Major semiconductor companies largely brush off Washington’s updated export restrictions. Russia wants to sell more gas to China, but Beijing plays hard to get. A major lithium takeover deal crumbles. Defense stocks are in the doldrums. Plus: drug traffickers infiltrate shipping lines and ports.

US CHIIP RESTRICTIONS: STILL FULL OF HOLES

Chip equipment makers see little impact from Washington’s new curbs

Washington has expanded its restrictions on semiconductor exports, barring the sale of more advanced chips designed by Nvidia and others to China. The move updates regulations released in October 2022.

But will the new curbs actually plug “loopholes,” as US officials and media reporting frame it? Comments during earnings calls this week from top chips manufacturing equipment makers suggest not.

Lam Research CEO Timothy Archer does not foresee “any material impact to our forecasted business” from the new regulations. CFO Douglas Bettinger echoed that sentiment: “Nothing new came from the regulations.” In fact, Lam’s sales to China are booming: China accounted for 48% of its revenue in the three months to September, up from 26% in the previous quarter.

The same goes for ASML. Its sales to China hit 2.44 billion euros ($2.58 billion) in the September quarter, nearly doubling the previous period and comprising 46% of total revenue for the quarter. CEO Peter Wennick says that the company is complying with export controls, and that the updated rules will impact around 10% to 15% of current shipments

Ultimately, piecemeal approaches like entity-based curbs are no match for an all-encompassing techno-industrial competition. Not only is China exploiting loopholes, it’s forging ahead with next-generation technologies. What’s needed is strategic action that enables the US to compete all along the semiconductor supply chain—not just playing whac-a-mole.

FACTORS

FACTORS

FACTORS

FACTORSPutin’s push for a China gas deal

Russia really, really wants to sell China some natural gas. Wrapping up his two-day visit to Beijing, Russian president Vladimir Putin touted “unprecedented” energy ties with China. That sounds like an exaggeration. While Gazprom didappear to snag a deal with China National Petroleum Corp. to sell more gas, it did not specify the quantity of increase. Meanwhile, there were no new announcements about Power of Siberia 2, a proposed pipeline through Mongolia to export more gas to China—and recoup a big chunk of lost deliveries to Europe. For now, Beijing is content with playing hard-to-get.

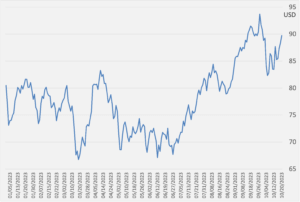

The US lifts oil sanctions on Venezuela

Washington has temporarily eased sanctions on Venezuela’s oil sector following a deal between the Caracas government and opposition parties for next year’s election. For the next six months, the OPEC member can produce and export oil without limitation—but with conditions, like lift bans on opposition candidates. Venezuela’s state-run oil company is already getting busy contacting customers with crude supply contracts, Reuters reports, though output isn’t expected to surge.

Global Brent crude prices slipped 0.9% after the sanctions were lifted, but climbed again on reports of a US Navy warship intercepting three missiles fired from Yemen.

Crude oil WTI futures

Source: Investing.com

The Albemarle-Liontown lithium deal falls through

The world’s largest lithium producer, US-based Albemarle, has been pursuing its Australian rival for a year. Liontown had spurned its suitor three times, and finally agreed to a 4.3 billion USD takeover bid last month. Albemarle took a victory lap, declaring its offer “best and final, in the absence of a superior proposal.” Now a wrench has been thrown in Albemarle’s plans: Australian tycoon Gina Rinehart had rapidly built a 19.9% stake in Liontown, putting her in a position to easily block the acquisition. In response, Albemarle ditched its buyout bid. For now, it’s unclear what Rinehart’s next move is. Markets don’t like the uncertainty: Liontown shares slumped tanked 34% on Friday (Oct. 20).

MARKETS

MARKETS

MARKETS

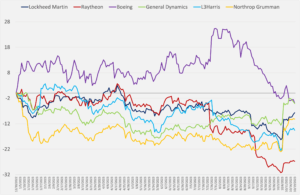

MARKETSWars heat up, defense stocks slump down

Defense contractor Lockheed Martin ended 2022 up over 36% on the year. Year to date 2023, however, it is down over 5%—even as the Russia-Ukraine war drags on, and a new Israel-Hamas war breaks out in the Middle East. And while Lockheed beat revenue and profit estimates for the most recent quarter, the company decline to give guidance for 2024 (as it usually does during its third-quarter call), with its CEO citing “the current status of the 2024 US defense budget, global geopolitical tensions and the macroeconomic environment.” Meanwhile, a basket of US defense giants is down 8.5% through Oct. 17, Bloomberg’s Brooke Sutherland notes. We’ll be watching Northrop Grumman, L3Harris Technologies, and General Dynamics’ earnings results next week.

YTD share price changes of select defense companies

Source: Investing.com

China tries to attract more foreign investment in manufacturing

Beijing has announced the removal of remaining restrictions on foreign investment in the domestic manufacturing sector, in a bid to woo more overseas businesses to expand their China footprint. But the move is largely symbolic: as of 2021, the only remaining restrictions on foreign investment in manufacturing concerned printing presses and the processing and production of certain Chinese medicines. Beijing clearly wants more foreign direct investment. Global businesses do so at ever increasing risk.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSDrug traffickers have infiltrated global shipping

Drug gangs “are infiltrating the whole [shipping] supply chain” in an “extreme” manner, Keith Svendson, an executive at Danish shipping group Maersk, tells the Financial Times. This means container carriers now shoulder additional burdens of clamping down on drug trafficking, potentially affecting their commercial operations. Meanwhile, the EU is intensifying efforts to fight organized crime: on Wednesday, it launched a European Port Alliance to “increase the resilience of ports against criminal infiltration.”

(Photo by Jeremy Waterhouse/Pexels)