Potential copper and graphite shortfall raises questions about future battery supply. Italy takes steps toward becoming a European energy hub, China’s natural gas crunch explained, a multilateral move in chip restrictions on China, and the Maersk-MSC shipping alliance breakup could shake up global shipping. Plus, reading the tea leaves of the US economy and a moment of truth for indebted African countries.

THE BIG BATTERY QUESTION

Copper troubles and graphite black swan

Numerous factors are coming together to potentially squeeze global copper supplies just as demand is set to surge. As we noted last week, protests in Peru have disrupted operations at major copper mines. And this week, Freeport McMoran flagged US worker shortages as a major limiting factor on its copper production, reflecting a broader skills crunch across the minerals and mining industry.

Meanwhile, mine delays and snarls in Chile are crimping copper output: The state-run Codelco recorded a 10% drop in copper production last year compared to 2021, and Chile’s total national production is now forecast to peak lower and later. Then there’s Panama, where the government may force a major copper mine to halt operations over a contract dispute. With so much uncertainty surrounding mining projects in Latin America, firms are looking to develop deposits elsewhere. Australia’s BHP this week struck a deal with Canada’s Munduro Capital to take a stake in three exploration areas in Serbia.

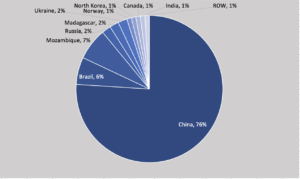

Plus, another critical battery mineral is set for an acute supply squeeze: graphite, which makes up 90% of a battery’s negative anode. As with many minerals, China dominates in production and processing: roughly 80% of the world’s mined graphite comes from China. The country is also a leading producer of artificial or synthetic graphite.

And indications suggest that China will consider limiting exports of natural graphite as a way to conserve domestic resources: A 2022 article in the China Engineering Journal noted that “compared with the metal mining industry, China’s graphite industry is not resolute in its ‘going out’ development,” with only one private Chinese firm currently active in developing a graphite project in Africa. That’s likely referring to the Australia-listed Triton Minerals, which has a Chinese firm as its largest shareholder.

Global graphite flake production, 2021

Source: S&P Global

FACTORS

FACTORS

FACTORS

FACTORSItaly’s energy hub ambitions

Where a state leader’s chooses to go for their first official bilateral trip abroad is calculated to send a clear signal on top policy priorities. For Italian prime minister Giorgia Meloni, visiting gas-rich Algeria this week underlined Rome’s determination to strengthen its energy security and wean itself off Russian fuels. The trip netted a raft of deals: a new gas and hydrogen- pipeline and undersea power cable linking the two countries; agreements between the Italian state-owned Eni and Algeria’s Sonatrach on joint energy projects; plus pledges to cooperate in areas like automotives, shipbuilding, space, and, green energy.

Separately, Italian gas grid operator Snam plans to invest 10 billion euros (10.8 billion USD) through 2026 in the gas industry, with the bulk of it funding the construction of the Adriatic Line to transport gas via pipelines from Africa and Caspian basin.

Italy has already made clear that it intends to become a regional energy hub, leveraging its strategic location in southern Europe and positioning as a critical pathway for gas and hydrogen flows. Deepening energy ties with Algeria are a key step in pursuit of that goal.

Hydrogen pipeline dreams

In other pipeline news, European transmission system operators Gascade and Fluxys are seeking a special regulatory status from the European Commission for their North Sea pipeline green hydrogen pipeline so as to speed up approvals and funding. Named the AquaDuctus, the 400 kilometer project will transport wind- and solar-power derived hydrogen produced at offshore sites to users on the mainland.

Another hydrogen pipeline in the works: a Norway-Germany pipeline, announced earlier this month, intended to transport hydrogen initially made from Norwegian gas fields and eventually from offshore wind farms in the North Sea.

China’s gas shortage, explained

China has been snapping up long-term LNG supply deals, cementing its position as a dominant buyer of the fuel. The country is certainly not short on natural gas supplies. But that hasn’t prevented a gas crunch this winter in Hebei province.

How to explain that? The shortage stems from high natural gas prices due to the Russia-Ukraine war, and Chinese regulations that cap retail gas prices but not wholesale prices. It’s also reminiscent of the country’s energy crisis in 2021 that led to factory shutdowns and rolling blackouts, as coal prices surged beyond what utilities could sell electricity for.

Short term crunch or not, China’s gas demand is expected to be a major swing factor determining how tight the global gas market will be this year. A key beneficiary is Russia: China’s LNG imports from Russia’s Sakhalin-2 project doubled in 2022, according to Reuters. The increased demand, coming also from other Asian buyers, could see the Sakhalin-2 doubling its revenue this year. For the US and its Western partners, this raises the question of when China’s ongoing support for Russia’s economy, and therefore Russia’s invasion of Ukraine, will be too much. And warnings from Washington this week about Chinese State-owned entities supporting the Russian war effort, as well as the sanctioning of China’s Spacety for providing satellite imagery to Russia’s Wagner Group, could signal that that moment is soon.

Trading gas, around the price cap

The Intercontinental Exchange, or ICE, said Friday (January 27) that it will launch a “parallel market” in London for TTF natural gas futures. Its TTF contracts are currently traded in Amsterdam, but ICE will activate the new London market as “insurance” to allow traders to circumvent the EU’s gas price cap. London has said it won’t enforce the EU price cap. Not great news for the price cap champions.

Separately, financial software company and commodities exchange Abaxx this week submitted contract specifications to Singaporean regulators for a new physically-settled LNG futures contract. The regional contracts would cover northwest Europe, north Asia Pacific, and the US Gulf of Mexico. Abaxx says they will improve price discovery and risk transfer.

MARKETS

MARKETS

MARKETS

MARKETSReading the US economy’s tea leaves

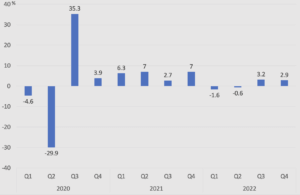

The US economy grew 2.9% in the fourth quarter from the previous quarter, besting economists’ expected reading of 2.8%. It’s still a deceleration from the third quarter’s 3.2%, but nothing like the screeching halt that investors had feared from the effects of the Fed’s aggressive monetary tightening.

Still, there are signs of sputtering momentum and the potential for further slowdowns ahead. Perhaps most concerning is the fall-off in business investment, which slowed to a 0.7% annual pace in the fourth quarter, compared to 6.2% in the preceding quarter. Consumer spending is also dropping off: It fell by 0.2% in December, while November was revised to -0.1% from 0.1%.

The hope is that the central bank can scale back its rate hikes soon enough to avert a recession. Conditions may be in place for them to do so: The Fed’s preferred inflation gauge, the core personal consumption expenditures price index, rose 0.3% in December on the month and 4.4% from a year earlier. Core PCE is now at its lowest since October 2021.

US real GDP, percent change from previous period

Source: US Bureau of Economic Analysis

South Korea slumps, and the Philippines surges

Over in South Korea, the outlook is gloomier: GDP shrank by 0.4% in the October-December period from the prior quarter, more than the expected 0.3% fall and the country’s first economic contraction in two and a half years. The shrinkage was led by a steep drop in exports, dragged down by China’s Covid disruptions, and a smaller—but unexpected—slump in private consumption.

By contrast, over in the Philippines, fourth-quarter growth was the fastest in over four decades: 7.2% annual growth, and 7.6% for the full year. And the government forecasts growth to maintain an aggressive pace of 7% this year, helped by increased tourism and improved labor market conditions. Faster inflation, however, could weigh on demand.

Multilateral chip restrictions on China

Japan and the Netherlands agreed this week to join the US in restricting the export of advanced chipmaking machinery to China, marking a step toward implementing a coordinated and multilateral approach to slowing the Chinese military’s chip development efforts. According to media reports, Dutch authorities will bar ASML from selling certain machines to China, while Tokyo will impose restrictions on Nikon.

This could be a huge development not only for US efforts to limit the development of Beijing’s semiconductor program but also for the ambition to form a multilateral front in combating China. At the same time, the one consistent reality about export controls? That they’re easier said than done, especially when companies have every incentive to maneuver around them.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSZambia’s debt crisis

Zambia, Africa’s second largest copper producer, was the first African nation to default on its sovereign debt during the Covid pandemic. Now, its economic fate hinges on whether China—which holds more than a third of its dollar debt—can help push forward a restructuring strategy to cope with the country’s debt crisis.

This week brought a small sign of progress as Washington put pressure on China: Beijing agreed “in principle” to help restructure Zambia’s debt (though not without first demanding that the US “cope with its own debt problem”). How a formal debt restructuring agreement ultimately takes shape will set an important precedent for other indebted African countries in a world where China plays an increasingly determinative role in their financial prospects.

Maersk and MSC’s 2M alliance is no more

The world’s two largest container shipping carriers announced this week that in 2025, they will break up their 2M alliance, which allows them to share cargo capacity. That decision could have far-reaching implications for the global shipping industry—and with it, global trade flows. The split is not entirely surprising. Both carriers had already been moving in different directions, with MSC focusing on expanding its fleet and Maersk investing heavily in becoming an integrated logistics provider. As the two companies put it, going their separate ways will allow them to pursue their separate strategies.

The question is what will happen next. 2M would have expanded into the P3 alliance if it hadn’t been for China’s surprise rejection in 2014 of the tripartite tie-up between Maersk, MSC, and France’s CMA CGM. Beijing argued P3 would have been anti-competitive, but Chinese academics like Liu Bin of the Dalian Maritime University have said the quiet part out loud: “The refusal to grant P3 is in line with China’s strategy.”

With 2M dismantled, the other two major alliances—the Ocean Alliance, of which Chinese state shipping giant Cosco is a member, and the THE alliance—could also get reshuffled. Maersk and MSC may each look to partner up with another carrier. One thing is certain: As in 2014, China will seek to leverage access to its ports and export market to influence the shape of shipping alliances. And perhaps this time, a newly assertive China will seek not only to deny the development of potential rivals, but also more directly to advance the positioning of its favored companies and alliances.

(Photo by Julius Silver/Pexels)