“Deglobalization” has entered the narrative zeitgeist. But what’s happening on the ground? This weekly series seeks to answer that question with a round-up of deglobalization developments from the week that’s done.

1. Even at Davos, the trend toward deglobalization is clear. A World Economic Forum piece this week, part of the Davos 2023 series, outlines a path for “reimagining your talent and technology strategies amid deglobalization: The deglobalization trend will accelerate as enterprises try to secure themselves from uncertainty, boost business resilience and mitigate risk. The most visible impact of deglobalization will be the urgency to exploit local markets, build proximity to customers, and re-shore and near-shore.”

2. MacroFab, a cloud manufacturing platform for building electronics with a network of more than 100 factories across North America, announced 42 million USD in new growth capital. The funding was led by Foundry, joined by BMW i Ventures, Edison Partners, and ATX Venture Partners. This brings MacroFab’s total financing to 82 million USD as it seeks to support the ongoing transformation of global supply chains. MacroFab’s shipments are up 275% year-over-year as companies move their electronics production to North America.

3. SeekingAlpha argues that GlobalFoundries, the last remaining US-based pure-play semiconductor foundry, is a rare bright spot amid general semiconductor malaise – underscoring the outsized opportunity of companies riding deglobalization trends. While semiconductor stocks are down 25% from a year ago, GlobalFoundries is about flat.

4. The Information dove into the $8 billion that investors like Sequoia, Susequehanna International Group, Coatue Management, and Tiger Global have poured into TikTok owner ByteDance – and now have no exit path for, amid both geopolitical tensions and Beijing’s techlash: “As of now, no initial public offering is remotely possible for the company as regulators in the US and China are tightening the screws on it.”

5. The House of Representatives passed legislation barring sales of oil from the strategic petroleum reserve to China – 331-97, with all Republicans and most Democrats in support. The bill, written by Energy and Commerce Committee Chairwoman Cathy McMorris Rodgers (R-WA), would prevent releases from the SPR to buyers “under the ownership, control, or influence of the Chinese Communist Party.”

6. The 2023 edition of Trade in Transition, by the Economist Impact research program and sponsored by DP World, finds that businesses are reshaping their supply chains to emphasize resilience over efficiency. In the process, they’re increasingly adopting concepts like “reshoring” and “nearshoring.” 96% of companies cited geopolitics as a major factor in supply chain management.

7. A note from the IMF argues that “after several decades of increasing global economic integration,” the world is headed toward “policy-driven geoeconomic fragmentation.” “The post Global Financial Crisis era has seen a leveling-off of global flows of goods and capital, and a surge in trade restrictions. The COVID-19 pandemic and Russia’s invasion of Ukraine have further tested international relations and increased skepticism about the benefits of globalization.”

8. Pensions and Investments describes this trend as an opportunity. One reality about deglobalization is clear: “It’s going to be a good opportunity for active management.” “Regional trading blocs, as well as economies and companies that can benefit from a more challenging environment, will make a great case for active management.”

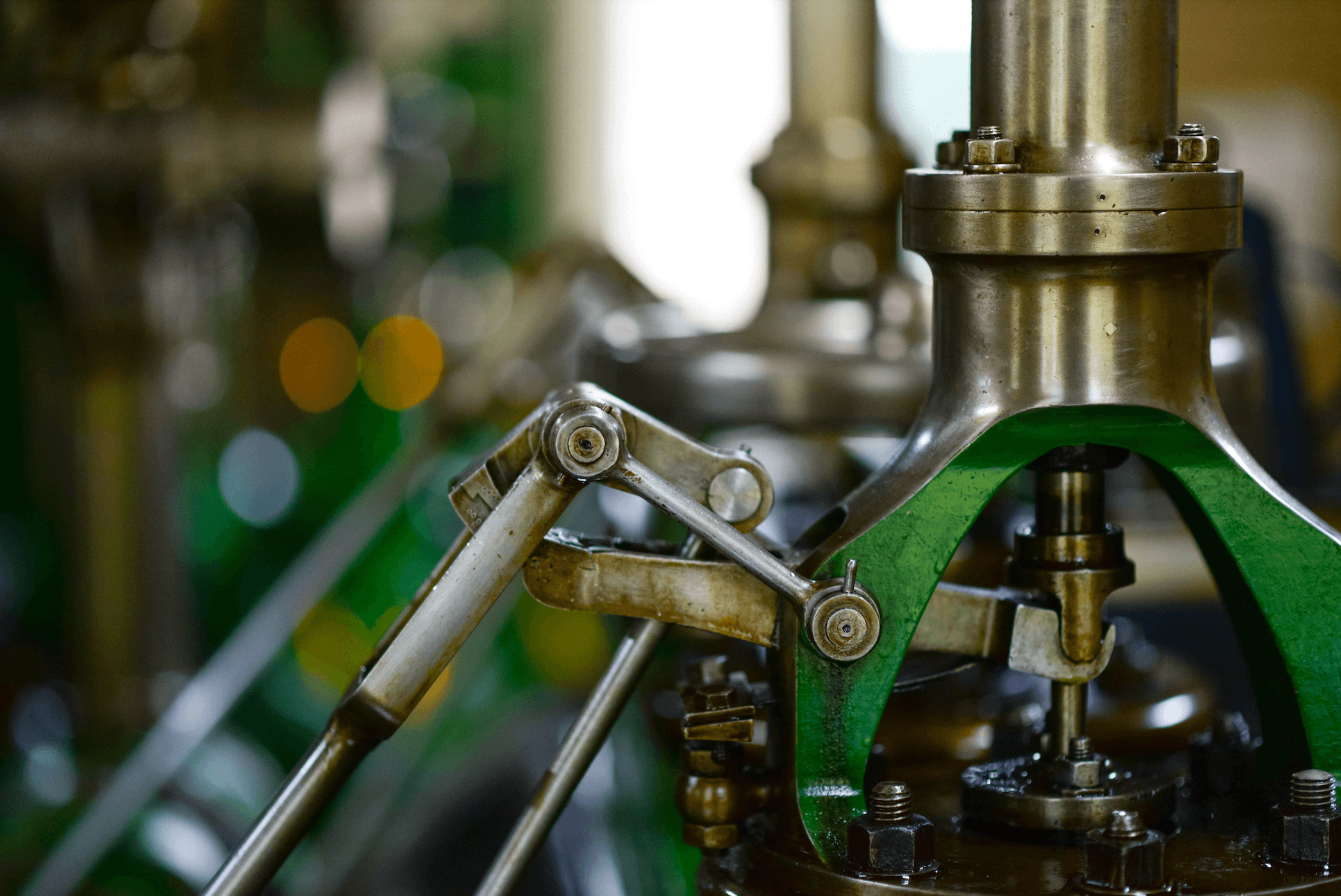

(Photo by Pexabay/Pexels)