Call it industrial policy, state intervention, or marketcrafting: governments have realized that market forces alone won’t address economic security and supply chain risks. Meanwhile, LNG volatility spikes, offshore wind investments hit snags, and the White House targets investment in Chinese tech. Plus: global food turmoil.

CHIPS AND IRA: ONE YEAR ON

Industrial policy’s comeback and pushback

This week marked the first anniversary of America’s CHIPS Act, and this coming Wednesday will be one year since the Inflation Reduction Act was signed into law.

The blockbuster legislations have unleashed a surge in US spending in manufacturing: some 230 billion USD in manufacturing investments and over 87,000 new jobs created, by one count. It’s not for nothing that the World Bank recently declared industrial policy’s official comeback.

But pushback is afoot, too. The EU’s recently retired chief competition economist Pierre Régibeau last week dismissed concerns about the hollowing out of Europe’s heavy industry.

“If it disappears, so be it,” he said, adding that safeguarding the bloc’s industrial base with taxpayer money is “stupid” and natural market forces will make sure any “shocks are absorbed.”

The EU’s vice president Margaritis Schinas wasn’t pleased: “It took a pandemic and now a war to realize that Europe needs a solid industrial capacity and strategic autonomy,” he wrote.

Plus, new economic research on industrial policy is urging a reassessment of the mainstream orthodox cannon, which has long faulted government intervention for as wasteful and distortionary.

The new literature is “much more favorable to industrial policy, tending to find that such policies…have often led to large, seemingly beneficial long-term effects in the structure of economic activity,” writes Harvard’s Dani Rodrik.

The debate over industrial policy is far from settled. One thing is clear, though: the world’s second-largest economy continues to pursue state interventions—with massive distortionary effects for everyone else.

FACTORS

FACTORS

FACTORS

FACTORSEurope’s LNG crisis continues…

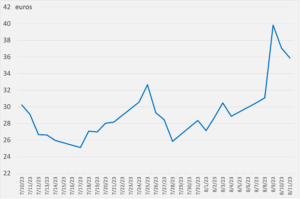

European benchmark natural gas prices jumped almost 40% this week on news of potential disruptions to global supplies due a planned strike by workers at key LNG plants in Australia. Those facilities supply about 10% of the global LNG market, and interruptions to Australian LNG exports—which Chevron and Woodside are scrambling to avert—could send prices spiraling upwards as Asian buyers compete to outbid European customers.

Europe’s high gas storage levels are helping to keep price increases in check. But with the global energy crisis by no means over, even the faintest sign of supply disruption can mean extreme volatility.

Dutch TTF natural gas prices

Source: Investing.com

…while Japan wants LNG assurances

Strikes aren’t the only potential disruptions Australian LNG exports. Japan, which counts on Australia for some 40% of its natural gas needs, has eyed Australia’s new carbon emissions rules warily, fearing risks to its energy security if Canberra’s carbon reduction targets limit the construction of new LNG export terminals. To hedge its bets and secure supplies, LNG Japan just struck a 880 million USD deal for a 10% stake in a large natural gas project off the coast of Western Australia.

Offshore wind could go off the rails

By 2024, China will deliver almost 70% of all new offshore wind projects globally, according to the International Energy Agency. And the country’s dominance in global offshore wind capacity could strengthen further as soaring costs threaten projects in the west. At least 10 offshore projects totaling 33 billion USD in planned investments have been delayed or put on hold in Europe and the US in recent weeks, the Wall Street Journal reports. The CEO of offshore wind developer Equinor says this is “the industry’s first crisis.” For China’s domestic players, that could present a lucrative opportunity.

Glencore stockpiles cobalt

Prices of cobalt have slumped this year on weak global demand and rising supplies from Congo and Indonesia. The commodity giant Glencore said this week that it stockpiled the key battery metal in the first half of the year to support prices, and may consider reducing production and more stockpiling.

China is building up its stores, too: Bloomberg reported last month that the government’s stockpiling body is taking advantage of tumbling prices to build up state reserves. That would give Chinese refiners, which already dominate cobalt processing, better margins—and making it all the harder for overseas processors to compete.

MARKETS

MARKETS

MARKETS

MARKETSWashington rolls out new outbound investment restrictions…

US president Joe Biden signed an executive order to place narrow limitations on US investments in China’s semiconductors and microelectronics, quantum computing, and artificial intelligence industries. The order also considers potentially banning investments into certain sensitive technologies within those sectors. Other countries may follow suit: the EU is also studying outbound screening mechanisms, and the UK is considering something similar.

The big question: these targeted bans meaningfully constrain China’s industrial ecosystem, or will they only hit surface-level threads while leaving deeper level nodes unaffected? (For a cautionary tale, look no further than Huawei’s comeback.)

…while China continues to invest in key technologies overseas

In the two years it took Washington to finalize its executive order on outbound investment, China has continued to invest in sensitive technologies overseas. Take the investment arm of Chinese EV maker Nio. This week, Nio Capital led a financing round in Italian electric drive solutions provider Mavel, whose powertrains will be used in Nio’s next-generation models. That comes after Nio Capital’s investment last September in Boston-based ClearMotion, which makes light detecting and raging sensors for cars.

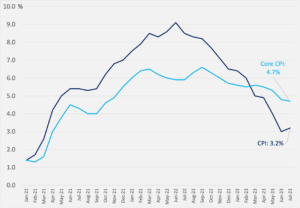

Good inflation feels, bad deflation news

US inflation is showing more signs of cooling: the consumer price index rose 3.2% in the 12 months to July, while the core index rose 4.7% over the same period. The overall CPI is up slightly from June’s 3%—the first acceleration in 13 months—but underlying details are encouraging: rent prices are moderating, airfares fell sharply, and used cars and trucks also saw declines.

The picture is looks far more grim in China. July trade figures show a third straight month of falling exports, and imports also contracted much faster than expected. Meanwhile, Chinese consumer and producer prices both fell more than forecast last month, tipping the country into deflation as the economic recovery continues to sputter.

US inflation, 12-month percent change

Source: US Bureau of Labor Statistics

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSTurmoil in the global food system

Food inflation risks are intensifying thanks to dryness in Thailand and floods in China, both of which are threatening rice crops and pushing rice prices up to their highest level in almost 15 years. That threatens food security for the world’s poorest people in Asia and Africa, who depend on the grain for a large portion of their caloric intake.

Elsewhere, Ukraine’s declaration of war on Russia’s Black Sea shipping further threatens disruptions to Russian grain exports. Moscow is hoping to grab market share by supplying grains to Africa, which had relied on Ukrainian grain until Russia pulled out of a deal that provided safe passage to Ukraine’s food cargo in the Black Sea.

(Photo by Pixabay/Pexels)