China dependent EV industry. Meanwhile, Tesla is facing increasing competitive pressure in China: its sales there hit just a record quarterly high, but its market share there is shrinking.

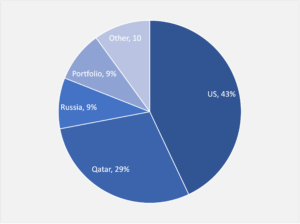

Core inflation’s very slow slowdown

The US Fed’s preferred gauge of inflation—the Personal Consumption Expenditures Index—plunged in May. Overall consumer prices rose 3.8% on the year, down from 5.4% in January and marking the lowest 12-month change in two years. That’s the good news. Worryingly, however, core prices excluding food and energy rose 4.6%, basically matching January’s 12-month rate of 4.7%. That suggests a very slow pace in the slowdown in core price increases—likely meaning a more prolonged rate-hiking campaign by the Fed.

The euro area is facing a similar situation: core prices excluding energy, food, alcohol, and tobacco are estimated to have increased 5.4% in June, essentially the same annual rate seen in January (5.3%).

US core PCE, percent change from year ago

Source: US Bureau of Economic Analysis

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSChina puts US companies on notice

Two new laws took effect in China on Saturday (Jul 1.): an amended counterespionage law that vastly expands the definition to espionage, and a foreign policy law that provides a clearer legal premise for China to take “countermeasures” against western actions it deems as threatening its national and economic security.

Both pieces of legislation add to the already heightened and murky risks of doing business in China. Washington is saying as much, with the National Counterintelligence and Security Center warning businesses of Beijing’s increasing power over, and control of, US companies with operations in China.

Of course, even without the latest two laws, Beijing has proven all too willing to target foreign firms and wage economic lawfare. The new legal powers don’t change that. But they are a clear signal of the direction Beijing is going in.

(Photo by Pok Rie/Pexels)