Is US manufacturing booming or slowing down? The factory output index is on a contractionary streak, even as industrial companies give rosy outlooks. Meanwhile, oil giant Exxon wants to supply lithium, a rare earths processing partnership collapses, and Italy regrets joining Beijing’s Belt and Road. Plus: potential disruptions to global uranium supplies.

VIEWS FROM THE US INDUSTRIAL BASE

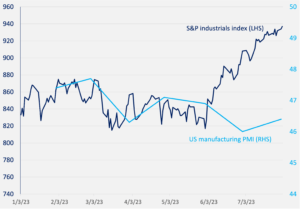

Two indices give two rather different pictures

For nine months straight, the US manufacturing PMI has stayed below 50, the point separating growth from contraction. That’s the longest such stretch since the 2007-2009 recession. July’s PMI came in at 46.4, below economist expectations of 46.8.

By contrast, the S&P’s industrials index surging: up over 12% since the beginning of the year, and headed for record highs. Meanwhile, as Bloomberg’s Brooke Sutherland notes this week, “three-quarters of S&P 500 industrial companies have beaten analysts’ earnings estimates” so far this earnings season.

What explains the discrepancy?

S&P industrial index and US manufacturing PMI

Source: Investing.com

Rockwell Automation’s CEO Blake Moret tells Bloomberg that thanks to disruptions like supply chain shortages and the pandemic, “[f]or now, we have decoupled from the traditional indicator that we were most highly correlated to for decades, and that is industrial production.” Another explanation is that the small manufacturers that may be struggling the most aren’t included in the S&P 500.

Whatever the case may be, comments during recent earnings calls suggest that industrial companies for now are taking a measured, rosy outlook. To give a few examples:

- United States Steel CEO Dave Burritt says deglobalization (along with decarbonization and digitization) is a “tremendous opportunity” for the firm, and will usher in “the best American steel market in a generation.”

- Columbus McKinnon CEO David Wilson says automation demand driven by labor shortages and capacity expansion in the US “is really driving very high levels of demand for automated solutions”—the company’s bread and butter.

- Gene Lowe, CEO of engineered infrastructure equipment provider SPX Technologies, says reshoring activity is driving increased demand in the semiconductor, data centers, and batteries domains.

- Emerson Electric CEO Lal Karsanbhai says nearshoring activity is “driving incremental investments around the globe in areas like life sciences and metals and mining…which we expect to turn to funded projects down the road.”

FACTORS

FACTORS

FACTORS

FACTORSOil on the rise

Oil prices jumped to a three-month high earlier this week on signs of rising demand and tightening supply. Brent oil prices rose 12.7% in July, the steepest monthly gain since last January.

Keeping global markets tight is Saudi Arabia’s decision to extend its voluntary output cut through September—and maybe beyond that. Meanwhile, prospects of a soft landing is also fueling bullish oil sentiment—in turn forcing hedge funds to cover their short positions, further lifting oil prices.

The US Department of Energy is paying close attention: prices have risen enough that it just rescinded an offer to buy six million barrels of oil to refill the Strategic Petroleum Reserve.

Exxon pushes ahead with lithium

Exxon Mobil is talking with automakers including Tesla, Ford, and Volkswagen, as well as battery makers like Samsung and SK On, about potentially supplying them with lithium, Bloomberg reports.

It’s part of Big Oil’s strategy to not miss out on the Big Shovel bonanza, as we wrote about in May. Exxon has bought drilling rights to a lithium-rich site in Arkansas, and is reportedly deciding whether to extract the mineral itself or in partnership with other players.

The company certainly knows it has the expertise for it: CEO Darren Woods said last week that the extraction and processing required in mining lithium from brine reservoirs like those at the Arkansas site are “very consistent with a lot of the things that we do in our refineries and chemical plants — and in fact, in some of our upstream operations.”

The challenges of rare earths processing

Digging rare earths out of the ground is the easy part. Separating and processing them into valuable rare earth metals is much more challenging—and critical to reducing reliance on China. Right now, even major players in the West are running into snags.

Reuters reports this week that a joint venture effort to build a US rare earths refining between Australian rare earths giant Lynas and Texas-based chemicals company Blue Line have collapsed. The news comes as Lynas separately announced an additional 138 million USD of funding from the US Department of Defense to build its own heavy rare earths processing facility in Texas.

The still more sobering reality: even if all its processing projects go according to plan, the West’s rare earth permanent magnet production capacity is still set to be a fraction of what China currently produces every year.

MARKETS

MARKETS

MARKETS

MARKETSItaly wishes it had never joined China’s Belt and Road

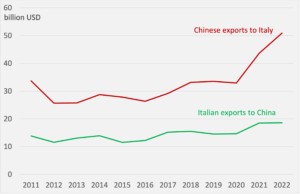

Italian defense minister Guido Crosetto didn’t mince his words: the previous administration’s decision to sign on to China’s Belt and Road Initiative was “improvised and heinous,” he said in an interview with local media last weekend. And it has indeed been a rotten deal: Italian exports to China lagged behind countries that didn’t join the BRI, while Chinese exports to China tripled. Prime minister Giorgia Meloni says her government will make a final decision on its BRI membership by December.

Chinese and Italian exports to each other

Source: UN Comtrade

China’s battery industry eyes South Korea

Chinese battery materials companies are splurging on investments in South Korea, with five plants worth 4.4 billion USD announced by Chinese companies and local partners in the country so far this year, according to Reuters. Those investments could allow the Chinese companies to benefit from IRA tax credits—unless Washington tightens loopholes.

The Commerce Department is looking into doing just that: its proposed regulations, for which public comments closed last month, will aim to tackle transnational subsidies—such as Chinese government support provided to a domestic firm manufacturing products in another country, like Vietnam or South Korea.

The legacy chips loophole

Washington has put in place broad restrictions on exports of advanced chips and chipmaking equipment to China. Some threads of media coverage would suggest that those restrictions are working.

But China is still getting plenty of access to legacy chips and mature equipment. ASML’s CEO sad last month that its sales to China are now “predominantly focused on mature and mid-critical nodes”—the “sweet spot” of chips that will power EVs, industrial IoT, telecommunications, and battery technologies, and where “China without any exception is leading.” Meanwhile, China is busy investing in next-generation compound semiconductors, where it could potentially leapfrog incumbents, as we wrote about last week.

Washington and Brussels are now worried about China’s push into mature and legacy chips, especially if it means heavily subsidized Chinese players flooding global markets with excess capacity and drowning out foreign competitors. The takeaway: restricting access to cutting-edge chips and surface-level nodes will do little to rein in China’s technological ambitions.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSUranium reliance

The military coup in Niger could complicate the West’s uranium supplies. Last year, the West African country accounted for a fifth of the EU’s uranium imports. Already, Europe and the US trying to curb their dependence on Russian uranium. A Niger that falls into Russia’s orbit will mean still more reliance on Moscow for atomic energy—just as countries turn increasingly to nuclear as an alternative fuel source to usher along the clean energy transition.

(Photo by Kateryna Babaieva/Pexels)