We give you a blueprint of China’s industrial strategy and will a Guinean iron ore mine help China slash dependence on Australian imports? Meanwhile, the EU unveils a critical minerals plan—just as China tightens its grips on cobalt and lithium. Plus, continued Black Sea grain deal uncertainty, national security risks from the SVB bank crisis, and trade controls served two ways.

CHINA’S BIG GAME

“Single Champions,” “Little Giants,” and China’s industrial strategy

This week’s big story is from us. Our latest report, covered by the Wall Street Journal on Thursday, surfaces and reviews two major, and largely unknown, Chinese industrial policy programs: The “Single Champions” and “Little Giants” programs.

“Single Champions” and “Little Giants” refer to almost 10,000 “specialized and advanced” small- and medium-sized enterprises (SMEs) selected and supported by the Chinese government for either their leading position in critical industrial nodes or their potential to establish such a position. “Single Champion” companies reflect areas of established Chinese dominance in critical value chains: To be selected, a company must be a top-three global leader in its niche market, produce one to two key products serving that segment, and derive the bulk of its revenue from sales of those products.

“Little Giant” companies are frontrunners in developing Chinese dominance in key value chain nodes. Criteria for “Little Giants” include leading market share at the national or provincial level, a high degree of specialization in a specific market niche, high research and development expenditure, and robust profit growth. Beijing has selected over 9,000 “little giants” to date.

These programs have been under way since at least 2011, backed by the Chinese Ministry of Industry and Information Technology. They are a primary way by which Beijing operationalizes its “Made in China 2025” national strategy. They reflect key actors, strengths, weaknesses, and priorities in that strategy and, by extension, key areas of vulnerability, threat, and opportunity for the international system. These programs also reflect China’s underlying ambition: The “Single Champion” and “Little Giant” programs make clear that Beijing invests not only to acquire dominant industrial capacity, but also to establish positions of leverage in key global supply chains. Such positioning promises asymmetric dependence; access, including to technology and influence; and ultimately, coercive capacity. It’s also a decidedly different approach to industrial policy, strategy, and growth than that of the US — and that assumptions about China necessarily suggest.

FACTORS

FACTORS

FACTORS

FACTORSSteeling against iron ore dependence

After years of delays, work to develop Guinea’s Simandou—the world’s richest untapped deposits of high-grade iron ore—looks set to resume this month. Guinean authorities this week approved terms of a joint venture between the shareholders, which include Rio Tinto, Chinalco, China Baowu Steel, and the Chinese- and Singaporean-backed Winning Consortium Simandou.

For China, the project represents a major step forward in its efforts to reduce the domestic steel industry’s dependence on Brazilian and Australian iron ore imports. As one Chinese iron industry news portal put it this week, citing the Simandou news: “Chinese steel is achieving a three-dimensional breakthrough” across upstream, downstream, domestic, and foreign domains.

This means the project also threatens to undercut Australia’s iron ore export dominance—even as Simandou offers a potentially significant new supply source for Anglo-Australian Rio, the world’s largest iron ore producer. And for Guinea, the joint venture guarantees the government 15% of Simandou’s iron ore and a matching free 15% stake in railway and port infrastructure. Infrastructure had been a major sticking point in the negotiations; Guinea finally won out over Rio and Winning in its demand for a free carry of its infrastructure stake.

China’s tightening critical minerals grip

The EU this week unveiled two major pieces of legislation aimed at boosting the bloc’s competitiveness in the green industrial revolution. The Net-Zero Industry Act targets EU production of at least 40% of its green technology needs, while the Critical Raw Materials Act aims to boost extraction and processing.

But, surprise: China is set to further increase its control over the critical minerals that power climate technologies. The UK-based cobalt trader Darton Commodities projects that China’s share of cobalt production will reach 50% of global output by 2025, up from 44% now. UBS forecasts lithium extraction from Chinese-controlled mines to reach one-third of global supply by 2025, from 24% last year.

The Chinese playbook for minerals is by now familiar: First, identify critical inputs for important emerging technologies; second, occupy key upstream nodes by developing and acquiring resources at home and abroad, thus establishing influence over the rest of the supply chain; third, consolidate that control through further downstream investments (batteries, for example). (And if you want to see this playing out in real time, check out our “Little Giants” and “Single Champions” report.)

And continued Chinese focus at the upstream

Still, the long-term success of the Chinese strategy to dominate critical minerals supply chains isn’t set in stone. Take rare earths: while China dominates that industry, the country is growing concerned over its increasing reliance on imports of raw rare earth materials, and the security of those supplies.

That’s pushing Chinese rare earth players to scour the world for mining projects and offtake agreements. In particular, Chinese companies are investing in Australia’s heavy minerals sands projects, while also ramping up production at home. It’s all part of a push to secure low-cost raw materials at the upstream, which will feed Chinese manufacturers cheap inputs and strengthen their downstream dominance.

Unsteady grains

Ukraine and Russia just extended the stopgap agreement this weekend on their grain deal, but it’s unclear for what length of time. Moscow had already flipped flopped on the deal in the lead-up to November’s 120-day extension. Recently, Moscow has been demanding a shortened 60 day extension, in part as a bargaining chip for resumed ammonia exports through a pipeline across Ukraine.

The bottom line: The temporary nature of the grain deal means continued unpredictability in global grain markets. While prices of key crops are now back at pre-war levels, US wheat and corn futures jumped this week as traders weighed the continuing uncertainty. Global grain stocks are still tight, leaving the world vulnerable to disruption.

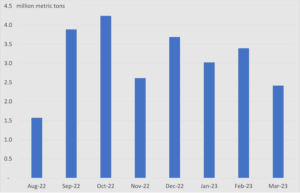

Black Sea Grain Initiative, monthly outbound shipments (through March 17)

Source: UN Black Sea Grain Initiative Joint Coordination Centre

MARKETS

MARKETS

MARKETS

MARKETSTrade controls, two ways

Rising regional threats are accelerating the Japan-South Korea rapprochement. It began last week with Seoul extending an olive branch, dropping its longstanding demand that Japanese firms compensate victims of forced labor during World War II. This week, the Japanese prime minister treated his visiting South Korean counterpart to omelette rice.

Culinary diplomacy was just the appetizer. The entrée was an agreement to boost collaboration on economic security, including Tokyo’s lifting of export controls on sales of semiconductor materials to South Korea.

Meanwhile, the EU is considering outbound investment controls to regulate how European firms invest in production facilities overseas. Those restrictions would seek to prevent the offshoring of certain production that risks circumventing export bans—like those recently imposed by the Netherlands on chipmaking equipment—by simply manufacturing technology elsewhere.

Global financial jitters and lurking security risks

Dust from Silicon Valley Bank’s collapse continues to settle. Central bankers worldwide are scrambling to ring fence contagion risk. To recap: US authorities stepped in to make all depositors of SVB and Signature Bank whole, essentially bailing out the two failed banks. Shares of regional banks plummeted on contagion fears; major US banks had to rescue First Republic Bank with a 30 billion USD injection. In Europe, Credit Suisse teetered on the brink before Switzerland’s central bank threw it a 54 billion dollar lifeline, while HSBC bought SVB’s UK arm for 1 GBP.

China is watching closely: The state-run Securities Daily said this week that China should take “lessons” from SVB’s collapse, adding that the crisis has “important implications for the development of small and medium-sized banks and the stability of the financial system in China. And if history is any guide, China may be positioning to use the SVB crisis as a strategic opportunity to gain a deeper foothold in the US innovation ecosystem.

Hot CPI, cooling PPI, slowing shopping spree

Inflation is cooling, but not quickly enough. Prices are falling, but remain high. Now throw in acute stress on the banking system and the US Federal Reserve finds itself with a knotty problem: How to tame inflation without jeopardizing financial stability?

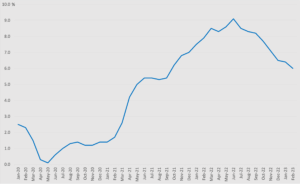

The latest consumer price index figures show inflation eased in February: Prices rose 0.4% from the preceding month, down slightly from January’s 0.5%. The year-on-year rise also slowed, dropping to 6% in February versus 6.4% in January. But that’s still far higher than the Fed’s 2% target. And core inflation, which excludes volatile energy and food prices, actually rose: 0.5% on the month in February, up from 0.4% in January.

That said, there are indicators of softening price pressures, too. Retail sales fell 0.4% in February, down from January’s increase of 3.2%. And the producer price index, which tracks wholesale prices, posted a surprise 0.1% drop (thanks in large part to plunging egg prices), bucking predictions of a 0.3% increase. That could ease upward pressures on consumer prices.

All eyes are now on the Fed’s rates decision this coming week, on the heels of the European Central Bank’s decision to stick with its 0.5% hike.

US CPI, 12 month percentage change

Source: US Bureau of Labor Statistics

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSAll aboard the AUKUS submarine deal?

The US, UK, and Australia have inked a landmark submarine deal. Some key components of the arrangement: Australia will buy up to five US Virginia-class nuclear submarines; the UK and US will help Canberra in its efforts to build a new AUKUS-class submarine; Australia will invest in the US shipbuilding industry; and the US will ramp up investment into its defense industrial base to boost submarine production.

In short, the deal is complex, expensive, and decades-long. Changing domestic political or fiscal constraints in each of the three participating countries could derail the deal. One thing is certain: Maintaining an edge in naval military capabilities requires robust industrial shipbuilding capacity. And on that front, the US Navy currently faces parts and labor shortages.

(Photo by Pixabay/Pexels)